Question: PLEASE ANSWER PARTS a b c AND D Required information Problem 15-45 (LO 15-3) (Algo) [The following information applies to the questions displayed below.] Mason

PLEASE ANSWER PARTS a b c AND D

![(LO 15-3) (Algo) [The following information applies to the questions displayed below.]](https://s3.amazonaws.com/si.experts.images/answers/2024/09/66db2c007ca58_68066db2c001504c.jpg)

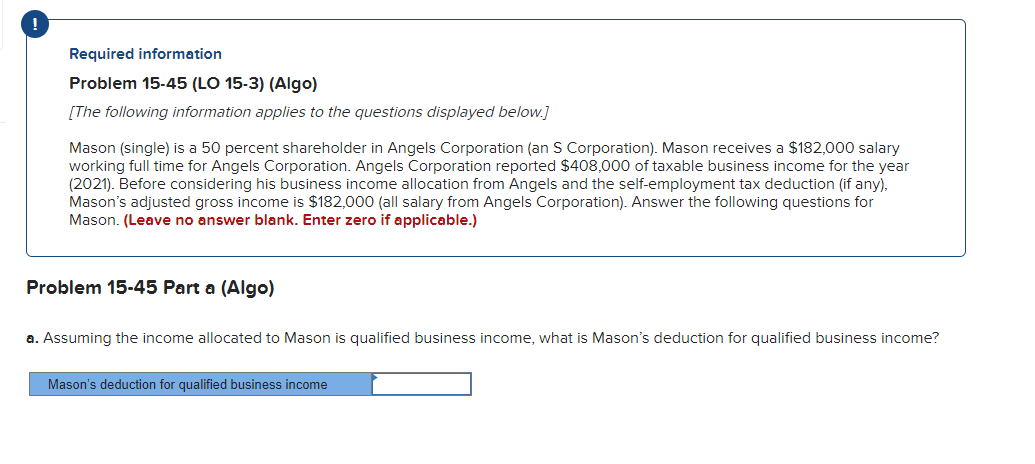

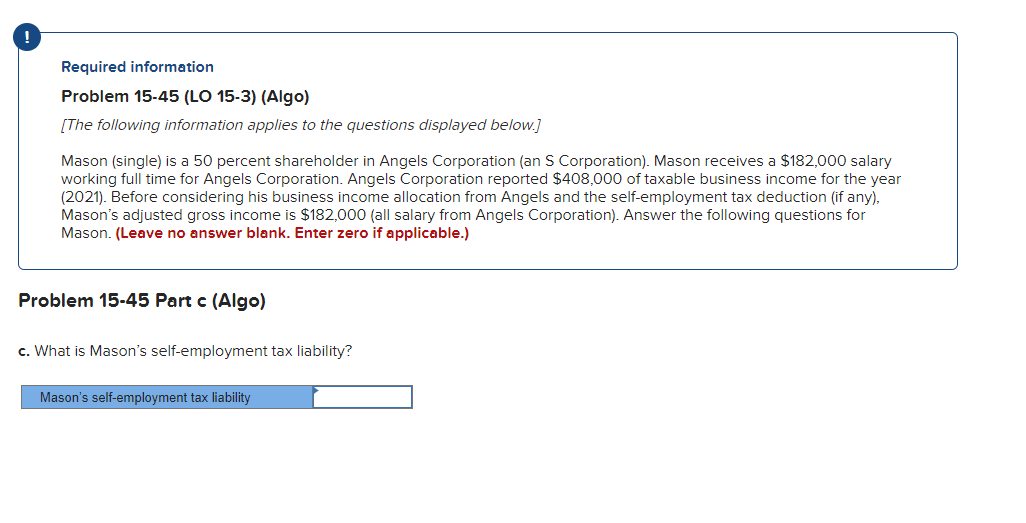

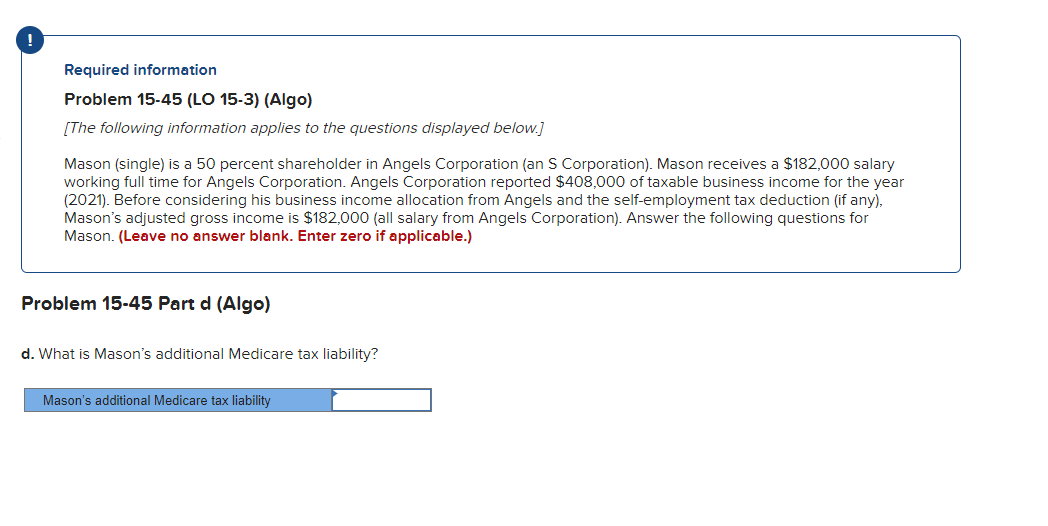

Required information Problem 15-45 (LO 15-3) (Algo) [The following information applies to the questions displayed below.] Mason (single) is a 50 percent shareholder in Angels Corporation (an S Corporation). Mason receives a $182,000 salary working full time for Angels Corporation. Angels Corporation reported $408,000 of taxable business income for the year (2021). Before considering his business income allocation from Angels and the self-employment tax deduction (if any), Mason's adjusted gross income is $182,000 (all salary from Angels Corporation). Answer the following questions for Mason. (Leave no answer blank. Enter zero if applicable.) roblem 15-45 Part a (Algo) Assuming the income allocated to Mason is qualified business income, what is Mason's deduction for qualified business income? Required information Problem 15-45 (LO 15-3) (Algo) [The following information applies to the questions displayed below.] Mason (single) is a 50 percent shareholder in Angels Corporation (an S Corporation). Mason receives a $182,000 salary working full time for Angels Corporation. Angels Corporation reported $408,000 of taxable business income for the year (2021). Before considering his business income allocation from Angels and the self-employment tax deduction (if any), Mason's adjusted gross income is $182,000 (all salary from Angels Corporation). Answer the following questions for Mason. (Leave no answer blank. Enter zero if applicable.) Problem 15-45 Part b (Algo) b. What is Mason's net investment income tax liability (assume no investment expenses)? Required information Problem 15-45 (LO 15-3) (Algo) [The following information applies to the questions displayed below.] Mason (single) is a 50 percent shareholder in Angels Corporation (an S Corporation). Mason receives a $182,000 salary working full time for Angels Corporation. Angels Corporation reported $408,000 of taxable business income for the year (2021). Before considering his business income allocation from Angels and the self-employment tax deduction (if any), Mason's adjusted gross income is $182,000 (all salary from Angels Corporation). Answer the following questions for Mason. (Leave no answer blank. Enter zero if applicable.) Problem 15-45 Part c (Algo) c. What is Mason's self-employment tax liability? Required information Problem 15-45 (LO 15-3) (Algo) [The following information applies to the questions displayed below.] Mason (single) is a 50 percent shareholder in Angels Corporation (an S Corporation). Mason receives a $182,000 salary working full time for Angels Corporation. Angels Corporation reported $408,000 of taxable business income for the year (2021). Before considering his business income allocation from Angels and the self-employment tax deduction (if any), Mason's adjusted gross income is $182,000 (all salary from Angels Corporation). Answer the following questions for Mason. (Leave no answer blank. Enter zero if applicable.) Problem 15-45 Part d (Algo) d. What is Mason's additional Medicare tax liability? Required information Problem 15-45 (LO 15-3) (Algo) [The following information applies to the questions displayed below.] Mason (single) is a 50 percent shareholder in Angels Corporation (an S Corporation). Mason receives a $182,000 salary working full time for Angels Corporation. Angels Corporation reported $408,000 of taxable business income for the year (2021). Before considering his business income allocation from Angels and the self-employment tax deduction (if any), Mason's adjusted gross income is $182,000 (all salary from Angels Corporation). Answer the following questions for Mason. (Leave no answer blank. Enter zero if applicable.) roblem 15-45 Part a (Algo) Assuming the income allocated to Mason is qualified business income, what is Mason's deduction for qualified business income? Required information Problem 15-45 (LO 15-3) (Algo) [The following information applies to the questions displayed below.] Mason (single) is a 50 percent shareholder in Angels Corporation (an S Corporation). Mason receives a $182,000 salary working full time for Angels Corporation. Angels Corporation reported $408,000 of taxable business income for the year (2021). Before considering his business income allocation from Angels and the self-employment tax deduction (if any), Mason's adjusted gross income is $182,000 (all salary from Angels Corporation). Answer the following questions for Mason. (Leave no answer blank. Enter zero if applicable.) Problem 15-45 Part b (Algo) b. What is Mason's net investment income tax liability (assume no investment expenses)? Required information Problem 15-45 (LO 15-3) (Algo) [The following information applies to the questions displayed below.] Mason (single) is a 50 percent shareholder in Angels Corporation (an S Corporation). Mason receives a $182,000 salary working full time for Angels Corporation. Angels Corporation reported $408,000 of taxable business income for the year (2021). Before considering his business income allocation from Angels and the self-employment tax deduction (if any), Mason's adjusted gross income is $182,000 (all salary from Angels Corporation). Answer the following questions for Mason. (Leave no answer blank. Enter zero if applicable.) Problem 15-45 Part c (Algo) c. What is Mason's self-employment tax liability? Required information Problem 15-45 (LO 15-3) (Algo) [The following information applies to the questions displayed below.] Mason (single) is a 50 percent shareholder in Angels Corporation (an S Corporation). Mason receives a $182,000 salary working full time for Angels Corporation. Angels Corporation reported $408,000 of taxable business income for the year (2021). Before considering his business income allocation from Angels and the self-employment tax deduction (if any), Mason's adjusted gross income is $182,000 (all salary from Angels Corporation). Answer the following questions for Mason. (Leave no answer blank. Enter zero if applicable.) Problem 15-45 Part d (Algo) d. What is Mason's additional Medicare tax liability

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts