Question: Please answer part B only a) when there is no inflation, an owner can expect to rent an unfurnished house for 12% of its market

Please answer part B only

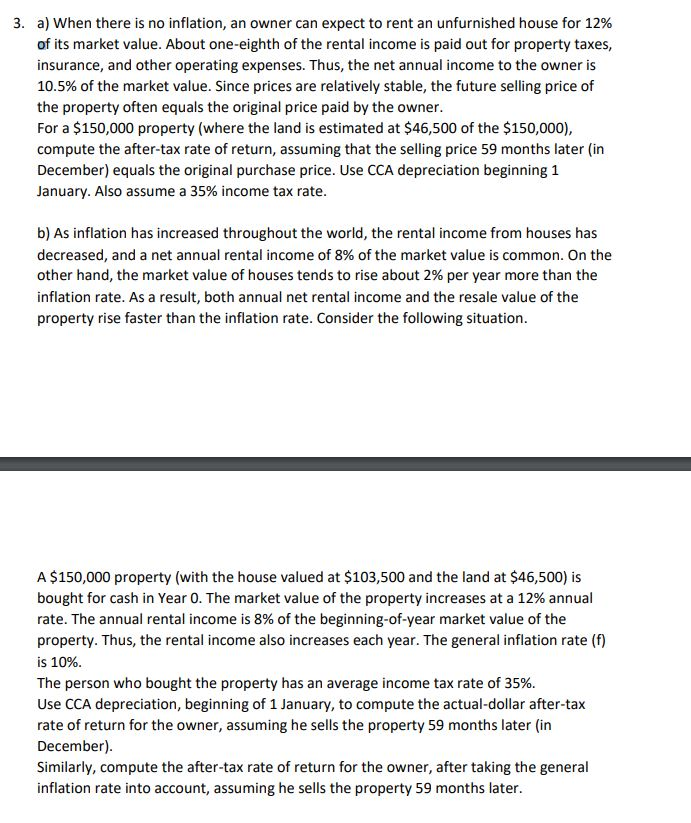

a) when there is no inflation, an owner can expect to rent an unfurnished house for 12% of its market value. About one-eighth of the rental income is paid out for property taxes, insurance, and other operating expenses. Thus, the net annual income to the owner is 10.5% of the market value. Since prices are relatively stable, the future selling price of the property often equals the original price paid by the owner For a $150,000 property (where the land is estimated at $46,500 of the $150,000), compute the after-tax rate of return, assuming that the selling price 59 months later (in December) equals the original purchase price. Use CCA depreciation beginning 1 January. Also assume a 35% income tax rate 3. b) As inflation has increased throughout the world, the rental income from houses has decreased, and a net annual rental income of 8% of the market value is common. On the other hand, the market value of houses tends to rise about 2% per year more than the inflation rate. As a result, both annual net rental income and the resale value of the property rise faster than the inflation rate. Consider the following situation A $150,000 property (with the house valued at $103,500 and the land at $46,500) is bought for cash in Year 0, The market value of the property increases at a 12% annual rate. The annual rental income is 8% of the beginning-of-year market value of the property. Thus, the rental income also increases each year. The general inflation rate (f) is 10%. The person who bought the property has an average income tax rate of 35%. Use CCA depreciation, beginning of 1 January, to compute the actual-dollar after-tax rate of return for the owner, assuming he sells the property 59 months later (in December) Similarly, compute the after-tax rate of return for the owner, after taking the general inflation rate into account, assuming he sells the property 59 months later a) when there is no inflation, an owner can expect to rent an unfurnished house for 12% of its market value. About one-eighth of the rental income is paid out for property taxes, insurance, and other operating expenses. Thus, the net annual income to the owner is 10.5% of the market value. Since prices are relatively stable, the future selling price of the property often equals the original price paid by the owner For a $150,000 property (where the land is estimated at $46,500 of the $150,000), compute the after-tax rate of return, assuming that the selling price 59 months later (in December) equals the original purchase price. Use CCA depreciation beginning 1 January. Also assume a 35% income tax rate 3. b) As inflation has increased throughout the world, the rental income from houses has decreased, and a net annual rental income of 8% of the market value is common. On the other hand, the market value of houses tends to rise about 2% per year more than the inflation rate. As a result, both annual net rental income and the resale value of the property rise faster than the inflation rate. Consider the following situation A $150,000 property (with the house valued at $103,500 and the land at $46,500) is bought for cash in Year 0, The market value of the property increases at a 12% annual rate. The annual rental income is 8% of the beginning-of-year market value of the property. Thus, the rental income also increases each year. The general inflation rate (f) is 10%. The person who bought the property has an average income tax rate of 35%. Use CCA depreciation, beginning of 1 January, to compute the actual-dollar after-tax rate of return for the owner, assuming he sells the property 59 months later (in December) Similarly, compute the after-tax rate of return for the owner, after taking the general inflation rate into account, assuming he sells the property 59 months later

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts