Question: Please answer Part C of this problem Stogy Corp. has a debt-equity ratio (in market value terms) of 1/9. The beta of Stodgy's stock is

Please answer Part C of this problem

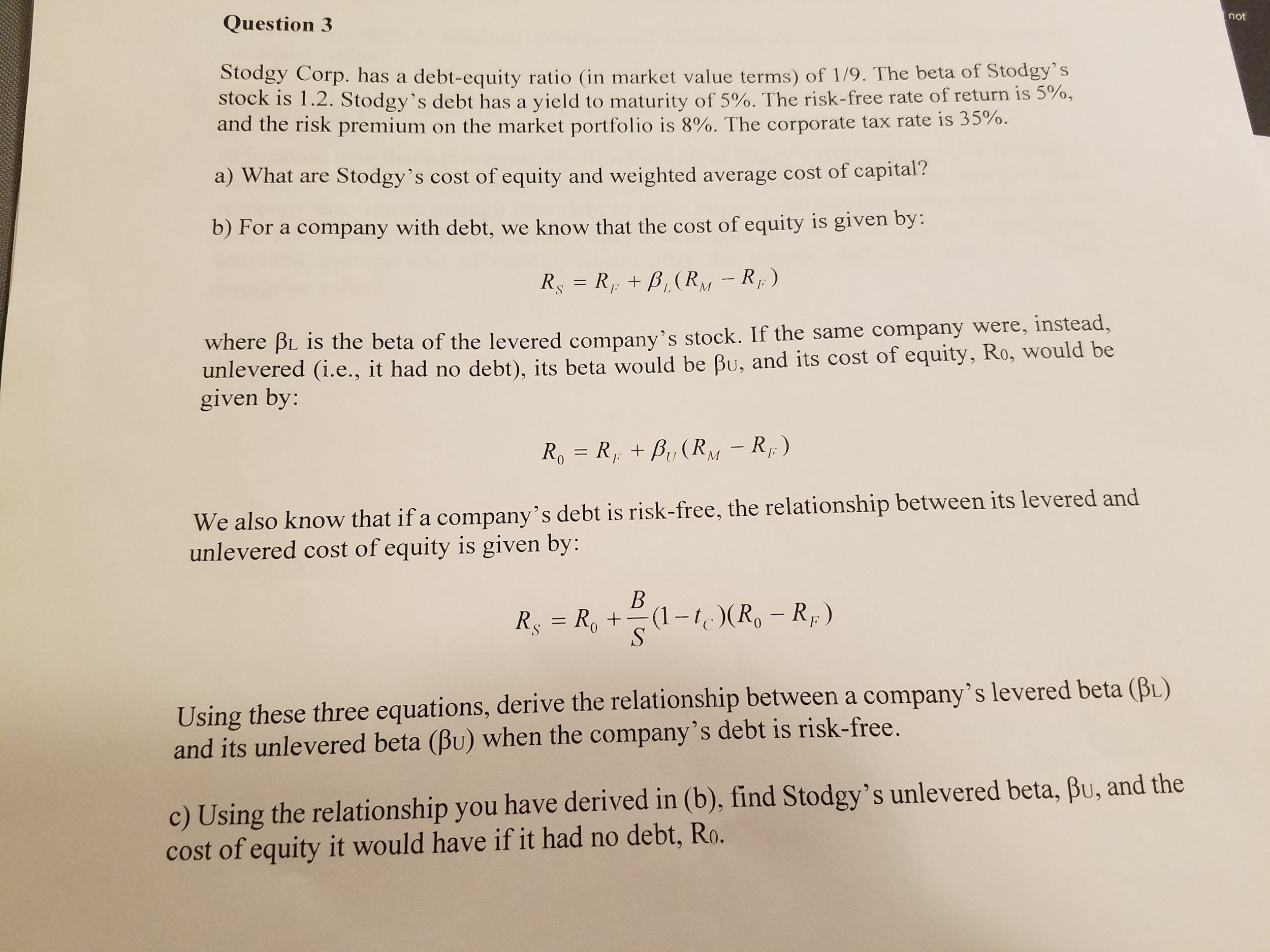

Stogy Corp. has a debt-equity ratio (in market value terms) of 1/9. The beta of Stodgy's stock is 1.2. Stodgy's debt has a yield to maturity of 5%. The risk-free rate of return is 5%, and the risk premium on the market portfolio is 8%. The corporate tax rate is 35%. What are Stodgy's cost of equity and weighted average cost of capital? For a company with debt, we know that the cost of equity is given by: R_S=R_F +beta_L, (R_M-R_r) where beta_l is the beta of the levered company's stock. If the same company were, instead, unlevered (i.e., it had no debt), its beta would be Pu, and its cost of equity, Ro, would be given by: R_0 = R_F + beta_U (R_M - R_F) We also know that if a company's debt is risk-free, the relationship between its levered and unlevered cost of equity is given by: R_S = R_0 + B/S (1 - t_C) (R_0 - R_F) Using these three equations, derive the relationship between a company's levered beta (beta L) and its unlevered beta (beta_u) when the company's debt is risk-free. c) Using the relationship you have derived in (b), find Stodgy's unlevered beta, beta_u, and the cost of equity it would have if it had no debt, R_0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts