Question: Please Answer part C! Thank you! Consider a project with free cash flow in one year of $149,413 or $180,716, with either outcome being equally

Please Answer part C! Thank you!

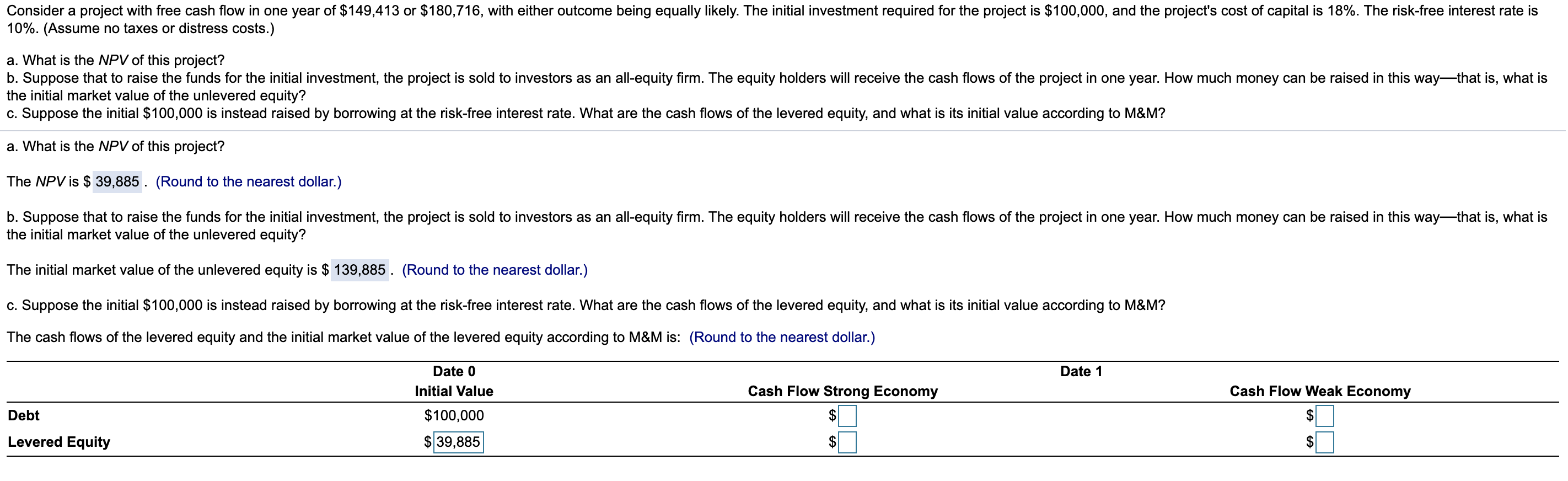

Consider a project with free cash flow in one year of $149,413 or $180,716, with either outcome being equally likely. The initial investment required for the project is $100,000, and the project's cost of capital is 18%. The risk-free interest rate is 10%. (Assume no taxes or distress costs.) a. What is the NPV of this project? b. Suppose that to raise the funds for the initial investment, the project is sold to investors as an all-equity firm. The equity holders will receive the cash flows of the project in one year. How much money can be raised in this waythat is, what is the initial market value of the unlevered equity? c. Suppose the initial $100,000 is instead raised by borrowing at the risk-free interest rate. What are the cash flows of the levered equity, and what is its initial value according to M&M? a. What is the NPV of this project? The NPV is $ 39,885 . (Round to the nearest dollar.) b. Suppose that to raise the funds for the initial investment, the project is sold to investors as an all-equity firm. The equity holders will receive the cash flows of the project in one year. How much money can be raised in this waythat is, what is the initial market value of the unlevered equity? The initial market value of the unlevered equity is $ 139,885. (Round to the nearest dollar.) c. Suppose the initial $100,000 is instead raised by borrowing at the risk-free interest rate. What are the cash flows of the levered equity, and what is its initial value according to M&M? The cash flows of the levered equity and the initial market value of the levered equity according to M&M is: (Round to the nearest dollar.) Date 1 Date 0 Initial Value Cash Flow Strong Economy Cash Flow Weak Economy Debt $ $ $100,000 $ 39,885 Levered Equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts