Question: Please Answer Part B . I got 15600 = job 101 and 7920 = job 111 for part A !!! Triple C Ltd. is in

Please Answer Part B. I got 15600 = job 101 and 7920 = job 111 for part A !!!

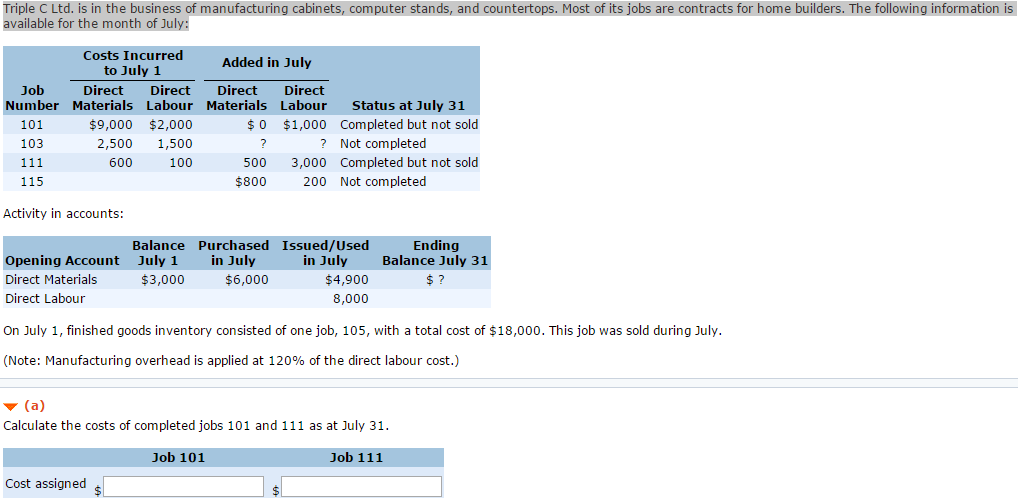

Triple C Ltd. is in the business of manufacturing cabinets, computer stands, and countertops. Most of its jobs are contracts for home builders. The following information is available for the month of July: Costs Incurred Added in July to July 1 Direct Direct Direct Direct Job Number Materials Labour Materials Labour Status at July 31 101 103 $9,000 $2,000 2,500 1,500 100 $0 $1,000 Completed but not sold ? Not completed 600 500 3,000 Completed but not sold 115 $800 200 Not completed Activity in accounts: Ending Balance July 31 Balance Purchased Issued/Used in July in July Opening Account Direct Materials Direct Labour July 1 $3,000 $4,900 8,000 $6,000 On July 1, finished goods inventory consisted of one job, 105, with a total cost of $18,000. This job was sold during July (Note: Manufacturing overhead is applied at 120% of the direct labour cost.) (a) Calculate the costs of completed jobs 101 and 111 as at July 31 Job 101 Job 111 Cost assigned

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts