Question: Please answer part e and f!!!!!!! This is a,b,c,d solutions.Please answer e and f. I. Capital Structure Decisions Consider an all-equity financed company worth $100,000

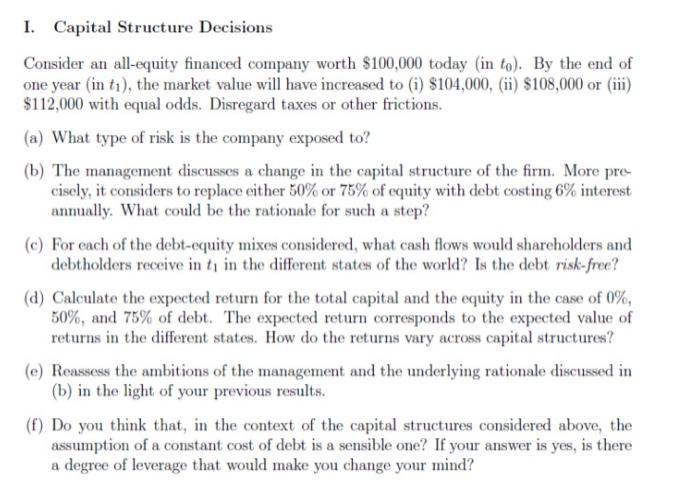

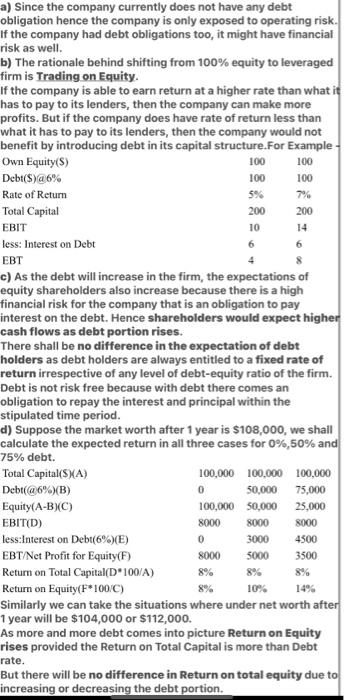

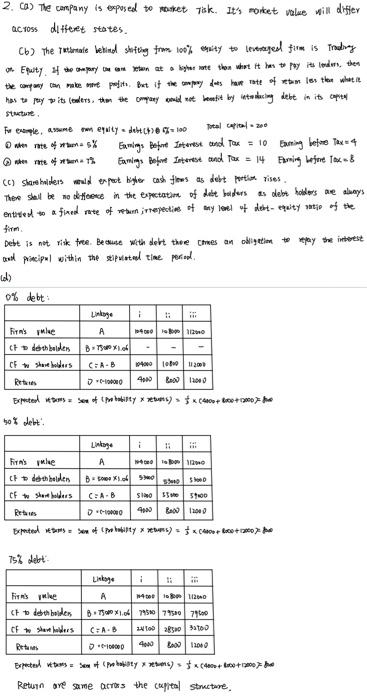

I. Capital Structure Decisions Consider an all-equity financed company worth $100,000 today (in to). By the end of one year in t), the market value will have increased to (i) $104,000, (ii) $108,000 or (ii) $112,000 with equal odds. Disregard taxes or other frictions. (a) What type of risk is the company exposed to? (b) The management discusses a change in the capital structure of the firm. More pre- cisely, it considers to replace either 50% or 75% of equity with debt costing 6% interest annually. What could be the rationale for such a step? (e) For each of the debt-equity mixes considered, what cash flows would shareholders and debtholders receive in t, in the different states of the world? Is the debt risk-free? (d) Calculate the expected return for the total capital and the equity in the case of 0%, 50%, and 75% of debt. The expected return corresponds to the expected value of returns in the different states. How do the returns vary across capital structures? (e) Reassess the ambitions of the management and the underlying rationale discussed in (b) in the light of your previous results. (f) Do you think that, in the context of the capital structures considered above, the assumption of a constant cost of debt is a sensible one? If your answer is yes, is there a degree of leverage that would make you change your mind? 100 200 10 14 6 8 a) Since the company currently does not have any debt obligation hence the company is only exposed to operating risk. If the company had debt obligations too, it might have financial risk as well. b) The rationale behind shifting from 100% equity to leveraged firm is Trading on Equity. If the company is able to earn return at a higher rate than what it has to pay to its lenders, then the company can make more profits. But if the company does have rate of return less than what it has to pay to its lenders, then the company would not benefit by introducing debt in its capital structure.For Example Own Equity($) 100 Debt($)@6% 100 100 Rate of Return 5% 7% Total Capital 200 EBIT less: Interest on Debt EBT c) As the debt will increase in the firm, the expectations of equity shareholders also increase because there is a high financial risk for the company that is an obligation to pay interest on the debt. Hence shareholders would expect higher cash flows as debt portion rises. There shall be no difference in the expectation of debt holders as debt holders are always entitled to a fixed rate of return irrespective of any level of debt-equity ratio of the firm. Debt is not risk free because with debt there comes an obligation to repay the interest and principal within the stipulated time period. d) Suppose the market worth after 1 year is $108,000, we shall calculate the expected return in all three cases for 0%, 50% and 75% debt. Total Capital(SA) 100.000 100.000 100,000 Debt@6%)(B) 50,000 75,000 Equity(A-B)(C) 100,000 50,000 25,000 EBIT(D) 8000 8000 8000 less:Interest on Debt(6%)E) 3000 4500 EBT/Net Profit for Equity(F) 8000 5000 3500 Return on Total Capital (D*100/A) Return on Equity(F*100/C) 10% Similarly we can take the situations where under net worth after 1 year will be $104,000 or $112,000. As more and more debt comes into picture Return on Equity rises provided the Return on Total Capital is more than Debt rate. But there will be no difference in Return on total equity due to increasing or decreasing the debt portion. 0 0 2. a) The company is exposed to forket Tsk. Its morket value will difier QC105 dittent states. Cb) The Totale behind shitting from 100% hy to leverage tom is Tradivay Of Euty, hepary to retain at light then what it has leder, then the cowy y Cake pit But it they des haur eben los ter what it has to its (ders, then the company will not benefit by stolicing debt in its capital Structure , For exemple. O equity do 100 Total capital 200 aten me mas% Emmings Befort Interest and Tox = 10 baring before 14 we mhe 1% Gamings Before Interest and tour = 14 Earing Lejere & (C) Share her depot Wigher cash flow as debt portion rises Then sheill be no cose in the expectatim of debt baders & debet holders se slays entitled to a fined rate of rebum irrespective of my lewe + dest-tystje of the Debt is not risk free. Because with dert thee Cheson obligation to pay the best Bol principal within the site time period d) 0% debt Linkage Fans A 104000 ch det helder CF w standars 14001112001 C-1000 Expected by * tus) $ (4000+ 60+500) 10% debt! Lintage 11 Firm's le A CH det helder CF to shareholders C:A-B 513559600 -200mg 4900 2011 Expected not to bity ) = 5x ++3800) 75% debet Links FTA whee A 00012010 Codebt beiden 8.750X164 7958079500 7400 CF t starters C:A. 2100 25000 Retures -10000 4000 1102 Expected wees = booty) (4100h Return ave same across the capital structure I. Capital Structure Decisions Consider an all-equity financed company worth $100,000 today (in to). By the end of one year in t), the market value will have increased to (i) $104,000, (ii) $108,000 or (ii) $112,000 with equal odds. Disregard taxes or other frictions. (a) What type of risk is the company exposed to? (b) The management discusses a change in the capital structure of the firm. More pre- cisely, it considers to replace either 50% or 75% of equity with debt costing 6% interest annually. What could be the rationale for such a step? (e) For each of the debt-equity mixes considered, what cash flows would shareholders and debtholders receive in t, in the different states of the world? Is the debt risk-free? (d) Calculate the expected return for the total capital and the equity in the case of 0%, 50%, and 75% of debt. The expected return corresponds to the expected value of returns in the different states. How do the returns vary across capital structures? (e) Reassess the ambitions of the management and the underlying rationale discussed in (b) in the light of your previous results. (f) Do you think that, in the context of the capital structures considered above, the assumption of a constant cost of debt is a sensible one? If your answer is yes, is there a degree of leverage that would make you change your mind? 100 200 10 14 6 8 a) Since the company currently does not have any debt obligation hence the company is only exposed to operating risk. If the company had debt obligations too, it might have financial risk as well. b) The rationale behind shifting from 100% equity to leveraged firm is Trading on Equity. If the company is able to earn return at a higher rate than what it has to pay to its lenders, then the company can make more profits. But if the company does have rate of return less than what it has to pay to its lenders, then the company would not benefit by introducing debt in its capital structure.For Example Own Equity($) 100 Debt($)@6% 100 100 Rate of Return 5% 7% Total Capital 200 EBIT less: Interest on Debt EBT c) As the debt will increase in the firm, the expectations of equity shareholders also increase because there is a high financial risk for the company that is an obligation to pay interest on the debt. Hence shareholders would expect higher cash flows as debt portion rises. There shall be no difference in the expectation of debt holders as debt holders are always entitled to a fixed rate of return irrespective of any level of debt-equity ratio of the firm. Debt is not risk free because with debt there comes an obligation to repay the interest and principal within the stipulated time period. d) Suppose the market worth after 1 year is $108,000, we shall calculate the expected return in all three cases for 0%, 50% and 75% debt. Total Capital(SA) 100.000 100.000 100,000 Debt@6%)(B) 50,000 75,000 Equity(A-B)(C) 100,000 50,000 25,000 EBIT(D) 8000 8000 8000 less:Interest on Debt(6%)E) 3000 4500 EBT/Net Profit for Equity(F) 8000 5000 3500 Return on Total Capital (D*100/A) Return on Equity(F*100/C) 10% Similarly we can take the situations where under net worth after 1 year will be $104,000 or $112,000. As more and more debt comes into picture Return on Equity rises provided the Return on Total Capital is more than Debt rate. But there will be no difference in Return on total equity due to increasing or decreasing the debt portion. 0 0 2. a) The company is exposed to forket Tsk. Its morket value will difier QC105 dittent states. Cb) The Totale behind shitting from 100% hy to leverage tom is Tradivay Of Euty, hepary to retain at light then what it has leder, then the cowy y Cake pit But it they des haur eben los ter what it has to its (ders, then the company will not benefit by stolicing debt in its capital Structure , For exemple. O equity do 100 Total capital 200 aten me mas% Emmings Befort Interest and Tox = 10 baring before 14 we mhe 1% Gamings Before Interest and tour = 14 Earing Lejere & (C) Share her depot Wigher cash flow as debt portion rises Then sheill be no cose in the expectatim of debt baders & debet holders se slays entitled to a fined rate of rebum irrespective of my lewe + dest-tystje of the Debt is not risk free. Because with dert thee Cheson obligation to pay the best Bol principal within the site time period d) 0% debt Linkage Fans A 104000 ch det helder CF w standars 14001112001 C-1000 Expected by * tus) $ (4000+ 60+500) 10% debt! Lintage 11 Firm's le A CH det helder CF to shareholders C:A-B 513559600 -200mg 4900 2011 Expected not to bity ) = 5x ++3800) 75% debet Links FTA whee A 00012010 Codebt beiden 8.750X164 7958079500 7400 CF t starters C:A. 2100 25000 Retures -10000 4000 1102 Expected wees = booty) (4100h Return ave same across the capital structure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts