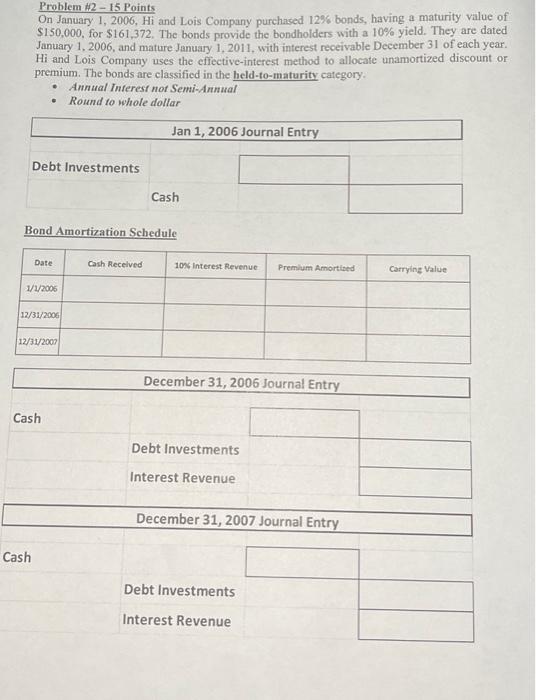

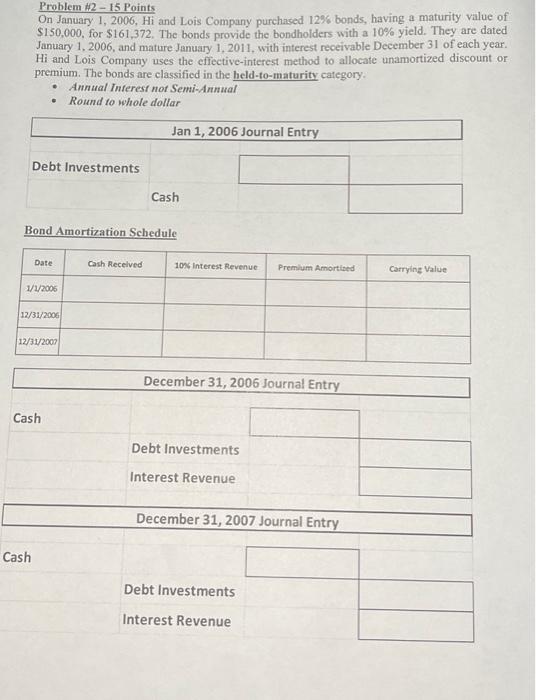

Question: please answer : Problem 1215 Points On January 1, 2006, Hi and Lois Company purchised 12% bonds, having a maturity value of $150,000, for $161,372.

please answer :

Problem 1215 Points On January 1, 2006, Hi and Lois Company purchised 12% bonds, having a maturity value of $150,000, for $161,372. The bonds provide the bondholders with a 10% yield. They are dated January 1,2006, and mature January 1, 2011, with interest receivable December 31 of each year. Hi and Lois Company uses the effective-interest method to allocate unamortized discount or premium. The bonds are classified in the held-to-maturity category. - Annual Interest not Semi-Annual - Round to whole dollar Bond Amortization Schedule

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock