Question: please answer part A B and C if possible. I had to repost this because the last person who answered it gave me an incomplete

please answer part A B and C if possible. I had to repost this because the last person who answered it gave me an incomplete answer. Thank you!!

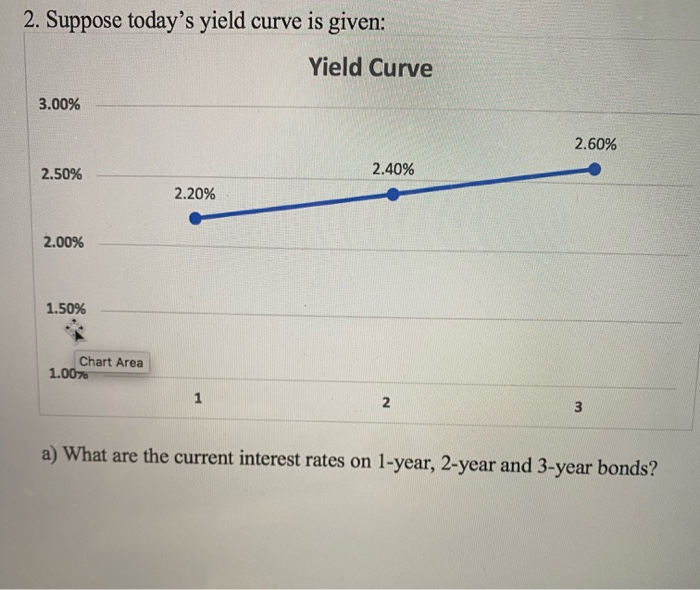

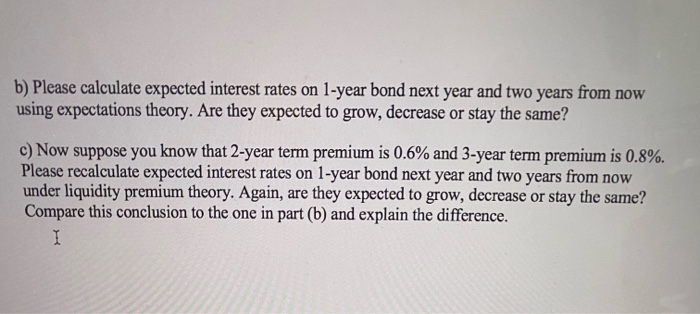

please answer part A B and C if possible. I had to repost this because the last person who answered it gave me an incomplete answer. Thank you!! 2. Suppose today's yield curve is given: Yield Curve 3.00% 2.60% 2.50% 2.40% 2.20% 2.00% 1.50% Chart Area 1.000 1 2 3 a) What are the current interest rates on 1-year, 2-year and 3-year bonds? b) Please calculate expected interest rates on 1-year bond next year and two years from now using expectations theory. Are they expected to grow, decrease or stay the same? c) Now suppose you know that 2-year term premium is 0.6% and 3-year term premium is 0.8%. Please recalculate expected interest rates on 1-year bond next year and two years from now under liquidity premium theory. Again, are they expected to grow, decrease or stay the same? Compare this conclusion to the one in part (b) and explain the difference

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts