Question: Please answer Part A and Part B. The product design group of lyengar Electric Supplies, Inc., has determined that it needs to design a new

Please answer Part A and Part B.

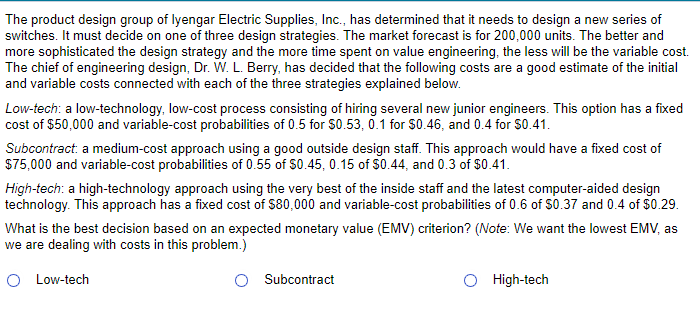

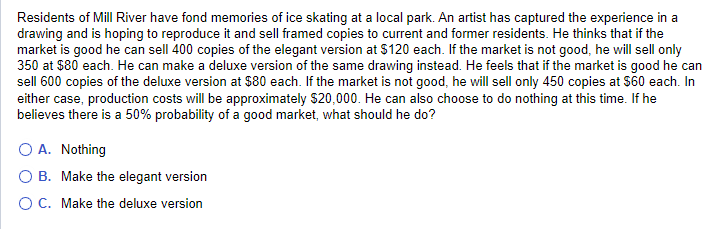

The product design group of lyengar Electric Supplies, Inc., has determined that it needs to design a new series of switches. It must decide on one of three design strategies. The market forecast is for 200,000 units. The better and more sophisticated the design strategy and the more time spent on value engineering, the less will be the variable cost. The chief of engineering design, Dr. W. L. Berry, has decided that the following costs are a good estimate of the initial and variable costs connected with each of the three strategies explained below. Low-tech: a low-technology, low-cost process consisting of hiring several new junior engineers. This option has a fixed cost of $50,000 and variable-cost probabilities of 0.5 for $0.53,0.1 for $0.46, and 0.4 for $0.41. Subcontract: a medium-cost approach using a good outside design staff. This approach would have a fixed cost of $75,000 and variable-cost probabilities of 0.55 of $0.45,0.15 of $0.44, and 0.3 of $0.41. High-tech: a high-technology approach using the very best of the inside staff and the latest computer-aided design technology. This approach has a fixed cost of $80,000 and variable-cost probabilities of 0.6 of $0.37 and 0.4 of $0.29. What is the best decision based on an expected monetary value (EMV) criterion? (Note: We want the lowest EMV, as we are dealing with costs in this problem.) Low-tech Subcontract High-tech Residents of Mill River have fond memories of ice skating at a local park. An artist has captured the experience in a drawing and is hoping to reproduce it and sell framed copies to current and former residents. He thinks that if the market is good he can sell 400 copies of the elegant version at $120 each. If the market is not good, he will sell only 350 at $80 each. He can make a deluxe version of the same drawing instead. He feels that if the market is good he can sell 600 copies of the deluxe version at $80 each. If the market is not good, he will sell only 450 copies at $60 each. In either case, production costs will be approximately $20,000. He can also choose to do nothing at this time. If he believes there is a 50% probability of a good market, what should he do? A. Nothing B. Make the elegant version C. Make the deluxe version

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts