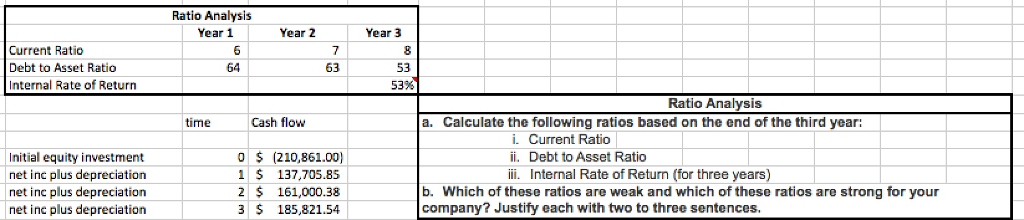

Question: Please answer part b based on the given information Ratio Analysis Year 1 Year 2 Year 3 Current Ratio Debt to Asset Ratio Internal Rate

Please answer part b

based on the given information

Ratio Analysis Year 1 Year 2 Year 3 Current Ratio Debt to Asset Ratio Internal Rate of Return 7 63 8 53 53% 64 Ratio Analysis time Cash flovw a. Calculate the following ratios based on the end of the third year: Initial equity investment net inc plus depreciation net inc plus depreciation net inc plus depreciation 0(210,861.00) 1 137,705.85 2 161,000.38 3 $ 185,821.54 i. Current Ratio ii, Debt to Asset Ratio i Internal Rate of Return (for three years) b. Which of these ratios are weak and which of these ratios are strong for your company Justify each with two to three sentences

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts