Question: please answer parts A through E. Will provide thumbs up for correct answer. Required information Problem 12-49 (LO 12-1, LO 12-3) (Static) [The following information

![applies to the questions displayed below.] Matt works for Fresh Corporation. Fresh](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66f71e7b63335_22766f71e7b138de.jpg)

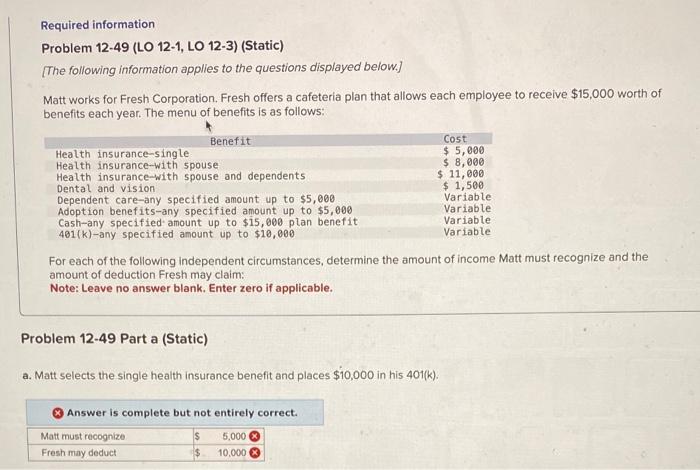

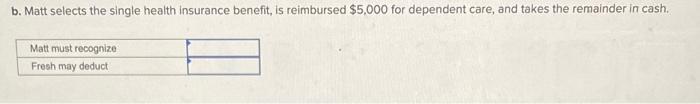

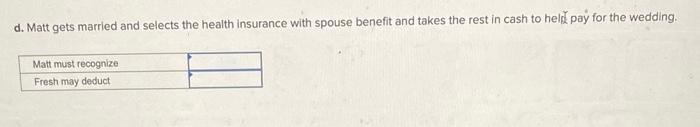

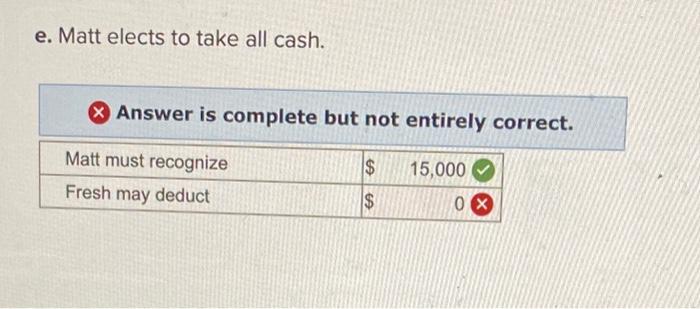

Required information Problem 12-49 (LO 12-1, LO 12-3) (Static) [The following information applies to the questions displayed below.] Matt works for Fresh Corporation. Fresh offers a cafeteria plan that allows each employee to receive $15,000 worth of benefits each year. The menu of benefits is as follows: For each of the following independent circumstances, determine the amount of income Matt must recognize and the amount of deduction Fresh may claim: Note: Leave no answer blank. Enter zero if applicable. Problem 12-49 Part a (Static) a. Matt selects the single health insurance benefit and places $10,000 in his 401(k). Answer is complete but not entirely correct. b. Matt selects the single health insurance benefit, is reimbursed $5,000 for dependent care, and takes the remainder in cash. \begin{tabular}{|l|} \hline Matt must recognize \\ \hline Fresh may deduct \\ \hline \end{tabular} c. Matt selects the single health insurance benefit and is reimbursed for $10,000 of dependent care. d. Matt gets married and selects the health insurance with spouse benefit and takes the rest in cash to heli? pay for the wedding. e. Matt elects to take all cash. Answer is complete but not entirely correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts