Question: Please answer part a-e. Handout: Chapter 2. Margin-Shorting Problem 1 You are bearish (pessimistic) about the prospects of Company ABC's stock price. Its current market

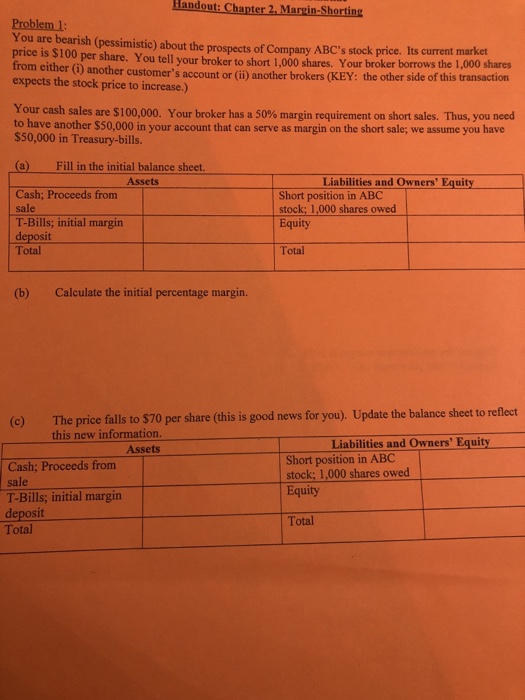

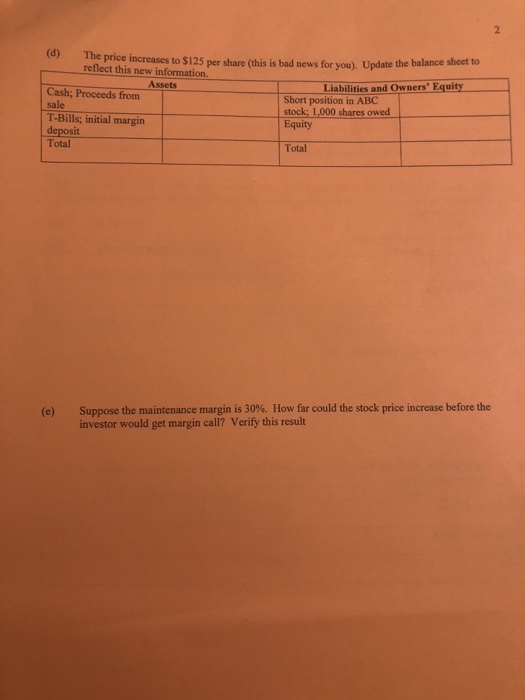

Handout: Chapter 2. Margin-Shorting Problem 1 You are bearish (pessimistic) about the prospects of Company ABC's stock price. Its current market price is $100 per share. You tell your broker to short 1,000 shares. from either (i) another customer's expects the stock price to increase.) Your broker borrows the 1,000 shares account or (ii) another brokers (KEY: the other side of this transaction Your cash sales are $100,000. Your broker has a 50% margin requirement on short sales. Thus, you need to have another $50,000 in your account that can serve as margin on the short sale; we assume you have $50,000 in Treasury-bills. (a) Fill in the initial balance sheet. Assets Liabilities and Owners' Equity Cash; Proceeds from sale T-Bills;, initial margin deposit Total Short position in ABC stock; 1,000 shares owed Equity Total (b) Calculate the initial percentage margin. (e) The price all to $70 per share (this is good news for you), Update the balance shet to rflect this new information Assets Liabilities and Owners' Equity Cash; Proceeds from sale T-Bills; initial margin Short position in ABC stock; 1,000 shares owed Equity sit Total Total

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts