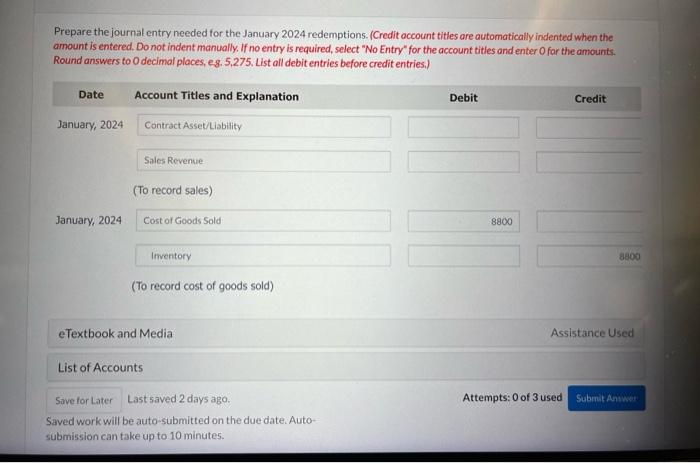

Question: Please answer part b, Jan 2024 redemptions (to record sales) journal entry. During December 2023. Crane Ltd, sells $26,500 of gift cards to customers. From

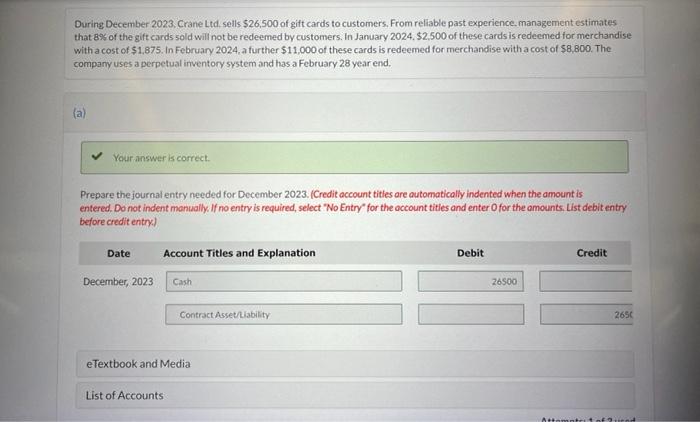

During December 2023. Crane Ltd, sells $26,500 of gift cards to customers. From reliable past experience. management estimates that 8% of the gift cards sold will not be redeemed by customers. In January 2024,$2,500 of these cards is redeemed for merchandise with a cost of $1,875. In February 2024, a further $11,000 of these cards is redeemed for merchandise with a cost of $8,800. The company uses a perpetual inventory system and has a February 28 year end. (a) Prepare the journal entry needed for December 2023. (Credit account titles are automatically indented when the amount is entered. Do not indent manually, If no entry is required, select "No Entry" for the account titles and enter O for the amounts, List debit entry before credit entry.) Prepare the journal entry needed for the January 2024 redemptions. (Credit occount titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round answers to O decimal places, eg. 5,275. List all debit entries before credit entries.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts