Question: Please answer Part C and show work if possible. Thank you! Question 4 Your answer is partially correct. Try again. Ayayai Industries makes artificial Christmas

Please answer Part C and show work if possible. Thank you!

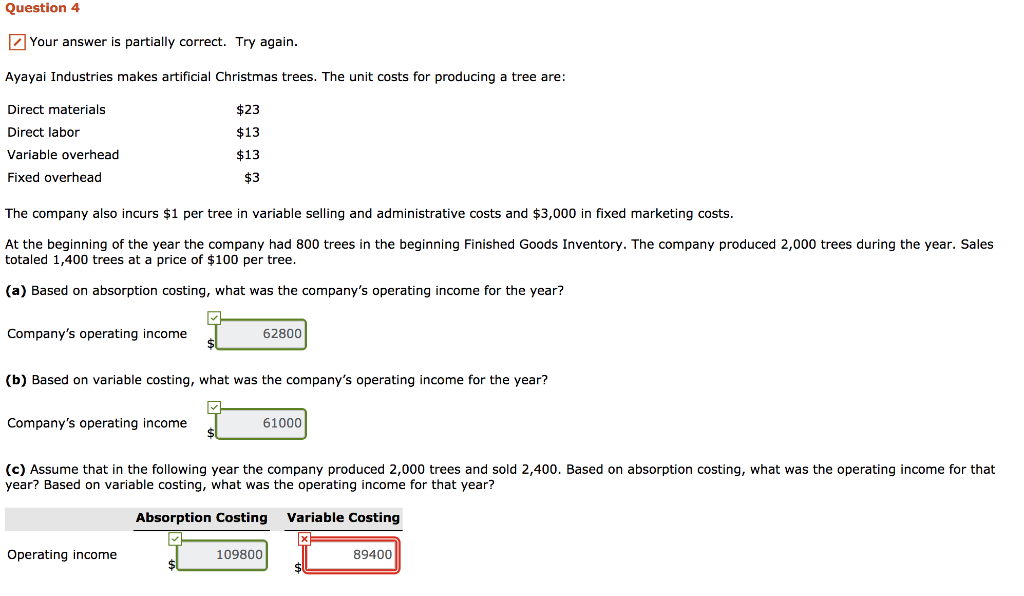

Question 4 Your answer is partially correct. Try again. Ayayai Industries makes artificial Christmas trees. The unit costs for producing a tree are: Direct materials $23 Direct labor Variable overhead Fixed overhead $13 $13 $3 The company also incurs $1 per tree in variable selling and administrative costs and $3,000 in fixed marketing costs. At the beginning of the year the company had 800 trees in the beginning Finished Goods Inventory. The company produced 2,000 trees during the year. Sales totaled 1,400 trees at a price of $100 per tree. (a) Based on absorption costing, what was the company's operating income for the year? Company's operating income 62800 (b) Based on variable costing, what was the company's operating income for the year? Company's operating income 61000 (c) Assume that in the following year the company produced 2,000 trees and sold 2,400. Based on absorption costing, what was the operating income for that year? Based on variable costing, what was the operating income for that year? Absorption Costing Variable Costing Operating income 109800 89400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts