Question: please answer part B #9 Assume that you are preparing to confirm accounts receivable at December 31,2025 , which is one month prior to the

please answer part B

#9

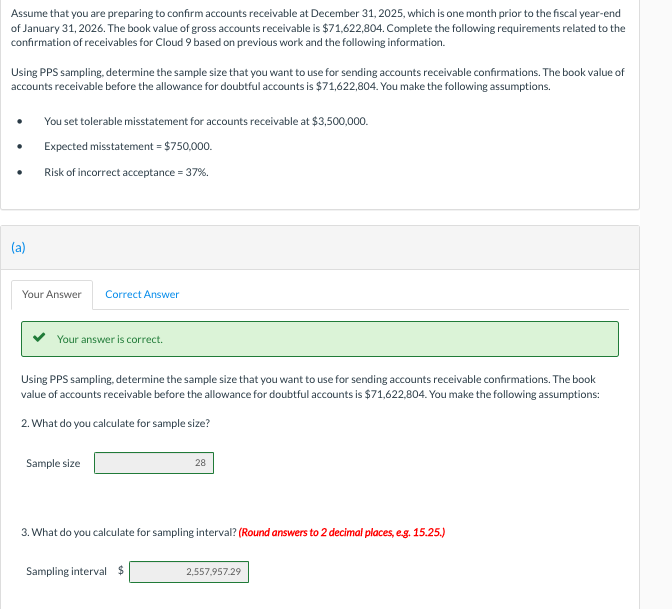

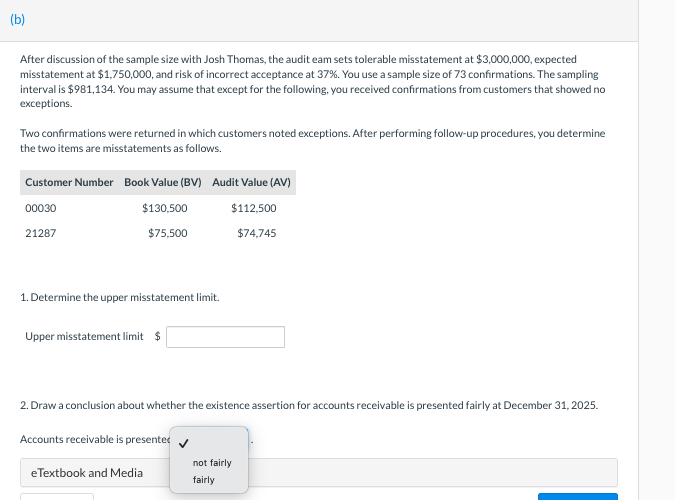

Assume that you are preparing to confirm accounts receivable at December 31,2025 , which is one month prior to the fiscal year-end of January 31,2026 . The book value of gross accounts receivable is $71,622,804. Complete the following requirements related to the confirmation of receivables for Cloud 9 based on previous work and the following information. Using PPS sampling, determine the sample size that you want to use for sending accounts receivable confirmations. The book value of accounts receivable before the allowance for doubtful accounts is $71,622,804. You make the following assumptions. - You set tolerable misstatement for accounts receivable at $3,500,000. - Expected misstatement =$750,000. - Risk of incorrect acceptance =37%. (a) Your answer is correct. Using PPS sampling, determine the sample size that you want to use for sending accounts receivable confirmations. The book value of accounts receivable before the allowance for doubtful accounts is $71,622,804. You make the following assumptions: 2. What do you calculate for sample size? Sample size 3. What do you calculate for sampling interval? (Round answers to 2 decimal places, e.g. 15.25.) Sampling interval $ After discussion of the sample size with Josh Thomas, the audit eam sets tolerable misstatement at $3,000,000, expected misstatement at $1,750,000, and risk of incorrect acceptance at 37%. You use a sample size of 73 confirmations. The sampling interval is $981,134. You may assume that except for the following, you received confirmations from customers that showed no exceptions. Two confirmations were returned in which customers noted exceptions. After performing follow-up procedures, you determine the two items are misstatements as follows. 1. Determine the upper misstatement limit. Uppermisstatement limit $ 2. Draw a conclusion about whether the existence assertion for accounts receivable is presented fairly at December 31,2025. Accounts receivable is presentet Assume that you are preparing to confirm accounts receivable at December 31,2025 , which is one month prior to the fiscal year-end of January 31,2026 . The book value of gross accounts receivable is $71,622,804. Complete the following requirements related to the confirmation of receivables for Cloud 9 based on previous work and the following information. Using PPS sampling, determine the sample size that you want to use for sending accounts receivable confirmations. The book value of accounts receivable before the allowance for doubtful accounts is $71,622,804. You make the following assumptions. - You set tolerable misstatement for accounts receivable at $3,500,000. - Expected misstatement =$750,000. - Risk of incorrect acceptance =37%. (a) Your answer is correct. Using PPS sampling, determine the sample size that you want to use for sending accounts receivable confirmations. The book value of accounts receivable before the allowance for doubtful accounts is $71,622,804. You make the following assumptions: 2. What do you calculate for sample size? Sample size 3. What do you calculate for sampling interval? (Round answers to 2 decimal places, e.g. 15.25.) Sampling interval $ After discussion of the sample size with Josh Thomas, the audit eam sets tolerable misstatement at $3,000,000, expected misstatement at $1,750,000, and risk of incorrect acceptance at 37%. You use a sample size of 73 confirmations. The sampling interval is $981,134. You may assume that except for the following, you received confirmations from customers that showed no exceptions. Two confirmations were returned in which customers noted exceptions. After performing follow-up procedures, you determine the two items are misstatements as follows. 1. Determine the upper misstatement limit. Uppermisstatement limit $ 2. Draw a conclusion about whether the existence assertion for accounts receivable is presented fairly at December 31,2025. Accounts receivable is presentet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts