Question: Please answer problem #19, showing all work accordingly on all parts. Thank you! An inexperienced accountant prepared this condensed income statement for Bramble Corp., a

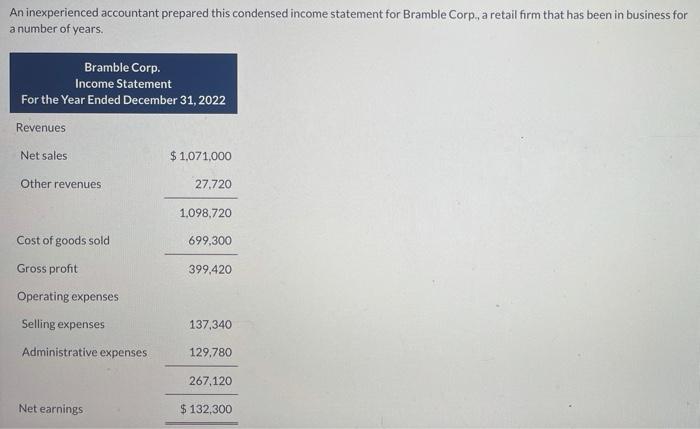

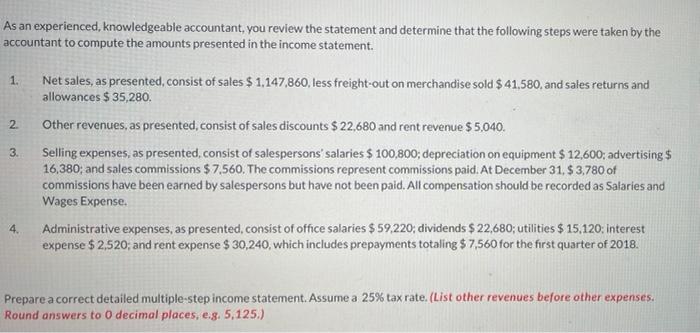

An inexperienced accountant prepared this condensed income statement for Bramble Corp., a retail firm that has been in business for a number of years Bramble Corp. Income Statement For the Year Ended December 31, 2022 Revenues Net sales $1,071,000 Other revenues 27.720 1,098,720 Cost of goods sold 699.300 Gross profit 399,420 Operating expenses Selling expenses 137.340 Administrative expenses 129.780 267,120 Net earnings $ 132,300 As an experienced, knowledgeable accountant, you review the statement and determine that the following steps were taken by the accountant to compute the amounts presented in the income statement. 1. 2 3. Net sales, as presented, consist of sales $ 1,147,860, less freight-out on merchandise sold $ 41,580, and sales returns and allowances $ 35,280. Other revenues, as presented, consist of sales discounts $ 22,680 and rent revenue $ 5,040. Selling expenses, as presented consist of salespersons' salaries $ 100,800; depreciation on equipment $ 12,600; advertising $ 16,380; and sales commissions $7.560. The commissions represent commissions paid. At December 31, $ 3.780 of commissions have been earned by salespersons but have not been paid. All compensation should be recorded as Salaries and Wages Expense. Administrative expenses, as presented, consist of office salaries $59,220, dividends $ 22,680; utilities $ 15,120: Interest expense $ 2,520; and rent expense $ 30,240, which includes prepayments totaling $ 7,560 for the first quarter of 2018. 4. Prepare a correct detailed multiple-step income statement. Assume a 25% tax rate. (List other revenues before other expenses. Round answers to 0 decimal places, e.g. 5,125.) Bramble Corp. Income Statement $ : $ .

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts