Question: Please answer part A, B, C and D. Thank you! Question 2.1 The attached paragraphs are copied from Microsoft 2021 annual report; please note that

Please answer part A, B, C and D. Thank you!

Please answer part A, B, C and D. Thank you!

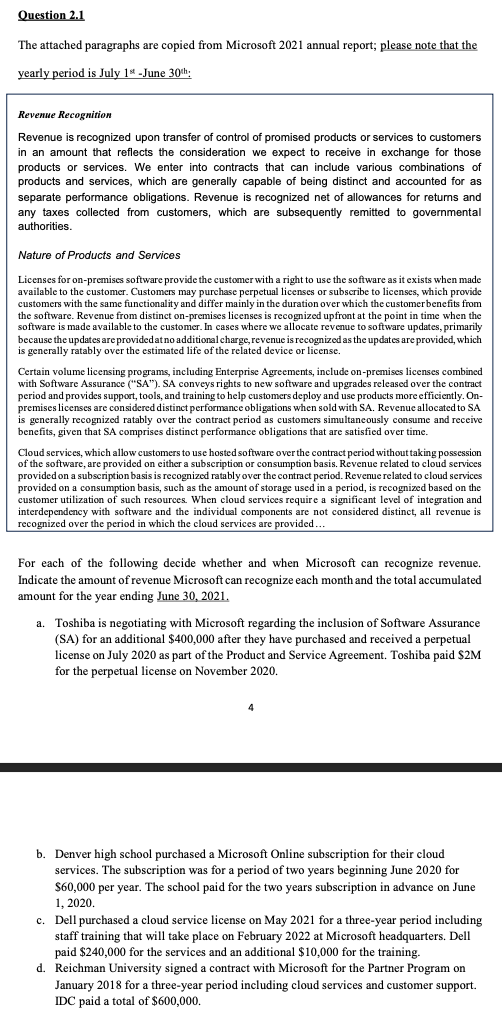

Question 2.1 The attached paragraphs are copied from Microsoft 2021 annual report; please note that the yearly period is July 1st June 30th: Revenue Recognition Revenue is recognized upon transfer of control of promised products or services to customers in an amount that reflects the consideration we expect to receive in exchange for those products or services. We enter into contracts that can include various combinations of products and services, which are generally capable of being distinct and accounted for as separate performance obligations. Revenue is recognized net of allowances for returns and any taxes collected from customers, which are subsequently remitted to governmental authorities. Nature of Products and Services Licenses for on-premises software provide the customer with a right to use the software as it exists when made available to the customer. Customers may purchase perpetual licenses or subscribe to licenses, which provide customers with the same functionality and differ mainly in the duration over which the customerbenefits from the software. Revenue from distinct on-premises licenses is recognized upfront at the point in time when the software is made available to the customer. In cases where we allocate revenue to software updates, primarily because the updates are provided at no additional charge, revenue is recognized as the updates are provided, which is generally ratably over the estimated life of the related device or license. Certain volume licensing programs, including Enterprise Agreements, include on-premises licenses combined with Software Assurance ("SA"). SA conveys rights to new software and upgrades released over the contract period and provides support, tools, and training to help customers deploy and use products more efficiently. Onpremises licenses are considered distinct performance obligations when sold with SA. Revenue allocated to SA is generally recognized ratably over the contract period as customers simultaneously consume and receive benefits, given that SA comprises distinct performance obligations that are satisfied over time. Cloud services, which allow customers to use hosted software over the contract period without taking possession of the software, are provided on either a subscription or consumption basis. Revenue related to cloud services provided on a subscription basis is recognized ratably over the contract period. Revenue related to cloud services provided on a consumption basis, such as the amount of storage used in a period, is recognized based on the customer utilization of such resources. When cloud services require a significant level of integration and interdependency with software and the individual components are not considered distinct, all revenue is recognized over the period in which the cloud services are provided... For each of the following decide whether and when Microsoft can recognize revenue. Indicate the amount of revenue Microsoft can recognize each month and the total accumulated amount for the year ending June 30, 2021. a. Toshiba is negotiating with Microsoft regarding the inclusion of Software Assurance (SA) for an additional $400,000 after they have purchased and received a perpetual license on July 2020 as part of the Product and Service Agreement. Toshiba paid \$2M for the perpetual license on November 2020. 4 b. Denver high school purchased a Microsoft Online subscription for their cloud services. The subscription was for a period of two years beginning June 2020 for $60,000 per year. The school paid for the two years subscription in advance on June 1,2020. c. Dell purchased a cloud service license on May 2021 for a three-year period including staff training that will take place on February 2022 at Microsoft headquarters. Dell paid $240,000 for the services and an additional $10,000 for the training. d. Reichman University signed a contract with Microsoft for the Partner Program on January 2018 for a three-year period including cloud services and customer support. IDC paid a total of $600,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts