Question: please answer part B Less: Allowance for doubtful accounts 80,000 During year 2, S165,000 of specific accounts receivable were written off as uncollectible. Of these

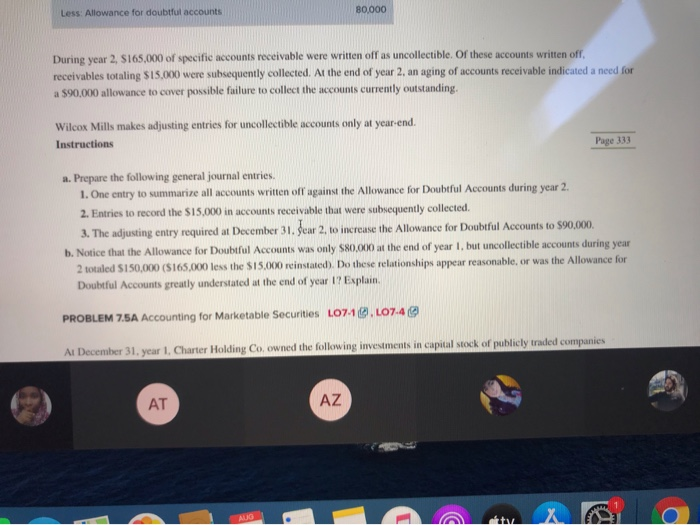

Less: Allowance for doubtful accounts 80,000 During year 2, S165,000 of specific accounts receivable were written off as uncollectible. Of these accounts written off receivables totaling $15,000 were subsequently collected. At the end of year 2. an aging of accounts receivable indicated a need for a $90,000 allowance to cover possible failure to collect the accounts currently outstanding, Wilcox Mills makes adjusting entries for uncollectible accounts only at year-end. Instructions Page 333 a. Prepare the following general journal entries. 1. One entry to summarize all accounts written off against the Allowance for Doubtful Accounts during year 2. 2. Entries to record the $15,000 in accounts receivable that were subsequently collected 3. The adjusting entry required at December 31. Sear 2, to increase the Allowance for Doubtful Accounts to $90,000, b. Notice that the Allowance for Doubtful Accounts was only $80.000 at the end of year 1, but uncollectible accounts during year 2 totaled $150,000 (S165.000 less the $15.000 reinstated). Do these relationships appear reasonable, or was the Allowance for Doubtful Accounts greatly understated at the end of year I? Explain. PROBLEM 7.5A Accounting for Marketable Securities 10710.107.4 At December 31. year 1, Charter Holding Co. owned the following investments in capital stock of publicly traded companies AT AZ AUG X

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts