Question: PLEASE ANSWER PART B. Analyzing, Interpreting and Capitalizing Operating Leases Assume YUM! Brands, Inc., reports the following footnote relating to its capital and operating leases

PLEASE ANSWER PART B.

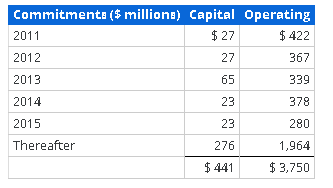

Analyzing, Interpreting and Capitalizing Operating Leases Assume YUM! Brands, Inc., reports the following footnote relating to its capital and operating leases in its 2010 10-K report ($ millions). Future minimum commitments under non-cancelable leases are set forth below. At December 25, 2010, and December 26, 2009, the present value of minimum payments under capital leases was $245 million and $228 million, respectively.

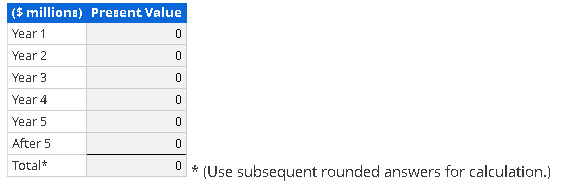

*** (B) Using a 8.36% discount rate and rounding the remaining lease life to three decimal places, compute the present value of YUM!'s operating leases. (Use a financial calculator or Excel to compute. Do not round until your final answers. Round each answer to the nearest whole number.)

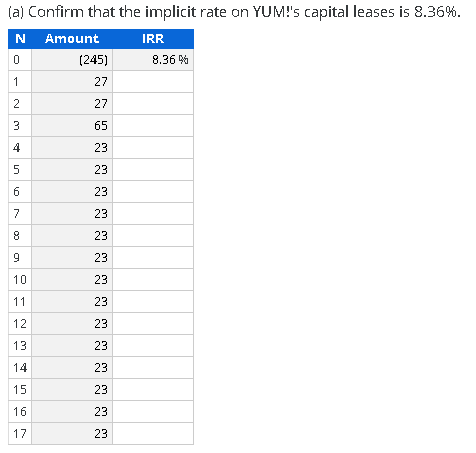

$422 339 Commitments ($ millione) Capital Operating 2011 $ 27 2012 367 2013 2014 378 2015 280 Thereafter 276 1,964 $441 $3,750 No (a) Confirm that the implicit rate on YUM!'s capital leases is 8.36%. NAmount IRR (245) 8.36 27 ($ millions) Present Value Year 1 Year 2 Year 3 Year 4 Year 5 After 5 Total* U*(Use subsequent rounded answers for calculation.) $422 339 Commitments ($ millione) Capital Operating 2011 $ 27 2012 367 2013 2014 378 2015 280 Thereafter 276 1,964 $441 $3,750 No (a) Confirm that the implicit rate on YUM!'s capital leases is 8.36%. NAmount IRR (245) 8.36 27 ($ millions) Present Value Year 1 Year 2 Year 3 Year 4 Year 5 After 5 Total* U*(Use subsequent rounded answers for calculation.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts