Question: PLEASE ANSWER PART B Please answer fast, thank you On January 1, 2020, Blossom Ltd. acquires a building at a cost of $260,000. The building

PLEASE ANSWER PART B

Please answer fast, thank you

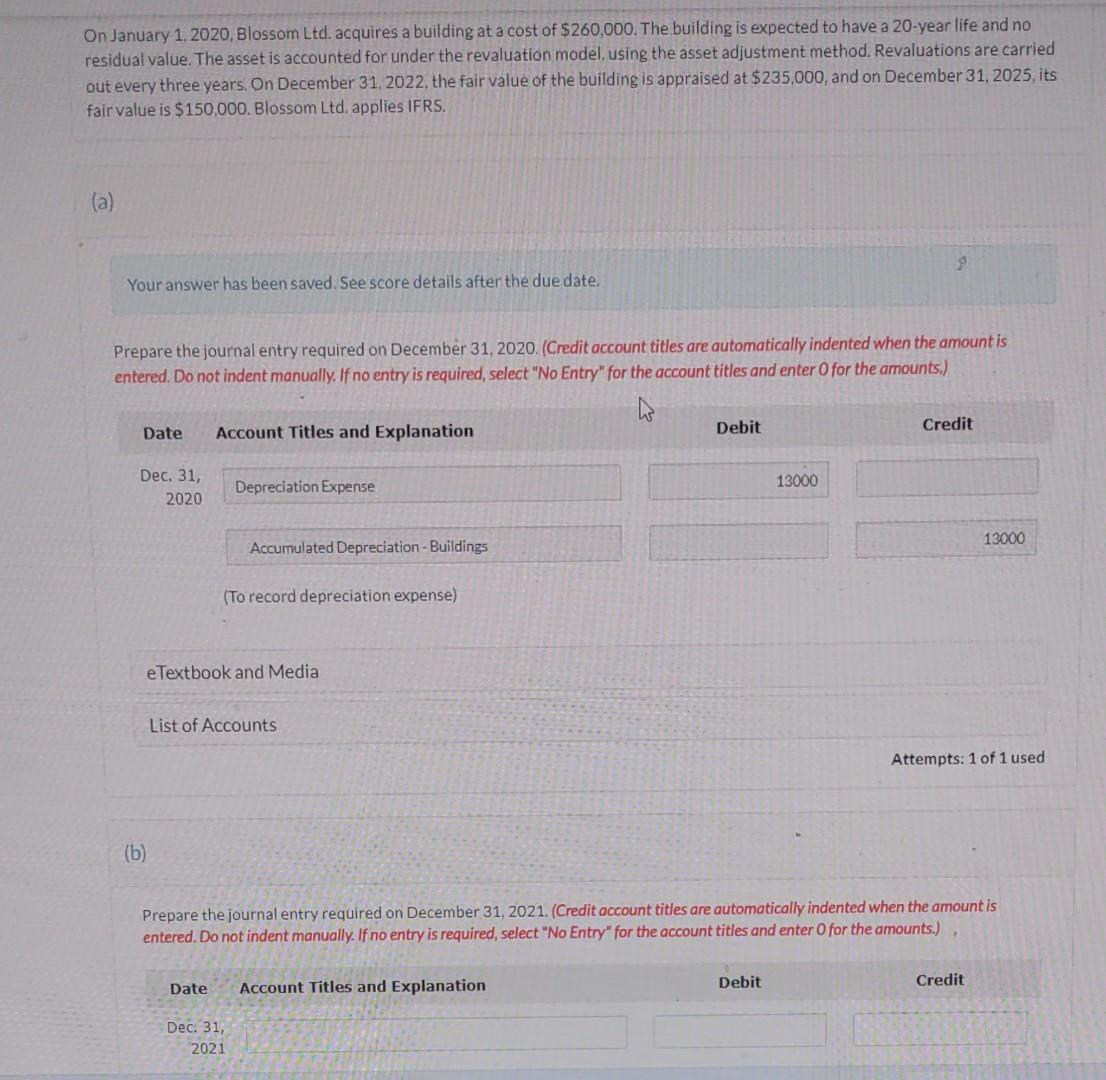

On January 1, 2020, Blossom Ltd. acquires a building at a cost of $260,000. The building is expected to have a 20-year life and no residual value. The asset is accounted for under the revaluation model, using the asset adjustment method. Revaluations are carried out every three years. On December 31, 2022, the fair value of the building is appraised at $235,000, and on December 31, 2025, its fair value is $150,000. Blossom Ltd. applies IFRS. Your answer has been saved. See score details after the due date. Prepare the journal entry required on December 31, 2020. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Dec. 31, 2020 Account Titles and Explanation (b) Depreciation Expense Accumulated Depreciation - Buildings (To record depreciation expense) eTextbook and Media List of Accounts Debit Date Account Titles and Explanation Dec. 31, 2021 13000 Debit Credit Prepare the journal entry required on December 31, 2021. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Attempts: 1 of 1 used 13000 7 Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts