Question: PLEASE ANSWER PART (C) & PART (D). [PART (A) & PART (B) HAS ALREADY BEEN ANSWERED ON A DIFFERENT THREAD]. Question 3 [Total 25 marks]

PLEASE ANSWER PART (C) & PART (D). [PART (A) & PART (B) HAS ALREADY BEEN ANSWERED ON A DIFFERENT THREAD].

PLEASE ANSWER PART (C) & PART (D). [PART (A) & PART (B) HAS ALREADY BEEN ANSWERED ON A DIFFERENT THREAD].

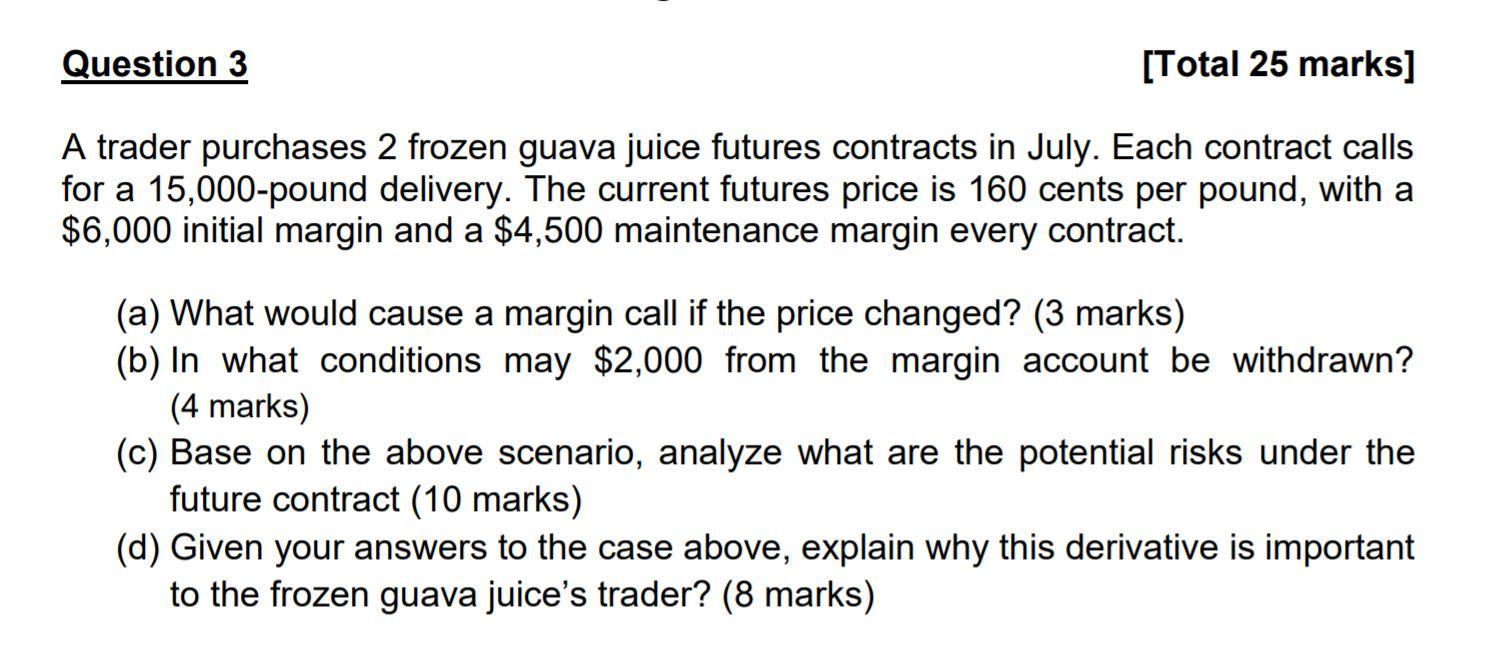

Question 3 [Total 25 marks] A trader purchases 2 frozen guava juice futures contracts in July. Each contract calls for a 15,000-pound delivery. The current futures price is 160 cents per pound, with a $6,000 initial margin and a $4,500 maintenance margin every contract. a (a) What would cause a margin call if the price changed? (3 marks) (b) In what conditions may $2,000 from the margin account be withdrawn? (4 marks) (c) Base on the above scenario, analyze what are the potential risks under the future contract (10 marks) (d) Given your answers to the case above, explain why this derivative is important to the frozen guava juice's trader? (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts