Question: please answer part c,d and e. Thank you!! Section A (30%) - Case Study Analysis Answer ALL questions in this section. TwoBoxes Thanks Company (TBT)

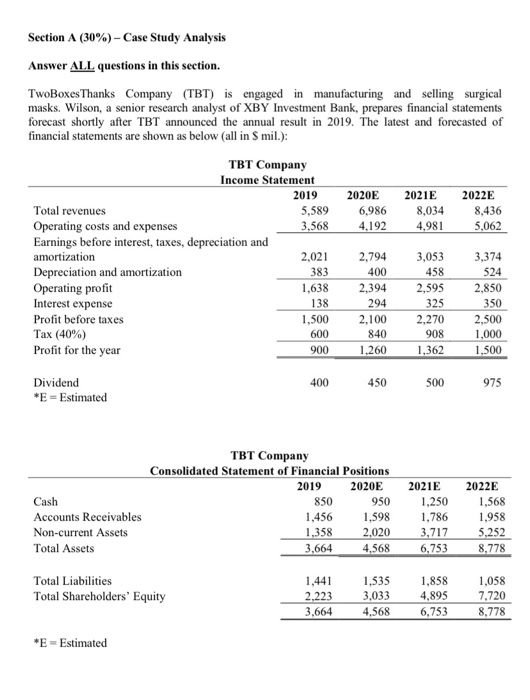

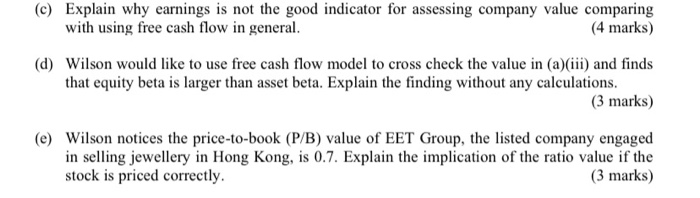

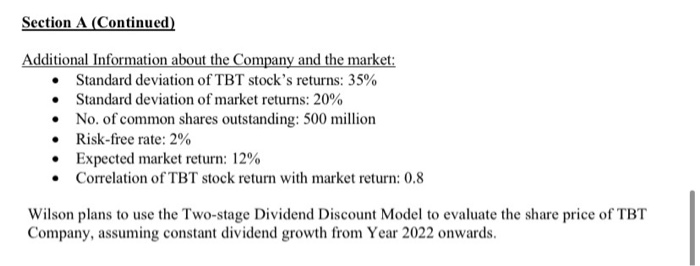

Section A (30%) - Case Study Analysis Answer ALL questions in this section. TwoBoxes Thanks Company (TBT) is engaged in manufacturing and selling surgical masks. Wilson, a senior research analyst of XBY Investment Bank, prepares financial statements forecast shortly after TBT announced the annual result in 2019. The latest and forecasted of financial statements are shown as below (all in $ mil.): TBT Company Income Statement 2019 2020E 2021E 2022E Total revenues 5,589 6,986 8,034 8,436 Operating costs and expenses 3,568 4,192 4,981 5,062 Earnings before interest, taxes, depreciation and amortization 2,021 2,794 3,053 3,374 Depreciation and amortization 383 400 458 524 Operating profit 1,638 2,394 2,595 2,850 Interest expense 138 294 325 350 Profit before taxes 1,500 2,100 2,270 2.500 Tax (40%) 600 840 908 1.000 Profit for the year 900 1,260 1,362 1,500 400 450 500 975 Dividend *E - Estimated Cash Accounts Receivables Non-current Assets Total Assets TBT Company Consolidated Statement of Financial Positions 2019 2020E 850 950 1,456 1,598 1,358 2,020 3,664 4,568 2021E 1,250 1,786 3.717 6,753 2022E 1,568 1,958 5,252 8,778 Total Liabilities Total Shareholders' Equity 1,441 2,223 3,664 1.535 3,033 4,568 1,858 4,895 6,753 1,058 7.720 8,778 *E - Estimated () Explain why earnings is not the good indicator for assessing company value comparing with using free cash flow in general. (4 marks) (d) Wilson would like to use free cash flow model to cross check the value in (a)(iii) and finds that equity beta is larger than asset beta. Explain the finding without any calculations. (3 marks) (e) Wilson notices the price-to-book (P/B) value of EET Group, the listed company engaged in selling jewellery in Hong Kong, is 0.7. Explain the implication of the ratio value if the stock is priced correctly. (3 marks) Section A (Continued) Additional Information about the Company and the market: Standard deviation of TBT stock's returns: 35% Standard deviation of market returns: 20% No. of common shares outstanding: 500 million Risk-free rate: 2% Expected market return: 12% Correlation of TBT stock return with market return: 0.8 Wilson plans to use the Two-stage Dividend Discount Model to evaluate the share price of TBT Company, assuming constant dividend growth from Year 2022 onwards

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts