Question: PLEASE ANSWER PARTS I, II, III, IV DOCUMENT ALL ACTIONS PLEASE!!! Presented below are selected account balances of Debra Company at the end of its

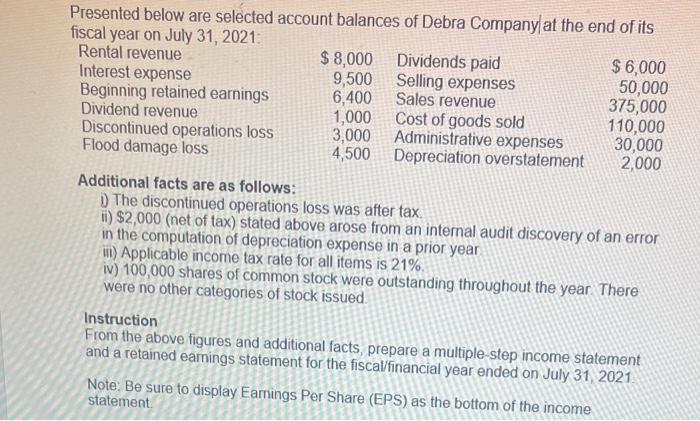

Presented below are selected account balances of Debra Company at the end of its fiscal year on July 31, 2021 Rental revenue $ 8,000 Dividends paid $ 6,000 Interest expense 9,500 Selling expenses 50,000 Beginning retained earnings 6,400 Sales revenue 375,000 Dividend revenue 1,000 Cost of goods sold 110,000 Discontinued operations loss 3,000 Administrative expenses 30,000 Flood damage loss 4,500 Depreciation overstatement 2,000 Additional facts are as follows: The discontinued operations loss was after tax il) $2,000 (net of tax) stated above arose from an internal audit discovery of an error in the computation of depreciation expense in a prior year in) Applicable income tax rate for all items is 21%. iv) 100,000 shares of common stock were outstanding throughout the year There were no other categories of stock issued Instruction From the above figures and additional facts, prepare a multiple-step income statement and a retained earnings statement for the fiscal/financial year ended on July 31, 2021 Note: Be sure to display Eamings Per Share (EPS) as the bottom of the income statement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts