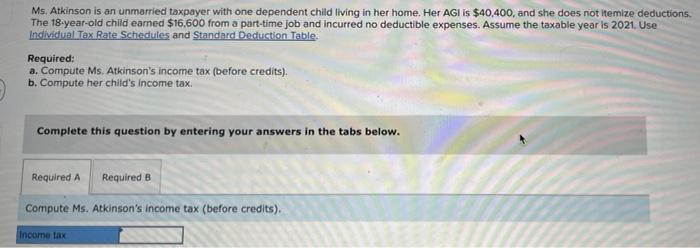

Question: PLEASE ANSWER PART A & B LEAVE STEPS TO SOLVE PROBLEM THOUROUGHLY CHARTS ARE PROVIDED FOR HEAD OF HOUSEHOLD FILING STATUS Ms. Atkinson is an

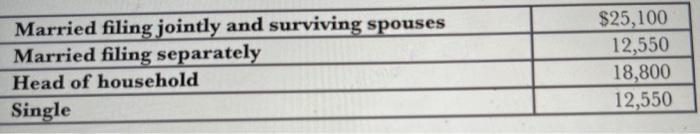

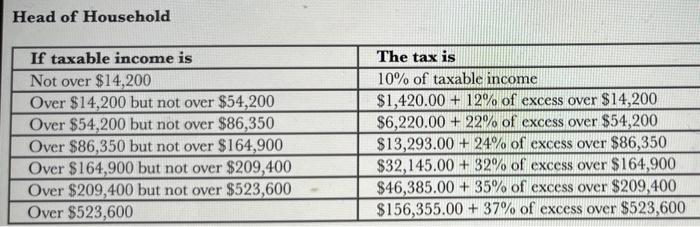

Ms. Atkinson is an unmarried taxpayer with one dependent child living in her home. Her AG is $40.400, and she does not hemize deductions. The 18-year-old child earned $16,600 from a part-time job and incurred no deductible expenses. Assume the taxable year is 2021. Use Individual Tax Rate Schedules and Standard Deduction Table Required: a. Compute Ms. Atkinson's income tax (before credits) b. Compute her child's income tax. Complete this question by entering your answers in the tabs below. Required A Required B Compute Ms. Atkinson's income tax (before credits). Income Tax Married filing jointly and surviving spouses Married filing separately Head of household Single $25,100 12,550 18,800 12,550 Head of Household If taxable income is Not over $14,200 Over $14,200 but not over $54,200 Over $54,200 but not over $86,350 Over $86,350 but not over $164,900 Over $164,900 but not over $209,400 Over $209,400 but not over $523,600 Over $523,600 The tax is 10% of taxable income $1,420.00 + 12% of excess over $14,200 $6,220.00 + 22% of excess over $54,200 $13,293.00 + 24% of excess over $86,350 $32,145.00 + 32% of excess over $164,900 $46,385.00 + 35% of excess over $209,400 $156,355.00 + 37% of excess over $523,600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts