Question: Please answer Please review question below On November 1, 2022, the account balances of Pharoah Equipment Repair were as follows. During November, the following summary

Please answer

Please review question below

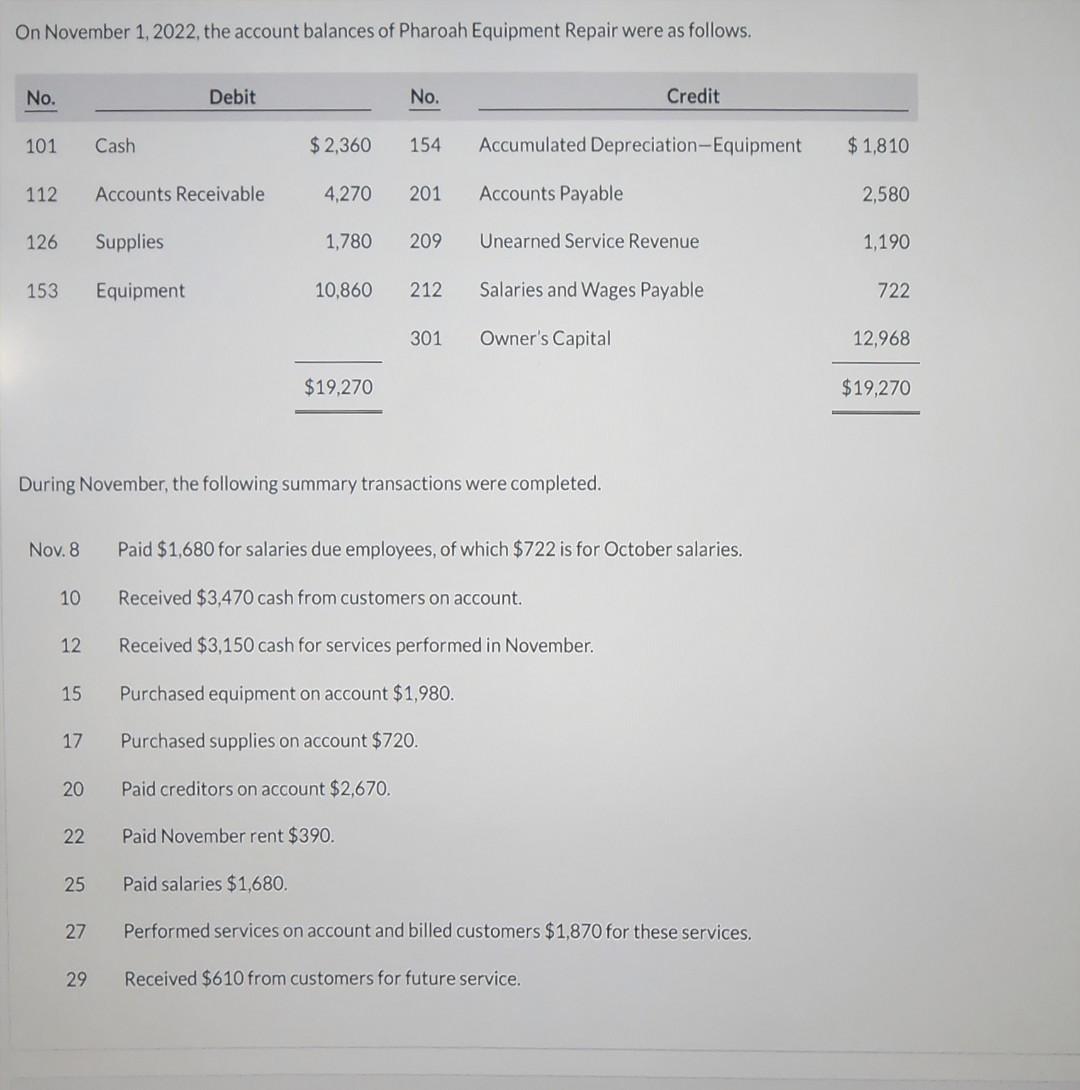

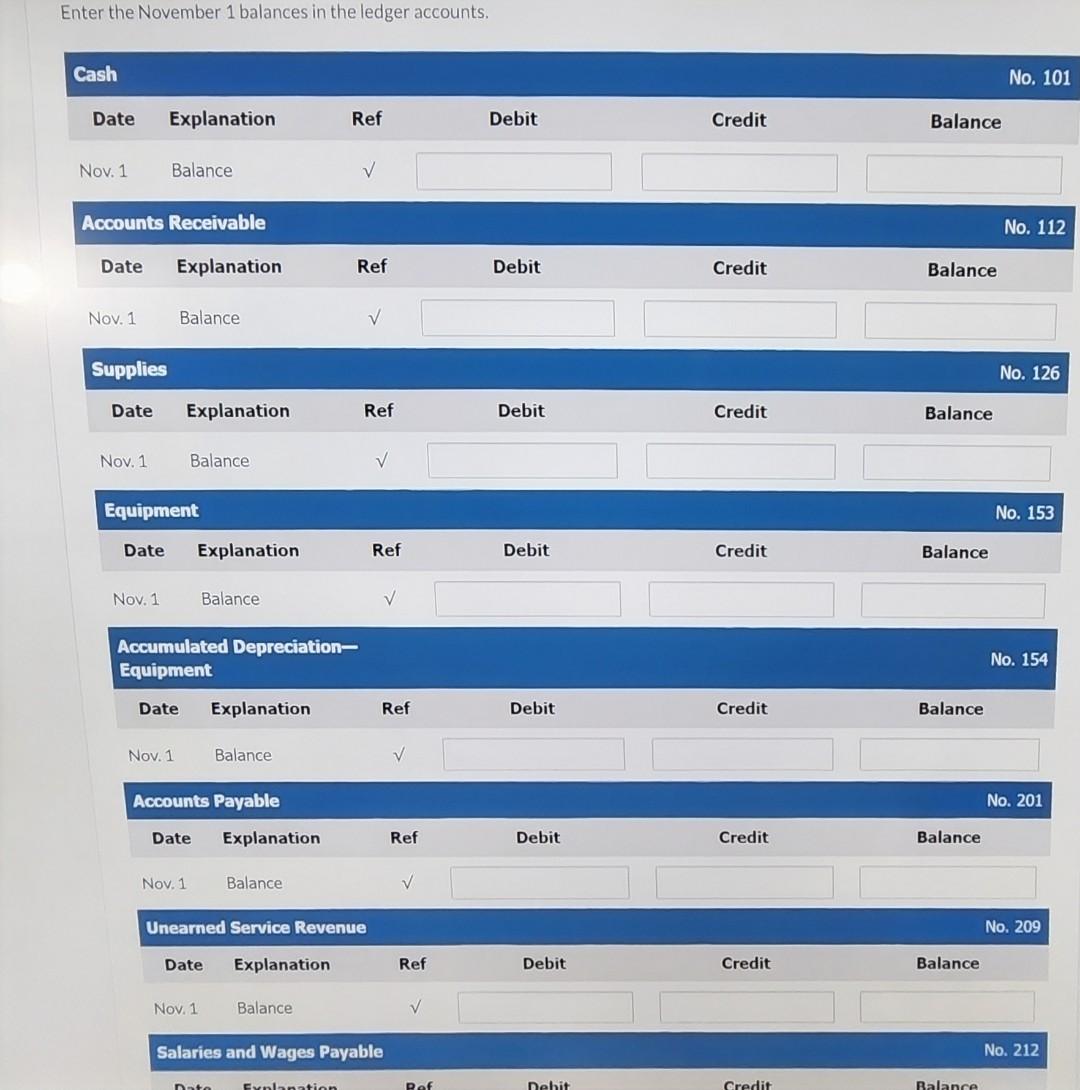

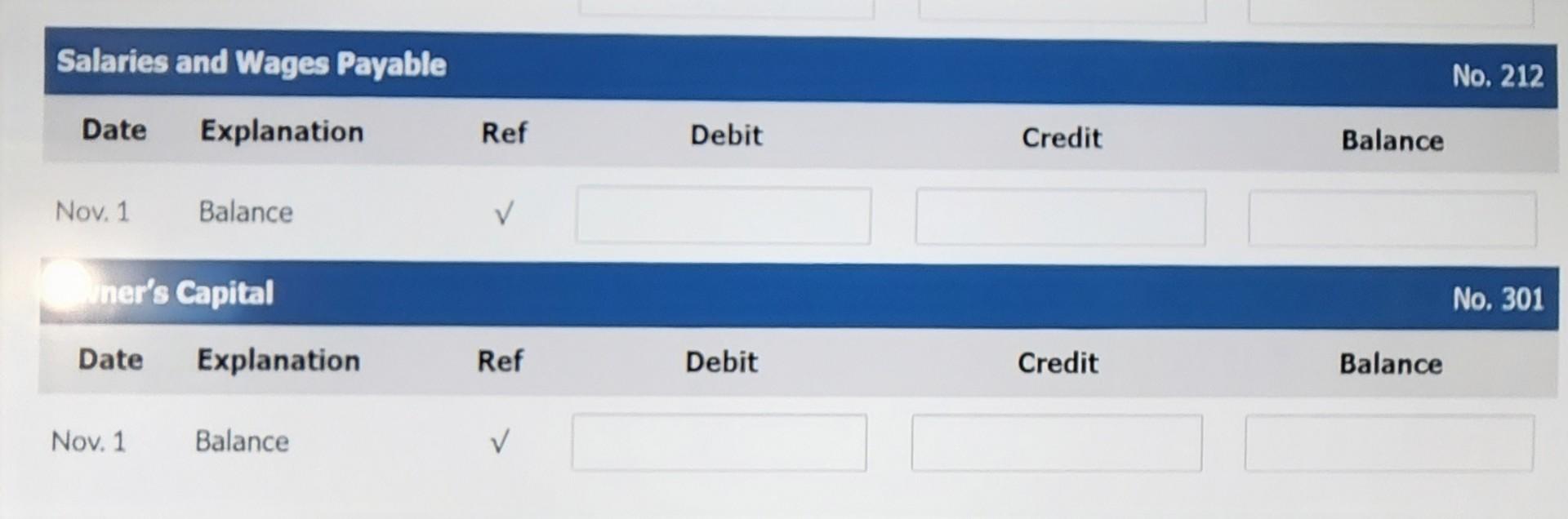

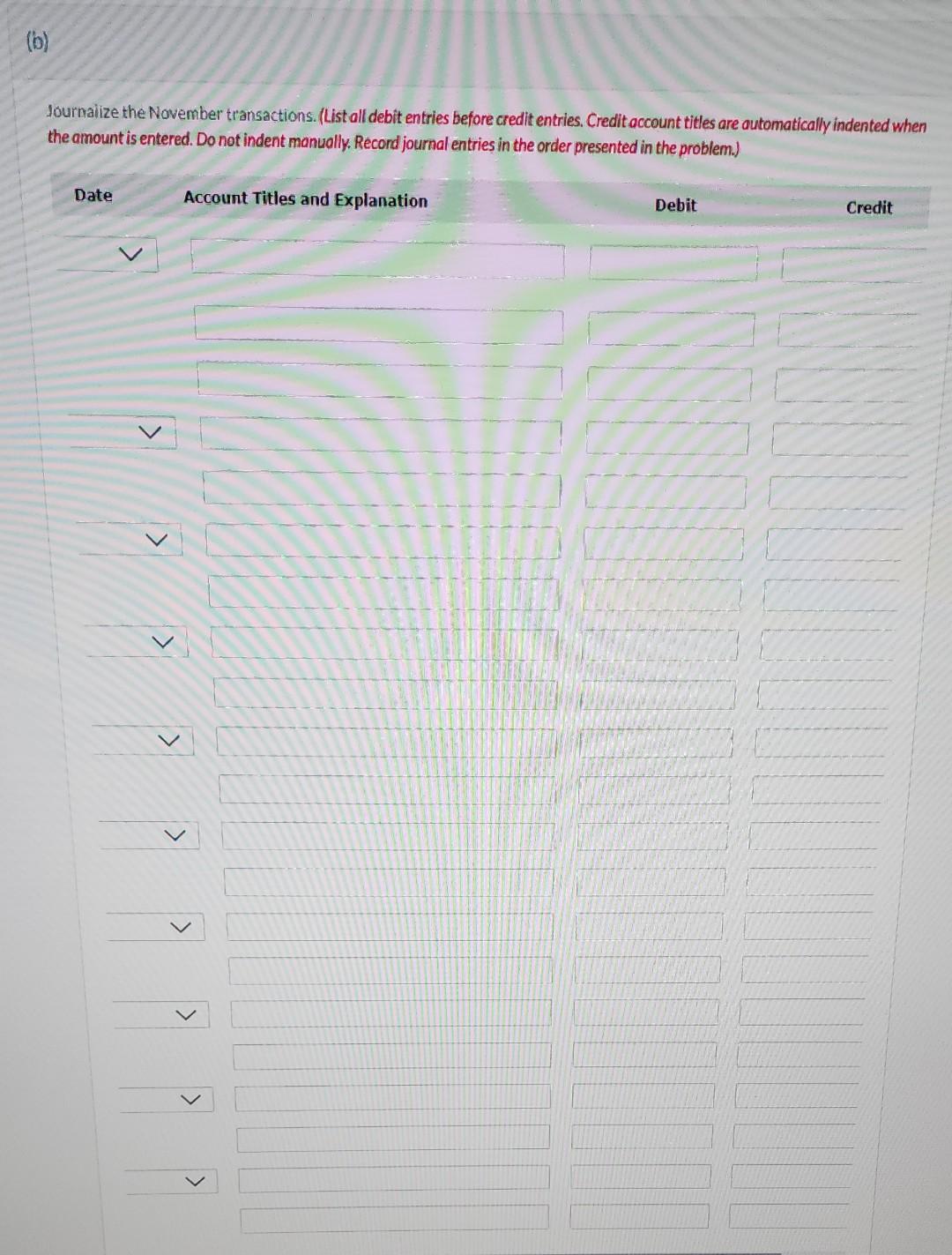

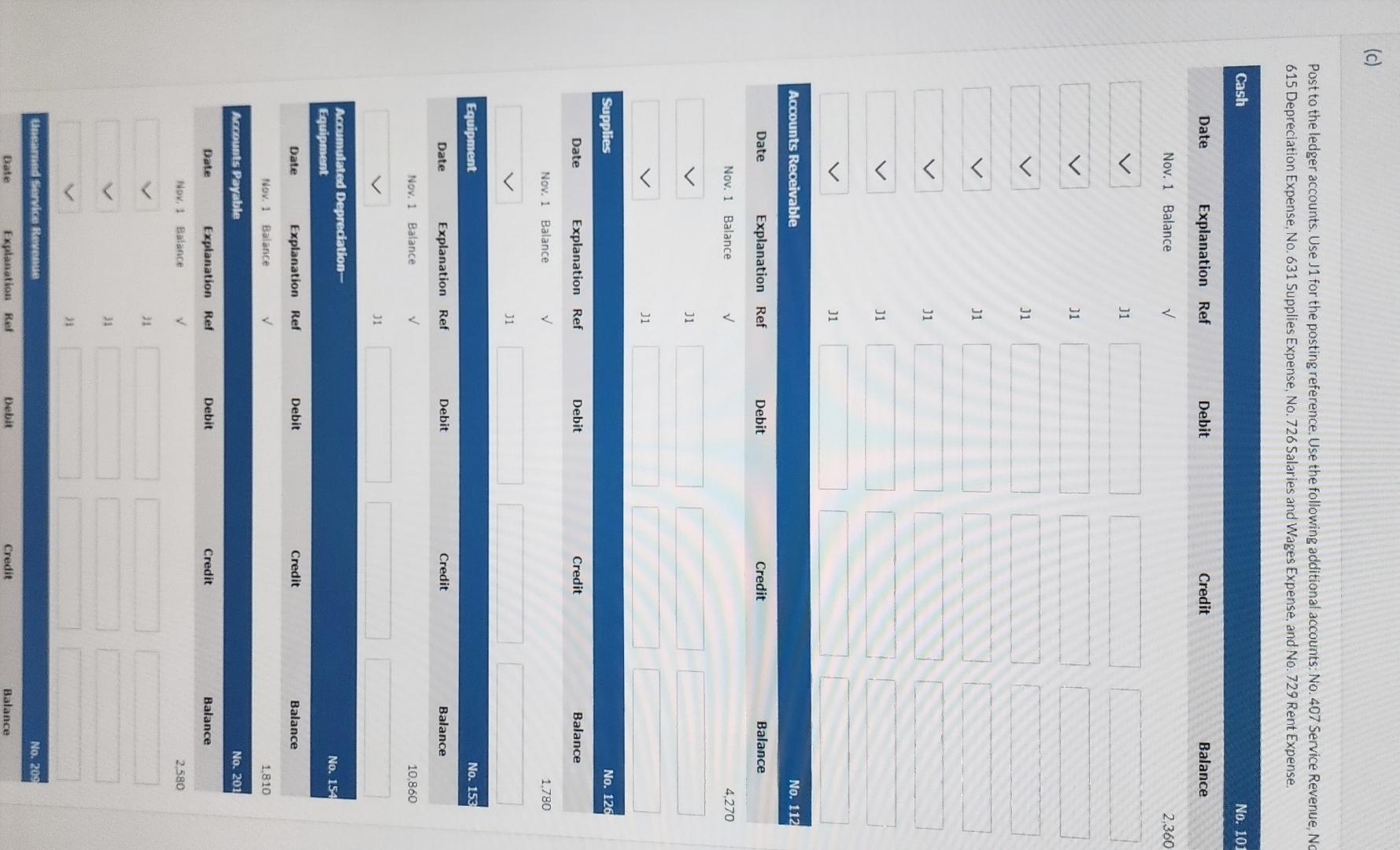

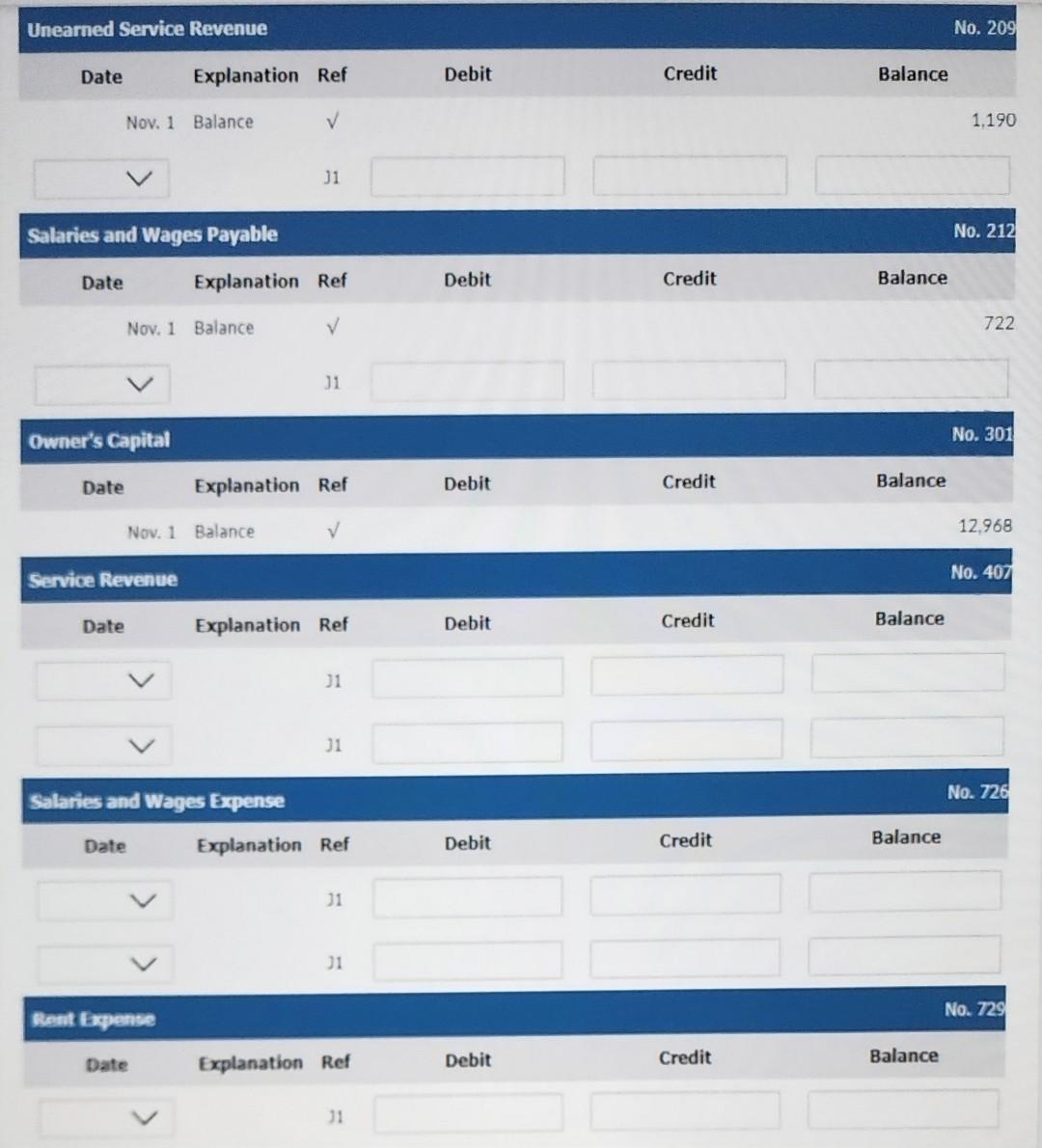

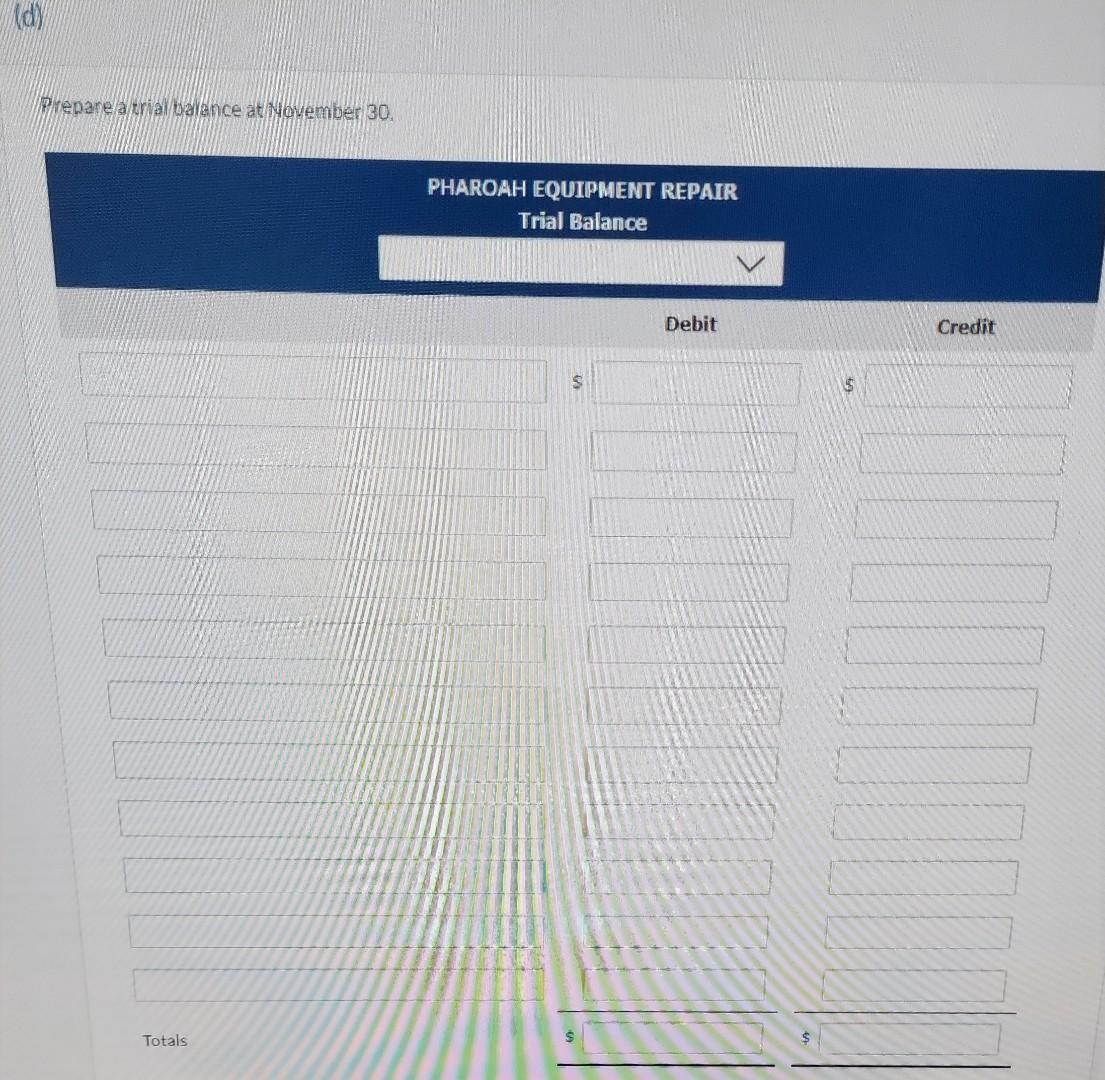

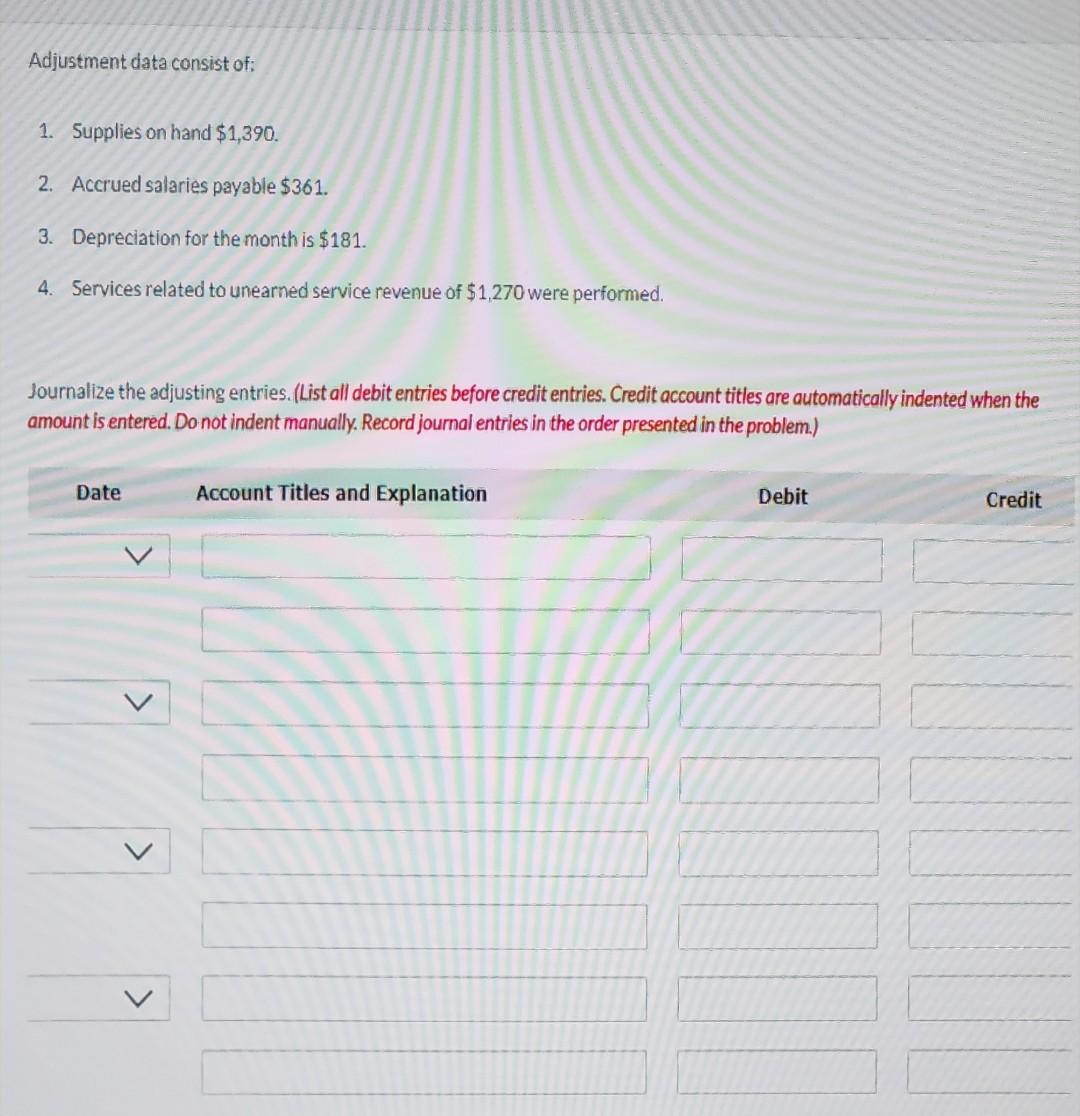

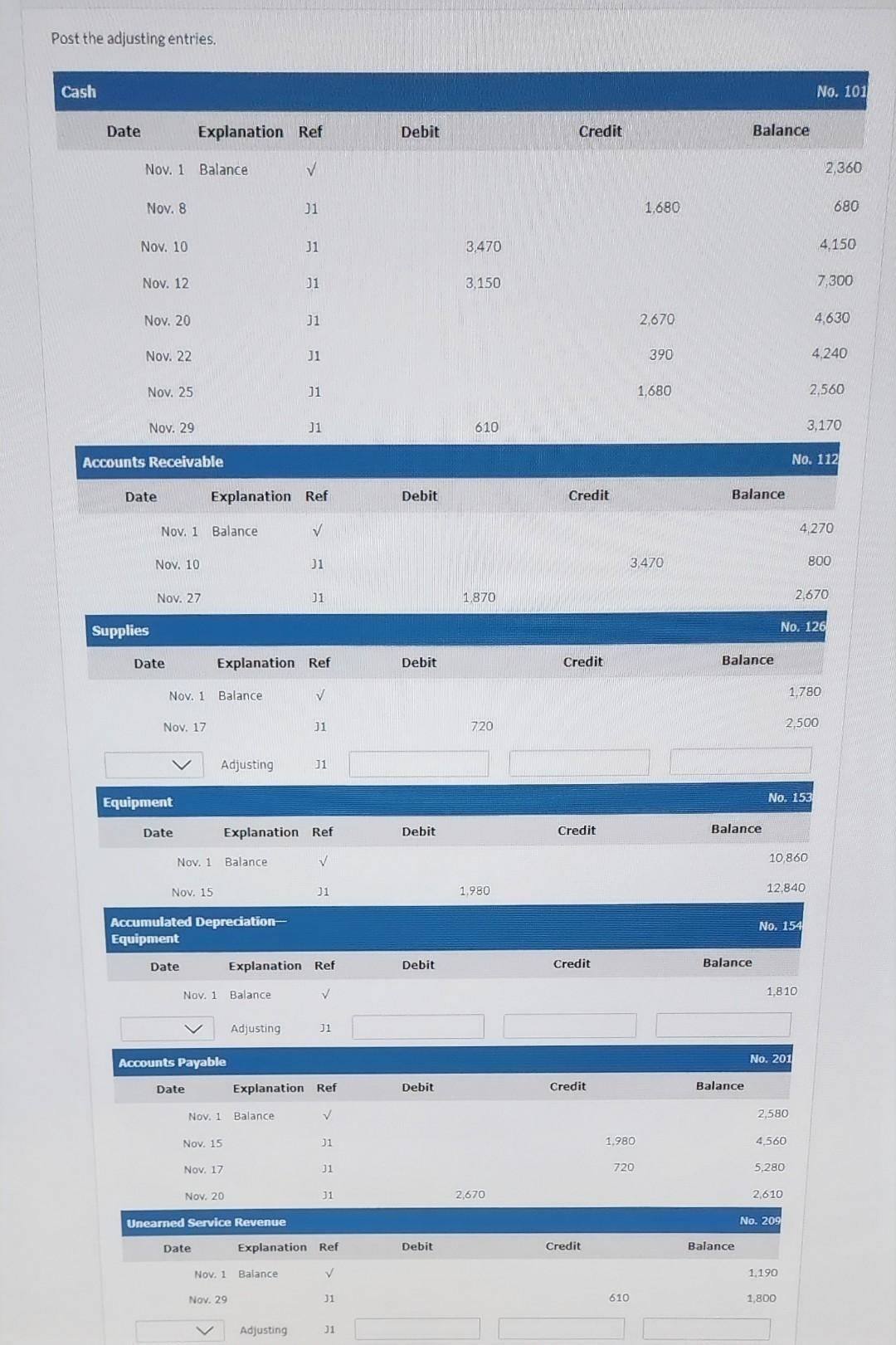

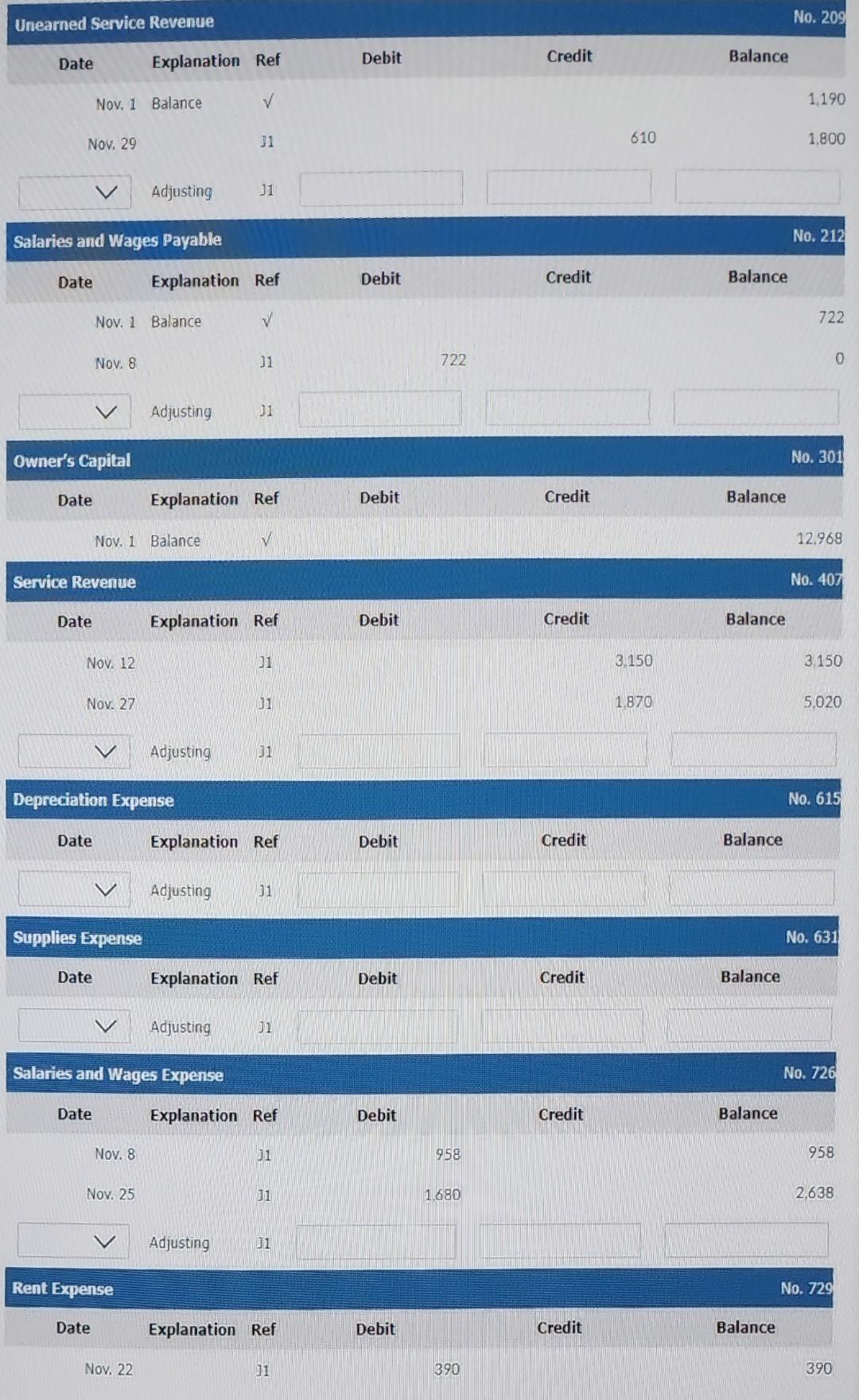

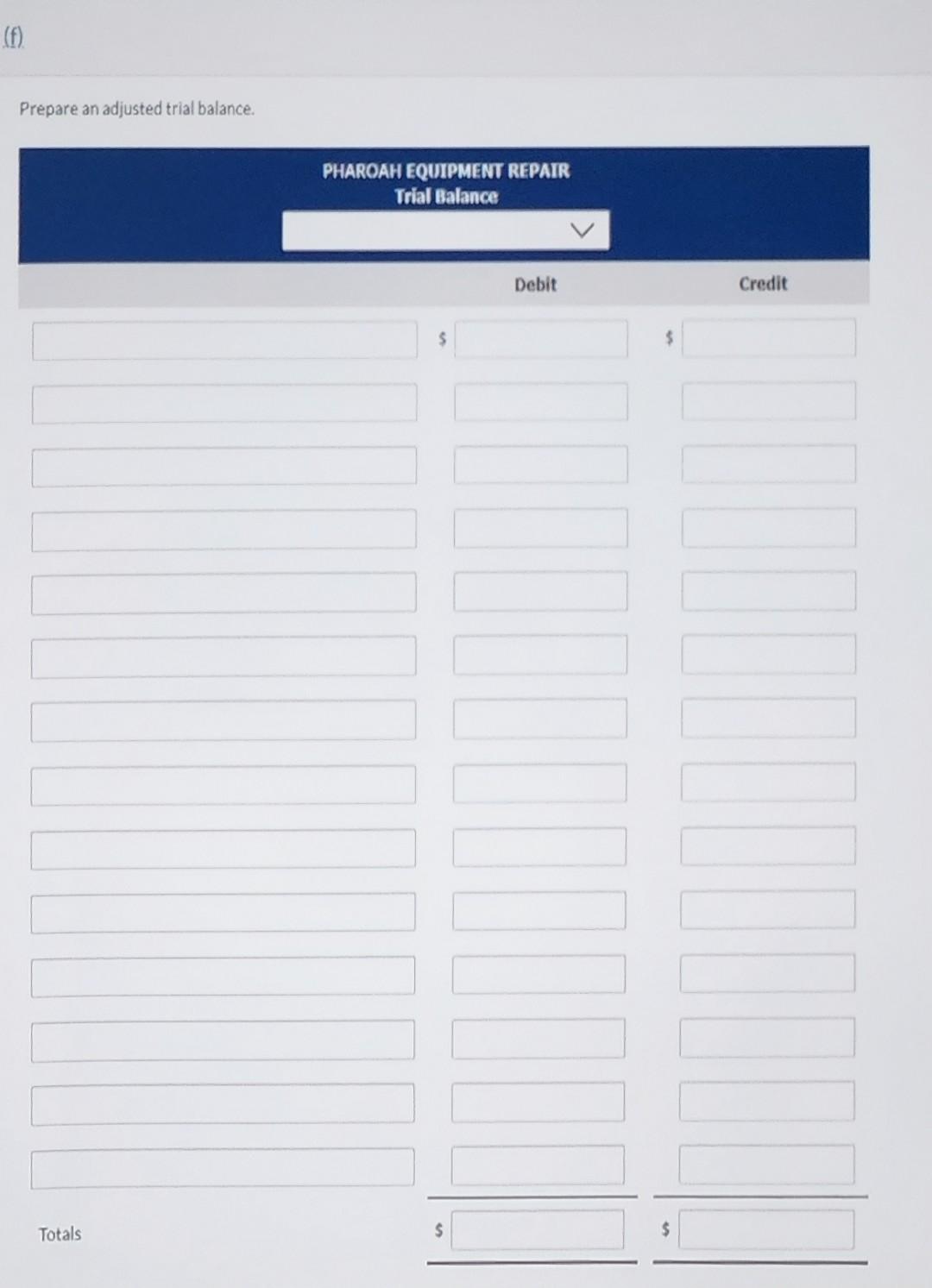

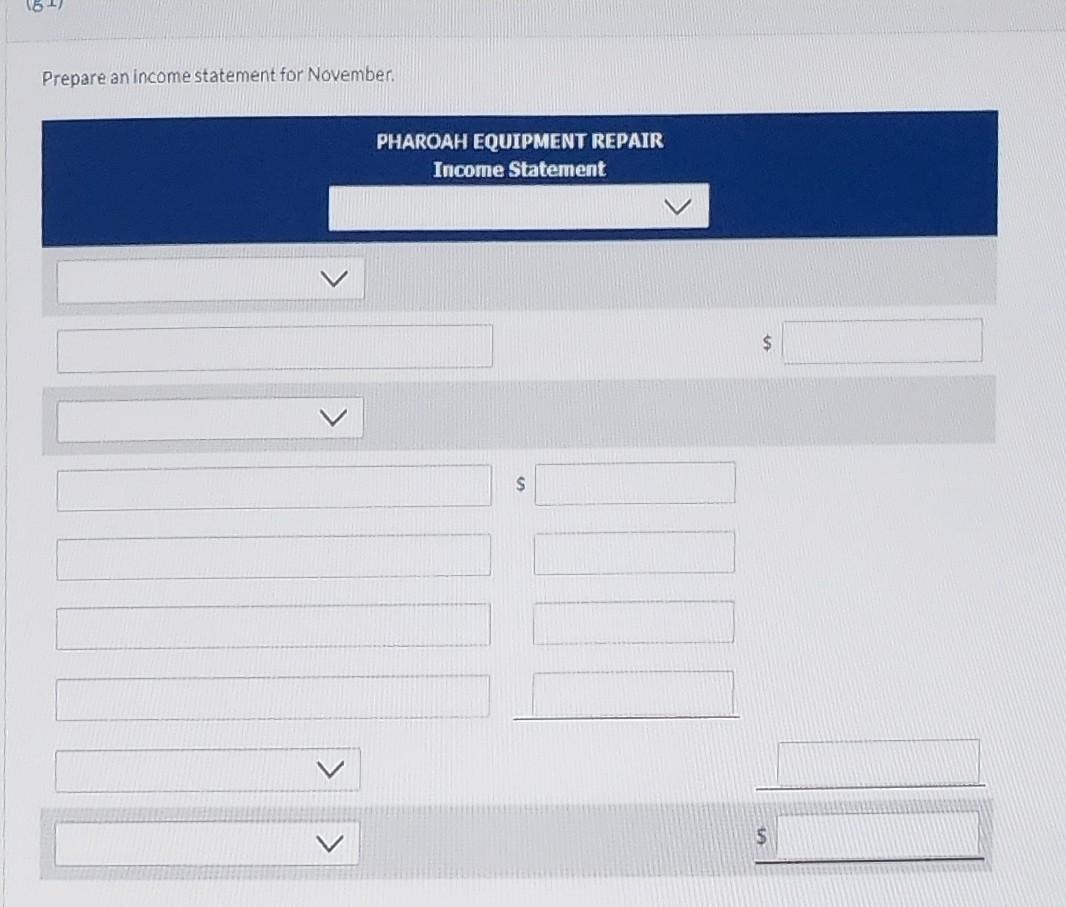

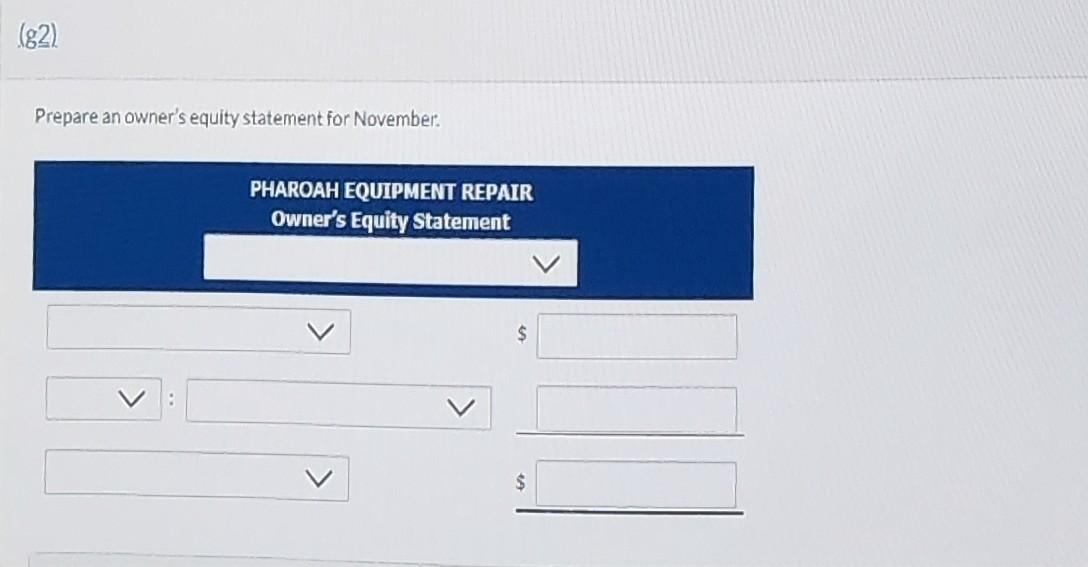

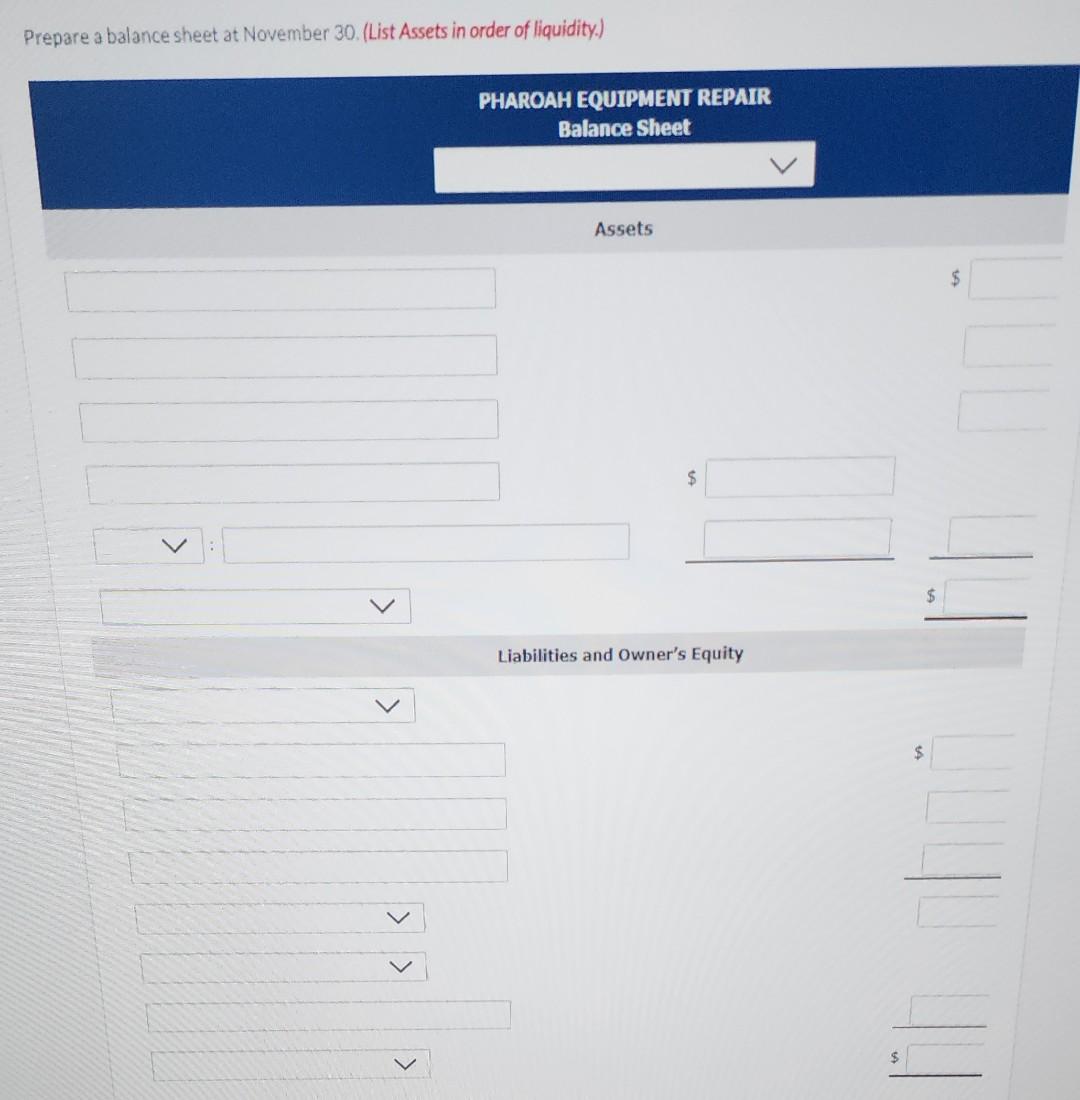

On November 1, 2022, the account balances of Pharoah Equipment Repair were as follows. During November, the following summary transactions were completed. Nov. 8 Paid $1,680 for salaries due employees, of which $722 is for October salaries. 10 Received $3,470 cash from customers on account. 12 Received $3,150 cash for services performed in November. 15 Purchased equipment on account $1,980. 17 Purchased supplies on account $720. 20 Paid creditors on account $2,670. 22 Paid November rent $390. 25 Paid salaries $1,680. 27 Performed services on account and billed customers $1,870 for these services. 29 Received $610 from customers for future service. Enter the November 1 balances in the ledger accounts. Salaries and Wages Payable No. 212 Nov. 1 Balance Journai ize the November transactions. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Post to the ledger accounts. Use J1 for the posting reference. Use the following additional accounts: No. 407 Service Revenue, 6 Unearned Service Revenue No. 209 31 Rent Ligense No. 729 Date Explanation Ref Debit Credit Balance prepare a triar beance at november 30 . Journalize the adjusting entries. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Post the adjusting entries. Unearned Service Revenue No. 209 Adjusting 11 Depreciation Expense No. 615 Date Explanation Ref Debit Credit Balance Adjusting J1 Supplies Expense No. 631 Prepare an income statement for November. PHAROAH EQUIPMENT REPAIR Income Statement $ s + 3 V 5 Prepare an owner's equity statement for November: Prs On November 1, 2022, the account balances of Pharoah Equipment Repair were as follows. During November, the following summary transactions were completed. Nov. 8 Paid $1,680 for salaries due employees, of which $722 is for October salaries. 10 Received $3,470 cash from customers on account. 12 Received $3,150 cash for services performed in November. 15 Purchased equipment on account $1,980. 17 Purchased supplies on account $720. 20 Paid creditors on account $2,670. 22 Paid November rent $390. 25 Paid salaries $1,680. 27 Performed services on account and billed customers $1,870 for these services. 29 Received $610 from customers for future service. Enter the November 1 balances in the ledger accounts. Salaries and Wages Payable No. 212 Nov. 1 Balance Journai ize the November transactions. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Post to the ledger accounts. Use J1 for the posting reference. Use the following additional accounts: No. 407 Service Revenue, 6 Unearned Service Revenue No. 209 31 Rent Ligense No. 729 Date Explanation Ref Debit Credit Balance prepare a triar beance at november 30 . Journalize the adjusting entries. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Post the adjusting entries. Unearned Service Revenue No. 209 Adjusting 11 Depreciation Expense No. 615 Date Explanation Ref Debit Credit Balance Adjusting J1 Supplies Expense No. 631 Prepare an income statement for November. PHAROAH EQUIPMENT REPAIR Income Statement $ s + 3 V 5 Prepare an owner's equity statement for November: Prs

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts