Question: Please answer part B !!! I need ASAP UUlem 1 (15 points) hletics is trying to determine its optimal capital structure, which now consists of

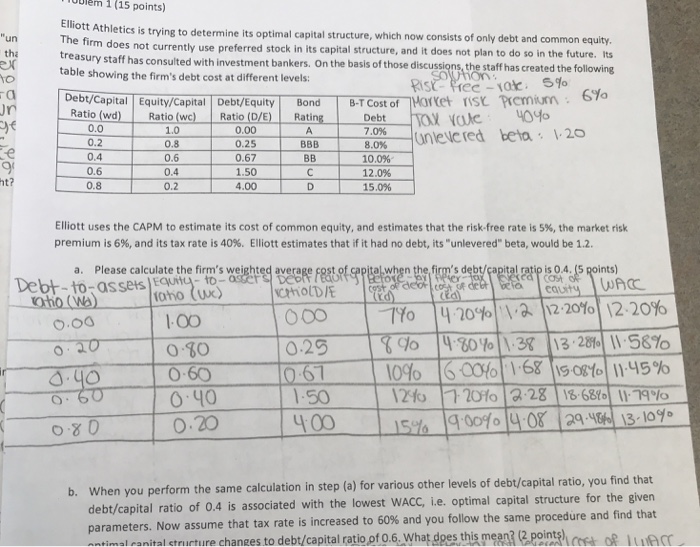

UUlem 1 (15 points) hletics is trying to determine its optimal capital structure, which now consists of only debt and common equity. oes not currently use preferred stock in its capital structure, and it does not plan to do so in the future. Its t bankers. On the basis of those discussions the staff has created thefollowing 6yo "un tha The firm d le showing the firm's debt cost at different levels Rise free-10K, 5% ra Debt/CapitalEquity/Capital Debt/Equity BondB-T Cost of Mortet rist Premim Ratio (wd)Ratio(wc) Ratio (D/E) Rating DebtOx vae 0.0 0.2 0.4 0.6 0.8 BBB | 8.00% luneced teta.. \'20 7.0% 0.25 0.8 0.6 0.4 0.2 0.67 1.50 4.00 10.0% 12.0% 15.0% ht Elliott uses the CAPM to estimate its cost of common equity, and estimates that the risk-free rate is 5%, the market risk premium is 6%, and its tax rate is 40%. Elliott estimates that if it had no debt, its "unlevered" beta, would be 12. a. Please calculate the firm's weighted average pital,when the,firm's debt/capital ratip is 0.4. (5 points) Debt-to-assetsoun AC cauty oho (u) 1.00 0 .80 0.60 0 40 O.20 O.20 1090 |6006|1 6811s osto!n45% 1.50 ?00 b. When you perform the same calculation in step (a) for various other levels of debt/capital ratio, you find that debt/capital ratio of 0.4 is associated with the lowest WACC, l.e. optimal capital structure for the given t tax rate is increased to 60% and you follow the same procedure and find that parameters. Now assume tha timal canital structure changes to debt/capital ratio of 0.6, What does this mean? (2 pointeo Lu

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts