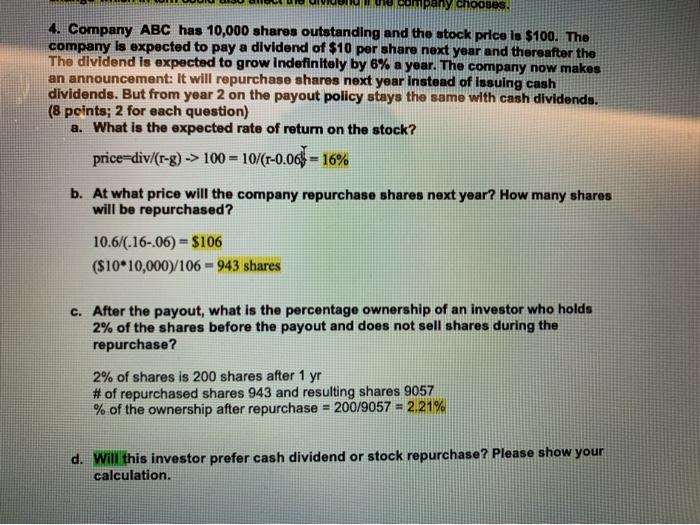

Question: please answer part d. need to get present value of all future dividends and present value of stock repurchases ny chooses 4. Company ABC has

ny chooses 4. Company ABC has 10,000 shares outstanding and the stock price is $100. The company is expected to pay a dividend of $10 per share next year and thereafter the The dividend is expected to grow indefinitely by 6% a year. The company now makes an announcement: It will repurchase shares next year instead of Issuing cash dividends. But from year 2 on the payout policy stays the same with cash dividends. (8 points; 2 for each question) a. What is the expected rate of retum on the stock? price-div/(r-g) -> 100 = 10/(1-0.06% 16% b. At what price will the company repurchase shares next year? How many shares will be repurchased? 10.6/(.16-.06) = $106 ($10*10,000)/106 - 943 shares c. After the payout, what is the percentage ownership of an investor who holds 2% of the shares before the payout and does not sell shares during the repurchase? 2% of shares is 200 shares after 1 yr # of repurchased shares 943 and resulting shares 9057 % of the ownership after repurchase = 200/9057 = 2.21% d. Will this investor prefer cash dividend or stock repurchase? Please show your calculation. ny chooses 4. Company ABC has 10,000 shares outstanding and the stock price is $100. The company is expected to pay a dividend of $10 per share next year and thereafter the The dividend is expected to grow indefinitely by 6% a year. The company now makes an announcement: It will repurchase shares next year instead of Issuing cash dividends. But from year 2 on the payout policy stays the same with cash dividends. (8 points; 2 for each question) a. What is the expected rate of retum on the stock? price-div/(r-g) -> 100 = 10/(1-0.06% 16% b. At what price will the company repurchase shares next year? How many shares will be repurchased? 10.6/(.16-.06) = $106 ($10*10,000)/106 - 943 shares c. After the payout, what is the percentage ownership of an investor who holds 2% of the shares before the payout and does not sell shares during the repurchase? 2% of shares is 200 shares after 1 yr # of repurchased shares 943 and resulting shares 9057 % of the ownership after repurchase = 200/9057 = 2.21% d. Will this investor prefer cash dividend or stock repurchase? Please show your calculation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts