Question: please answer part a, b and c Question 43 0.4 pts Consider the following two mutually exclusive 4-year projects (cash flow in S). Project X:

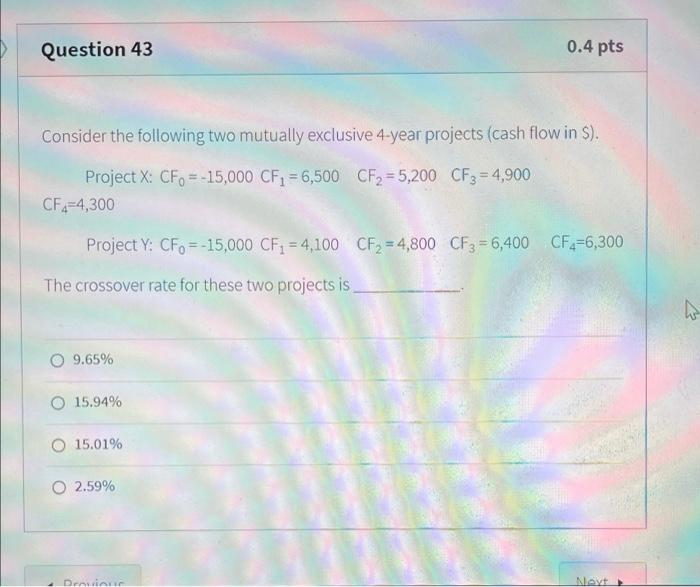

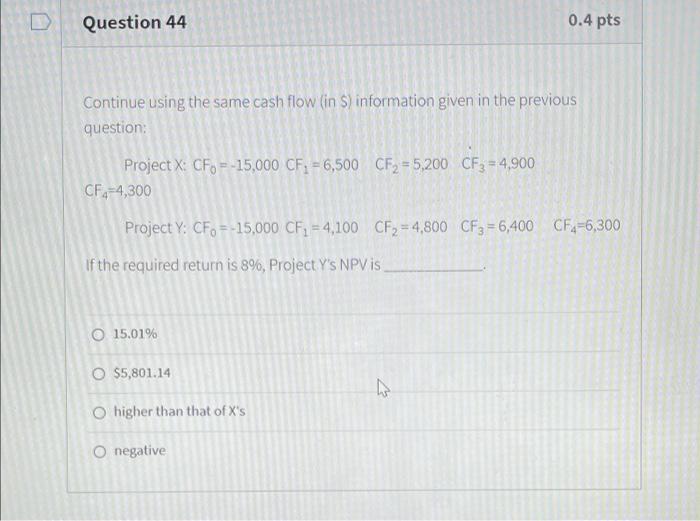

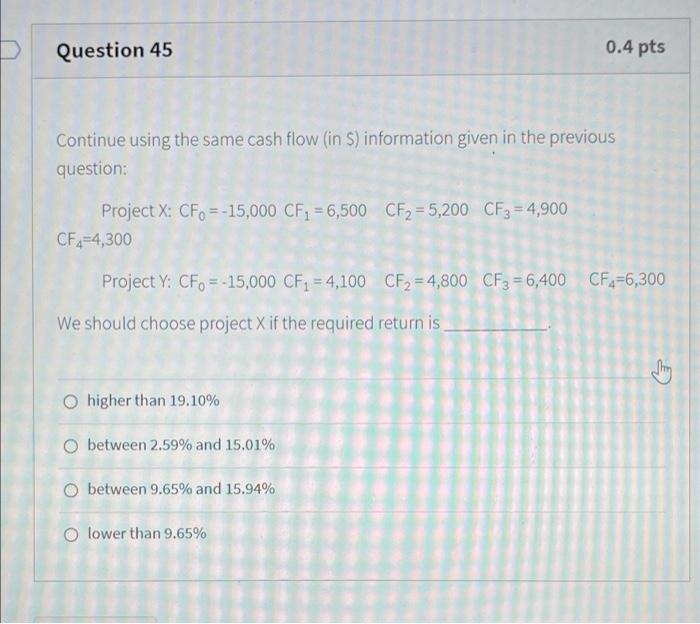

Question 43 0.4 pts Consider the following two mutually exclusive 4-year projects (cash flow in S). Project X: CF0 = -15,000 CF = 6,500 CF2 = 5,200 CF3 = 4,900 CF2=4,300 Project Y: CF3 =-15,000 CF; = 4,100 CF2 = 4,800 CF3 = 6,400 CF4=6,300 The crossover rate for these two projects is ho O 9.65% O 15.94% 15.01% O 2.59% Dravi Navt Question 44 0.4 pts Continue using the same cash flow (in ) information given in the previous question: Project X: CF= -15,000 CF, = 6,500 CF2=5,200 CF3 = 4,900 CF4-4,300 Project Y: CF = -15,000 CF2 = 4,100 CF, = 4,800 CF3 = 6,400 CF4-6,300 If the required return is 8%, Project Y's NPV is O 15.01% O $5,801.14 hr O higher than that of X's O negative Question 45 0.4 pts Continue using the same cash flow (in S) information given in the previous question: Project X: CF = -15,000 CF, = 6,500 CF2 = 5,200 CF3 = 4,900 CF2=4,300 Project Y: CF, = -15,000 CF1 = 4,100 CF2 =4,800 CF3 = 6,400 CF =6,300 We should choose project X if the required return is O higher than 19.10% O between 2.59% and 15.01% O between 9.65% and 15.94% O lower than 9.65%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts