Question: Please answer part a and b with full working out. Question 1: Contribution format income statement and High-Low Method The accounting department of Blackwell Pty

Please answer part a and b with full working out.

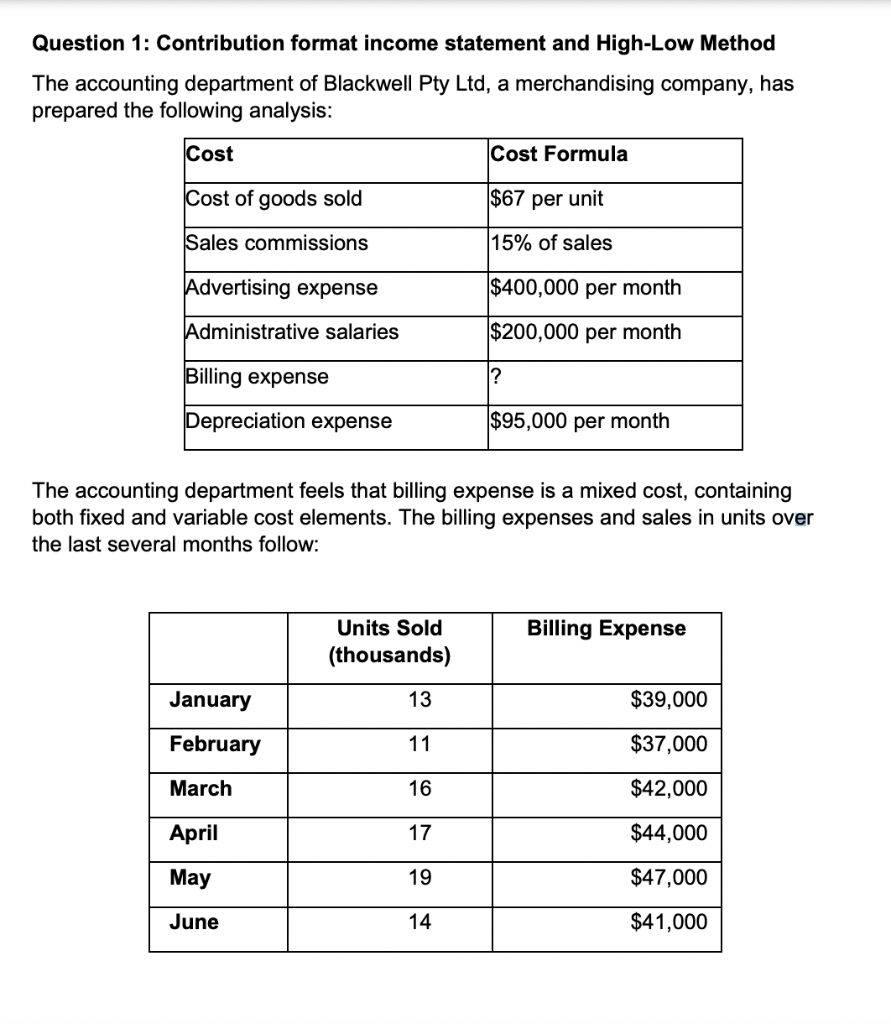

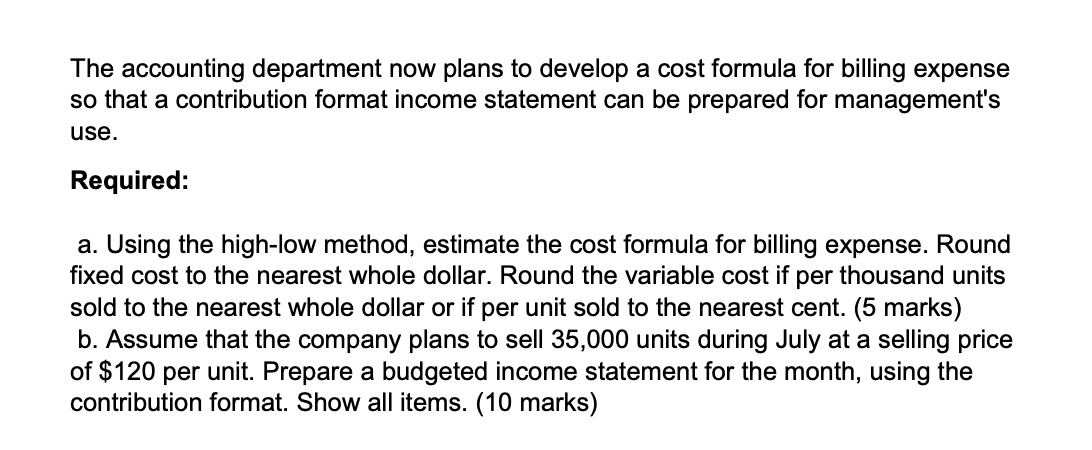

Question 1: Contribution format income statement and High-Low Method The accounting department of Blackwell Pty Ltd, a merchandising company, has prepared the following analysis: The accounting department feels that billing expense is a mixed cost, containing both fixed and variable cost elements. The billing expenses and sales in units over the last several months follow: The accounting department now plans to develop a cost formula for billing expense so that a contribution format income statement can be prepared for management's use. Required: a. Using the high-low method, estimate the cost formula for billing expense. Round fixed cost to the nearest whole dollar. Round the variable cost if per thousand units sold to the nearest whole dollar or if per unit sold to the nearest cent. (5 marks) b. Assume that the company plans to sell 35,000 units during July at a selling price of $120 per unit. Prepare a budgeted income statement for the month, using the contribution format. Show all items. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts