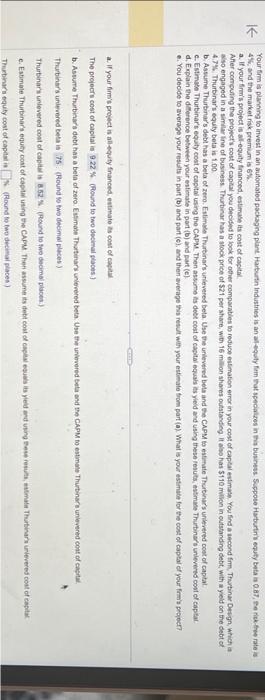

Question: please answer part c, d and e. Thank you. 44 , and the market risk premim is 6%. a. If your firm's project is all-equity

44 , and the market risk premim is 6%. a. If your firm's project is all-equity tnanced, estimase its cost of capital aso engaged in a simlar ine of business. Thurtinar has a stock price of $21 per share, with 16 million shares oulstandeg it also has $110milion in outstanding debt, with a yeld on the debt of 4.74. Thurtinar's equty beta is 1.00 b. Assume Thurbinar's debt has a beta of zero. Entimese Thurtinar's unlevered beta. Use the urievtred bela and Ge cNpM to estimate Thutinar's unievered coet of captal c. Estmete Thurbinar's equity cost of capital ising the CAPM. Then assime is deet cost of capital equals is yieid and using these fesubs, astmase Thutiner's unieriets cost of captat d. Explain the demerence betwetc your entinase in port (b) and part (c). a. If your fimst propect is allequfy franced, entmate is cost of caghid The projecrs cost of capital is (Pesund to two deeimal ploces s Thubinars uniewered beta is (Round is two decimel places) Thurbinars undevered cost of capial is a 52%. (Round io tho deamal placest) Thubinarn pauty cost of capatar is K. (Flound to two decimal places)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts