Question: please answer part B by filling out the chart! Let me know if you need any more information Heading Title a. Explain the economic performance

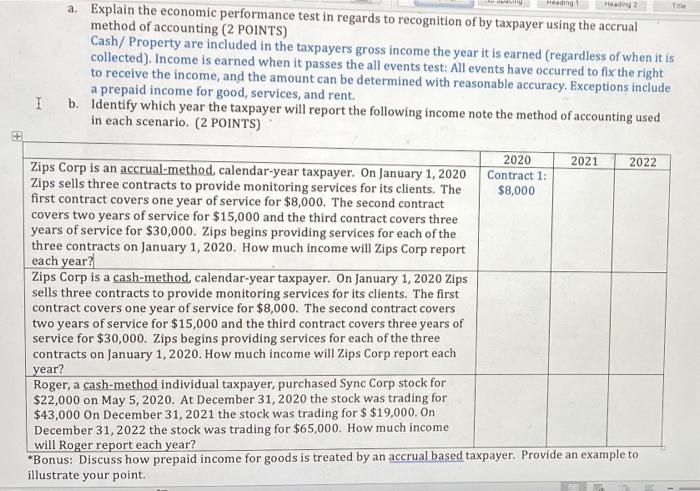

Heading Title a. Explain the economic performance test in regards to recognition of by taxpayer using the accrual method of accounting (2 POINTS) Cash/ Property are included in the taxpayers gross income the year it is earned (regardless of when it is collected). Income is earned when it passes the all events test: All events have occurred to fix the right to receive the income, and the amount can be determined with reasonable accuracy. Exceptions include a prepaid income for good, services, and rent. I b. Identify which year the taxpayer will report the following income note the method of accounting used in each scenario. (2 POINTS) 2020 2021 2022 Zips Corp is an accrual-method calendar-year taxpayer. On January 1, 2020 Contract 1: Zips sells three contracts to provide monitoring services for its clients. The $8,000 first contract covers one year of service for $8,000. The second contract covers two years of service for $15,000 and the third contract covers three years of service for $30,000. Zips begins providing services for each of the three contracts on January 1, 2020. How much income will Zips Corp report each year? Zips Corp is a cash-method, calendar-year taxpayer. On January 1, 2020 Zips sells three contracts to provide monitoring services for its clients. The first contract covers one year of service for $8,000. The second contract covers two years of service for $15,000 and the third contract covers three years of service for $30,000. Zips begins providing services for each of the three contracts on January 1, 2020. How much income will Zips Corp report each year? Roger, a cash-method individual taxpayer, purchased Sync Corp stock for $22,000 on May 5, 2020. At December 31, 2020 the stock was trading for $43,000 on December 31, 2021 the stock was trading for $ $19,000. On December 31, 2022 the stock was trading for $65,000. How much income will Roger report each year? *Bonus: Discuss how prepaid income for goods is treated by an accrual based taxpayer. Provide an example to illustrate your point

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts