Question: Please answer part a, b and c clearly. Easiride is a manufacturing company producing bicycles. The firm has to decide whether to manufacture bicycle tyres

Please answer part a, b and c clearly.

Please answer part a, b and c clearly.

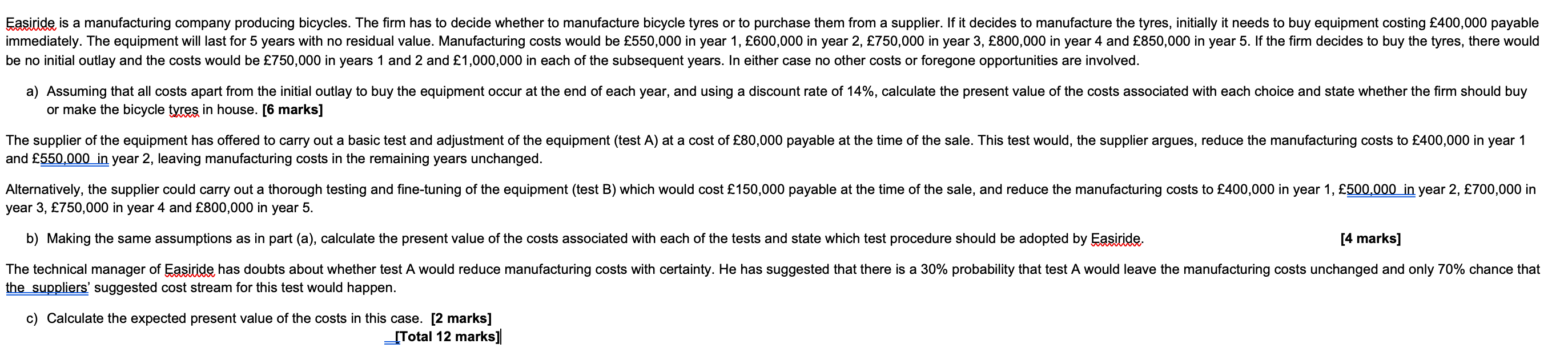

Easiride is a manufacturing company producing bicycles. The firm has to decide whether to manufacture bicycle tyres or to purchase them from a supplier. If it decides to manufacture the tyres, initially it needs to buy equipment costing 400,000 payable immediately. The equipment will last for 5 years with no residual value. Manufacturing costs would be 550,000 in year 1, 600,000 in year 2, 750,000 in year 3, 800,000 in year 4 and 850,000 in year 5. If the firm decides to buy the tyres, there would be no initial outlay and the costs would be 750,000 in years 1 and 2 and 1,000,000 in each of the subsequent years. In either case no other costs or foregone opportunities are involved. a) Assuming that all costs apart from the initial outlay to buy the equipment occur at the end of each year, and using a discount rate of 14%, calculate the present value of the costs associated with each choice and state whether the firm should buy or make the bicycle tyres in house. [6 marks] The supplier of the equipment has offered to carry out a basic test and adjustment of the equipment (test A) at a cost of 80,000 payable at the time of the sale. This test would, the supplier argues, reduce the manufacturing costs to 400,000 in year 1 and 550,000 in year 2, leaving manufacturing costs in the remaining years unchanged. Alternatively, the supplier could carry out a thorough testing and fine-tuning of the equipment (test B) which would cost 150,000 payable at the time of the sale, and reduce the manufacturing costs to 400,000 in year 1, 500,000 in year 2, 700,000 in year 3, 750,000 in year 4 and 800,000 in year 5. b) Making the same assumptions as in part (a), calculate the present value of the costs associated with each of the tests and state which test procedure should be adopted by Easiride. [4 marks] The technical manager of Easiride has doubts about whether test A would reduce manufacturing costs with certainty. He has suggested that there is a 30% probability that test A would leave the manufacturing costs unchanged and only 70% chance that the suppliers' suggested cost stream for this test would happen. c) Calculate the expected present value of the costs in this case. [2 marks] _[Total 12 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts