Question: Please answer part 3 of this question using the template provided. I have parts 1 and 2 done. Flandro Company uses a standard cost system

Please answer part 3 of this question using the template provided. I have parts 1 and 2 done.

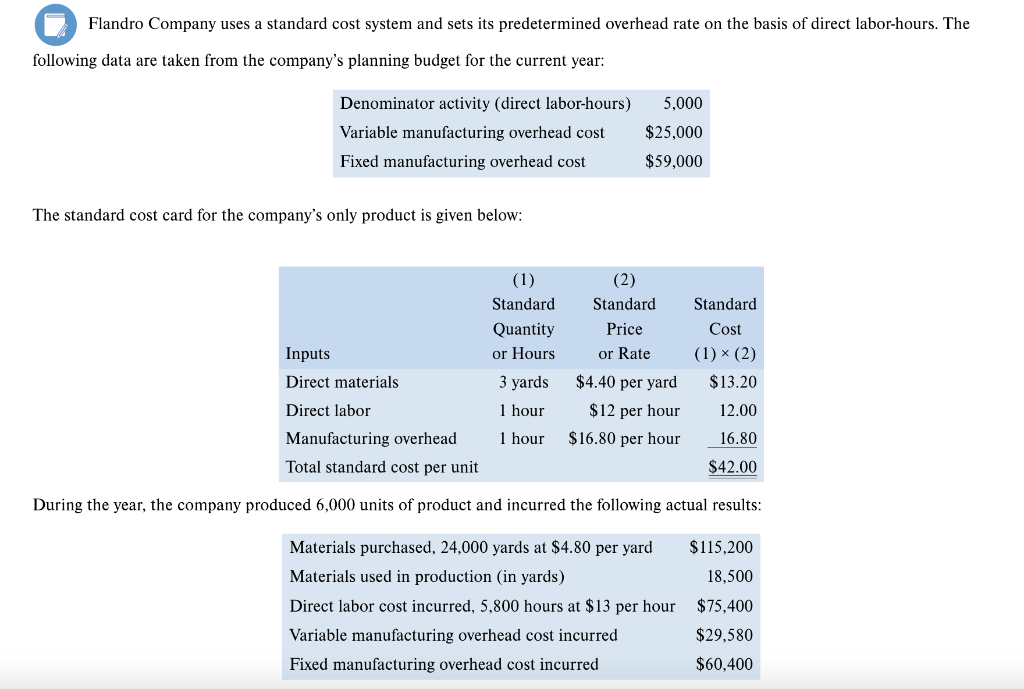

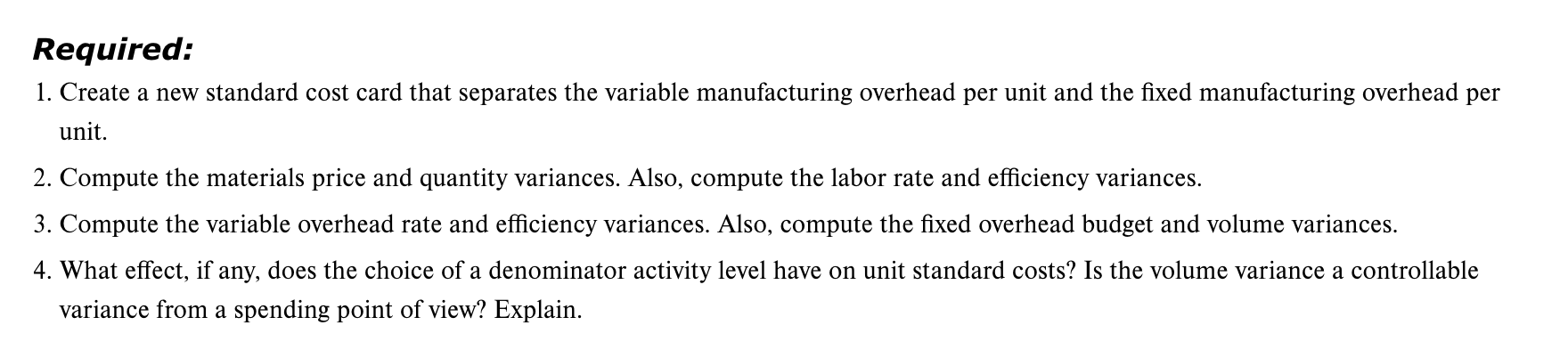

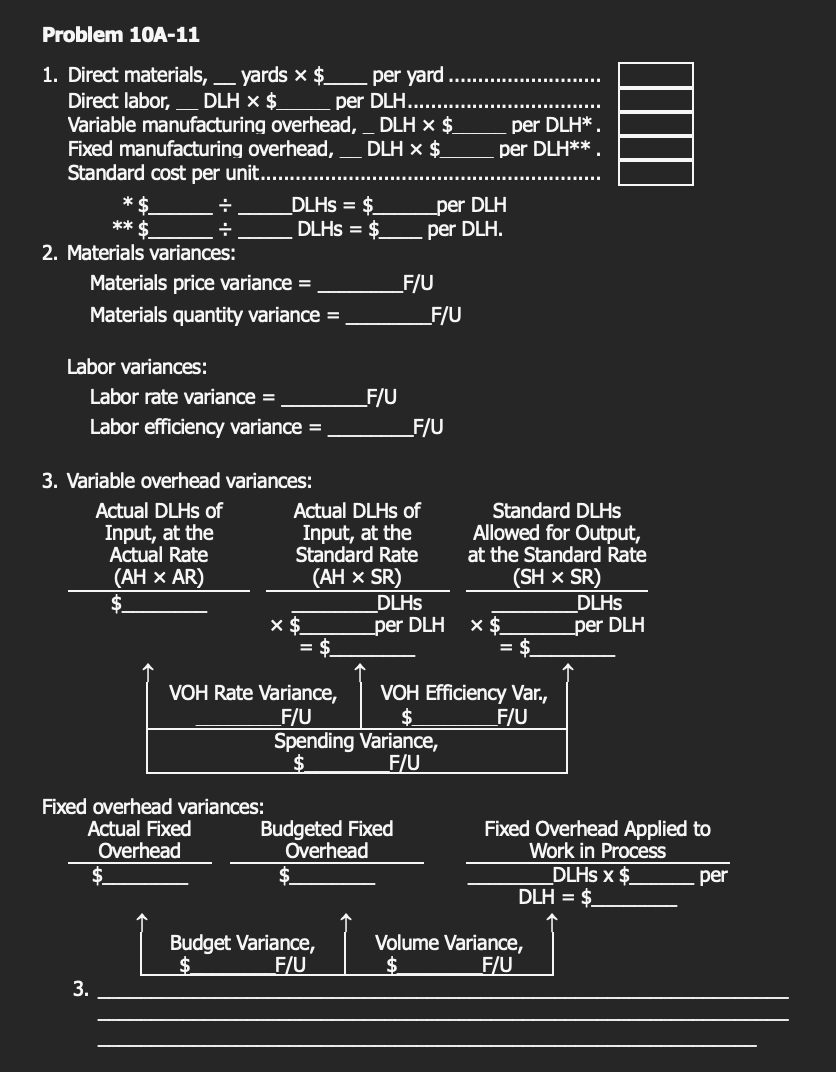

Flandro Company uses a standard cost system and sets its predetermined overhead rate on the basis of direct labor-hours. The following data are taken from the company's planning budget for the current year: The standard cost card for the company's only product is given below: During the year, the company produced 6,000 units of product and incurred the following actual results: 1. Create a new standard cost card that separates the variable manufacturing overhead per unit and the fixed manufacturing overhead per unit. 2. Compute the materials price and quantity variances. Also, compute the labor rate and efficiency variances. 3. Compute the variable overhead rate and efficiency variances. Also, compute the fixed overhead budget and volume variances. 4. What effect, if any, does the choice of a denominator activity level have on unit standard costs? Is the volume variance a controllable variance from a spending point of view? Explain. Problem 10A-11 2. Materials variances: Materials price variance = F/U Materials quantity variance = F/U Labor variances: Labor rate variance = F/U Labor efficiency variance = F/U 3. Variable overhead variances: Fixed overhead variances: 3. Flandro Company uses a standard cost system and sets its predetermined overhead rate on the basis of direct labor-hours. The following data are taken from the company's planning budget for the current year: The standard cost card for the company's only product is given below: During the year, the company produced 6,000 units of product and incurred the following actual results: 1. Create a new standard cost card that separates the variable manufacturing overhead per unit and the fixed manufacturing overhead per unit. 2. Compute the materials price and quantity variances. Also, compute the labor rate and efficiency variances. 3. Compute the variable overhead rate and efficiency variances. Also, compute the fixed overhead budget and volume variances. 4. What effect, if any, does the choice of a denominator activity level have on unit standard costs? Is the volume variance a controllable variance from a spending point of view? Explain. Problem 10A-11 2. Materials variances: Materials price variance = F/U Materials quantity variance = F/U Labor variances: Labor rate variance = F/U Labor efficiency variance = F/U 3. Variable overhead variances: Fixed overhead variances: 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts