Question: Please answer parts 1-6 in format 1) 2) 3) 4) 5) 6) Lattice Semiconductor is thinking of buying a new machine for $170,000 that would

Please answer parts 1-6

in format 1) 2) 3) 4) 5) 6)

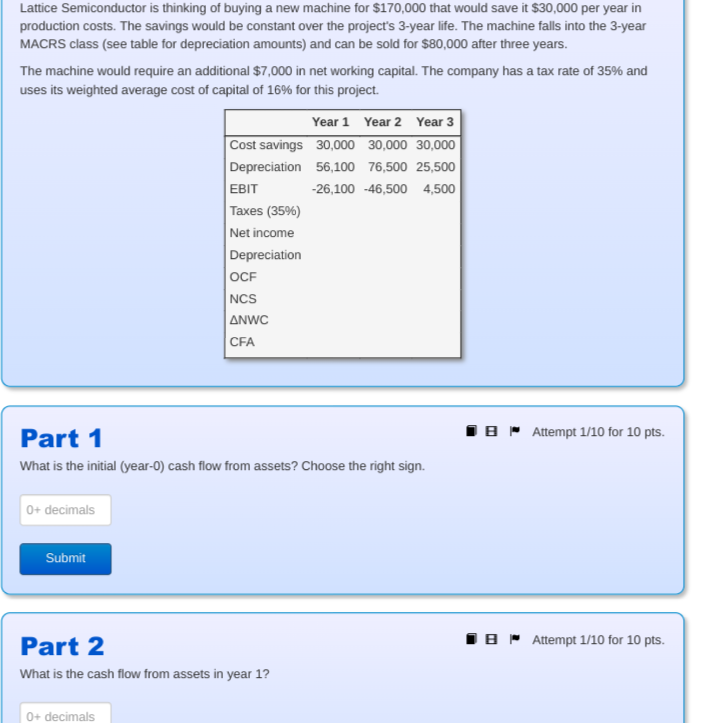

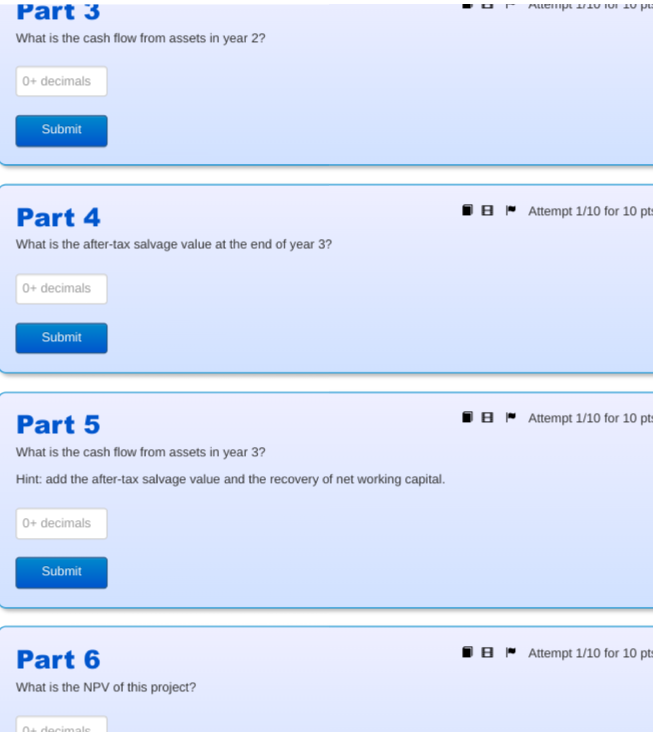

Lattice Semiconductor is thinking of buying a new machine for $170,000 that would save it $30,000 per year in production costs. The savings would be constant over the project's 3-year life. The machine falls into the 3-year MACRS class (see table for depreciation amounts) and can be sold for $80,000 after three years. The machine would require an additional $7,000 in net working capital. The company has a tax rate of 35% and uses its weighted average cost of capital of 16% for this project. Year 1 Year 2 Year 3 Cost savings 30,000 30,000 30,000 Depreciation 56,100 76,500 25,500 EBIT -26,100 -46,500 4,500 Taxes (35%) Net income Depreciation OCF NCS ANWC CFA IBAttempt 1/10 for 10 pts. Part 1 What is the initial (year-o) cash flow from assets? Choose the right sign. 0+ decimals Submit I. Attempt 1/10 for 10 pts. Part 2 What is the cash flow from assets in year 1? 0+ decimals : Part 3 What is the cash flow from assets in year 2? 0+ decimals Submit IB Attempt 1/10 for 10 pts Part 4 What is the after-tax salvage value at the end of year 3? 0+ decimals Submit IB Attempt 1/10 for 10 pts Part 5 What is the cash flow from assets in year 3? Hint: add the after-tax salvage value and the recovery of net working capital. 0+ decimals Submit IB Attempt 1/10 for 10 pts Part 6 What is the NPV of this project? decimals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts