Question: Please answer Part A) with Journal Entries using these available accounts: Cash Taxes Receivable-Current Allowance for Uncollectible Current Taxes Taxes Receivable-Delinquent Allowance for Uncollectible Delinquent

Please answer Part A) with Journal Entries using these available accounts:

| Cash | ||

| Taxes Receivable-Current | ||

| Allowance for Uncollectible Current Taxes | ||

| Taxes Receivable-Delinquent | ||

| Allowance for Uncollectible Delinquent Taxes | ||

| Interest and Penalties Receivable on Taxes | ||

| Allowance for Uncollectible Interest and Penalties | ||

| Due from Federal Government | ||

| Due from State Government | ||

| Accrued Sales Taxes Receivable | ||

| Interest Receivable on Investments | ||

| Internal Receivables from Business-Type Activities | ||

| Inventory of Supplies | ||

| Investments | ||

| Land | ||

| Improvements other than Buildings | ||

| Accumulated Depreciation-Improvements other than Buildings | ||

| Infrastructure | ||

| Accumulated Depreciation-Infrastructure | ||

| Buildings | ||

| Accumulated Depreciation-Buildings | ||

| Equipment | ||

| Accumulated Depreciation-Equipment | ||

| Construction in Progress | ||

| Deferred Outflows of Resources | ||

| Vouchers Payable | ||

| Tax Anticipation Notes Payable | ||

| Due to Federal Government | ||

| Due to State Government | ||

| Contracts Payable | ||

| Contracts Payable-Retained Percentage | ||

| Accrued Interest Payable on Long-Term Debt | ||

| Judgments Payable | ||

| Internal Payables to Business-Type Activities | ||

| Current Portion of Long-Term Debt | ||

| Serial Bonds Payable | ||

| Deferred Serial Bonds Payable | ||

| Premium on Deferred Serial Bonds Payable | ||

| Deferred Inflows of Resources | ||

| Net Position-Net Investment in Capital Assets | ||

| Net Position-Restricted for General Government | ||

| Net Position-Restricted for Public Safety | ||

| Net Position-Restricted for Public Works | ||

| Net Position-Restricted for Health and Welfare | ||

| Net Position-Restricted for Culture and Recreation | ||

| Net Position-Restricted for Capital Projects | ||

| Net Position-Restricted for Debt Service | ||

| Net Position-Unrestricted | ||

| Program Revenues-General Government-Charges for Services | ||

| Program Revenues-General Government-Operating Grants and Contributions | ||

| Program Revenues-General Government-Capital Grants and Contributions | ||

| Program Revenues-Public Safety-Charges for Services | ||

| Program Revenues-Public Safety-Operating Grants and Contributions | ||

| Program Revenues-Public Safety-Capital Grants and Contributions | ||

| Program Revenues-Public Works-Charges for Services | ||

| Program Revenues-Public Works-Operating Grants and Contributions | ||

| Program Revenues-Public Works-Capital Grants and Contributions | ||

| Program Revenues-Health and Welfare-Charges for Services | ||

| Program Revenues-Health and Welfare-Operating Grants and Contributions | ||

| Program Revenues-Health and Welfare-Capital Grants and Contributions | ||

| Program Revenues-Culture and Recreation-Charges for Services | ||

| Program Revenues-Culture and Recreation-Operating Grants and Contributions | ||

| Program Revenues-Culture and Recreation-Capital Grants and Contributions | ||

| General Revenues-Taxes-Real Property | ||

| General Revenues-Taxes-Sales | ||

| General Revenues-Interest and Penalties on Taxes | ||

| General Revenues-Miscellaneous | ||

| General Revenues-Investment Earnings | ||

| General Revenues-Change in Fair Value of Investments | ||

| Expenses-General Government | ||

| Expenses-Public Safety | ||

| Expenses-Public Works | ||

| Expenses-Health and Welfare | ||

| Expenses-Culture and Recreation | ||

| Expenses-Interest on Long-Term Debt |

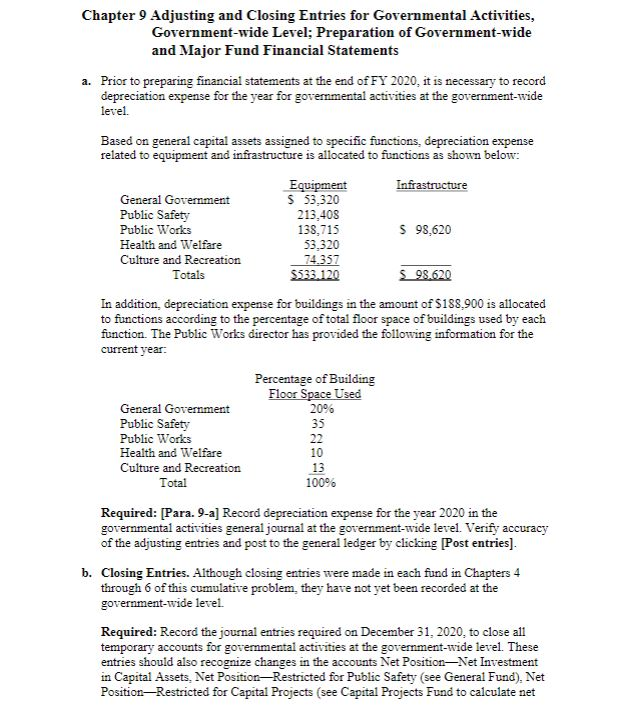

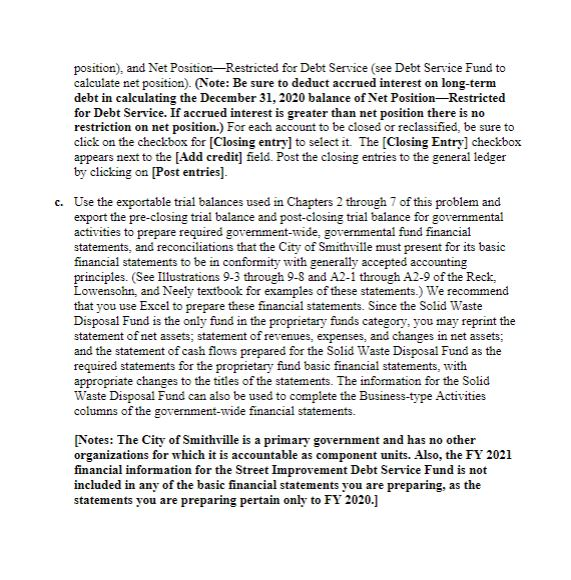

Chapter 9 Adjusting and Closing Entries for Governmental Activities, Government-wide Level; Preparation of Government-wide and Major Fund Financial Statements a. Prior to preparing financial statements at the end of FY 2020, it is necessary to record depreciation expense for the year for governmental activities at the government-wide level. Based on general capital assets assigned to specific functions, depreciation expense related to equipment and infrastructure is allocated to functions as shown below: Equipment Infrastructure General Government $ 53,320 Public Safety 213,408 Public Works 138,715 $ 98,620 Health and Welfare 53,320 Culture and Recreation 74.357 Totals $533.120 S 98.620 In addition, depreciation expense for buildings in the amount of $188,900 is allocated to functions according to the percentage of total floor space of buildings used by each function. The Public Works director has provided the following information for the current year: Percentage of Building Floor Space Used General Government 20% Public Safety 35 Public Works 22 Health and Welfare 10 Culture and Recreation 13 Total 100% Required: (Para. 9-a] Record depreciation expense for the year 2020 in the governmental activities general journal at the government-wide level. Verify accuracy of the adjusting entries and post to the general ledger by clicking Post entries]. b. Closing Entries. Although closing entries were made in each fund in Chapters 4 through 6 of this cumulative problem, they have not yet been recorded at the government-wide level Required: Record the journal entries required on December 31, 2020. to close all temporary accounts for govermental activities at the government-wide level. These entries should also recognize changes in the accounts Net PositionNet Investment in Capital Assets. Net Position-Restricted for Public Safety (see General Fund). Net Position-Restricted for Capital Projects (see Capital Projects Fund to calculate net position) and Net Position-Restricted for Debt Service (see Debt Service Fund to calculate net position). (Note: Be sure to deduct accrued interest on long-term debt in calculating the December 31, 2020 balance of Net Position-Restricted for Debt Service. If accrued interest is greater than net position there is no restriction on net position.) For each account to be closed or reclassified, be sure to click on the checkbox for [Closing entry] to select it. The (Closing Entry] checkbox appears next to the [Add credit] field. Post the closing entries to the general ledger by clicking on [Post entries]. c. Use the exportable trial balances used in Chapters 2 through 7 of this problem and export the pre-closing trial balance and post-closing trial balance for governmental activities to prepare required government-wide governmental fund financial statements, and reconciliations that the City of Smithville must present for its basic financial statements to be in conformity with generally accepted accounting principles. (See Illustrations 9-3 through 9-8 and A2-1 through A2-9 of the Reck. Lowensohn and Neely textbook for examples of these statements. We recommend that you use Excel to prepare these financial statements. Since the Solid Waste Disposal Fund is the only fund in the proprietary funds category, you may reprint the statement of net assets; statement of revenues, expenses, and changes in net assets; and the statement of cash flows prepared for the Solid Waste Disposal Fund as the required statements for the proprietary fund basic financial statements, with appropriate changes to the tities of the statements. The information for the Solid Waste Disposal Fund can also be used to complete the Business-type Activities columns of the government-wide financial statements. [Notes: The City of Smithville is a primary government and has no other organizations for which it is accountable as component units. Also, the FY 2021 financial information for the Street Improvement Debt Service Fund is not included in any of the basic financial statements you are preparing, as the statements you are preparing pertain only to FY 2020.] Chapter 9 Adjusting and Closing Entries for Governmental Activities, Government-wide Level; Preparation of Government-wide and Major Fund Financial Statements a. Prior to preparing financial statements at the end of FY 2020, it is necessary to record depreciation expense for the year for governmental activities at the government-wide level. Based on general capital assets assigned to specific functions, depreciation expense related to equipment and infrastructure is allocated to functions as shown below: Equipment Infrastructure General Government $ 53,320 Public Safety 213,408 Public Works 138,715 $ 98,620 Health and Welfare 53,320 Culture and Recreation 74.357 Totals $533.120 S 98.620 In addition, depreciation expense for buildings in the amount of $188,900 is allocated to functions according to the percentage of total floor space of buildings used by each function. The Public Works director has provided the following information for the current year: Percentage of Building Floor Space Used General Government 20% Public Safety 35 Public Works 22 Health and Welfare 10 Culture and Recreation 13 Total 100% Required: (Para. 9-a] Record depreciation expense for the year 2020 in the governmental activities general journal at the government-wide level. Verify accuracy of the adjusting entries and post to the general ledger by clicking Post entries]. b. Closing Entries. Although closing entries were made in each fund in Chapters 4 through 6 of this cumulative problem, they have not yet been recorded at the government-wide level Required: Record the journal entries required on December 31, 2020. to close all temporary accounts for govermental activities at the government-wide level. These entries should also recognize changes in the accounts Net PositionNet Investment in Capital Assets. Net Position-Restricted for Public Safety (see General Fund). Net Position-Restricted for Capital Projects (see Capital Projects Fund to calculate net position) and Net Position-Restricted for Debt Service (see Debt Service Fund to calculate net position). (Note: Be sure to deduct accrued interest on long-term debt in calculating the December 31, 2020 balance of Net Position-Restricted for Debt Service. If accrued interest is greater than net position there is no restriction on net position.) For each account to be closed or reclassified, be sure to click on the checkbox for [Closing entry] to select it. The (Closing Entry] checkbox appears next to the [Add credit] field. Post the closing entries to the general ledger by clicking on [Post entries]. c. Use the exportable trial balances used in Chapters 2 through 7 of this problem and export the pre-closing trial balance and post-closing trial balance for governmental activities to prepare required government-wide governmental fund financial statements, and reconciliations that the City of Smithville must present for its basic financial statements to be in conformity with generally accepted accounting principles. (See Illustrations 9-3 through 9-8 and A2-1 through A2-9 of the Reck. Lowensohn and Neely textbook for examples of these statements. We recommend that you use Excel to prepare these financial statements. Since the Solid Waste Disposal Fund is the only fund in the proprietary funds category, you may reprint the statement of net assets; statement of revenues, expenses, and changes in net assets; and the statement of cash flows prepared for the Solid Waste Disposal Fund as the required statements for the proprietary fund basic financial statements, with appropriate changes to the tities of the statements. The information for the Solid Waste Disposal Fund can also be used to complete the Business-type Activities columns of the government-wide financial statements. [Notes: The City of Smithville is a primary government and has no other organizations for which it is accountable as component units. Also, the FY 2021 financial information for the Street Improvement Debt Service Fund is not included in any of the basic financial statements you are preparing, as the statements you are preparing pertain only to FY 2020.]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts