Question: Please answer problem 30-1 and problem 30-2 (both case no. 1 and no. 2). Thank you so much. PROBLEM 30-1 One Class of Shares Data

Please answer problem 30-1 and problem 30-2 (both case no. 1 and no. 2). Thank you so much.

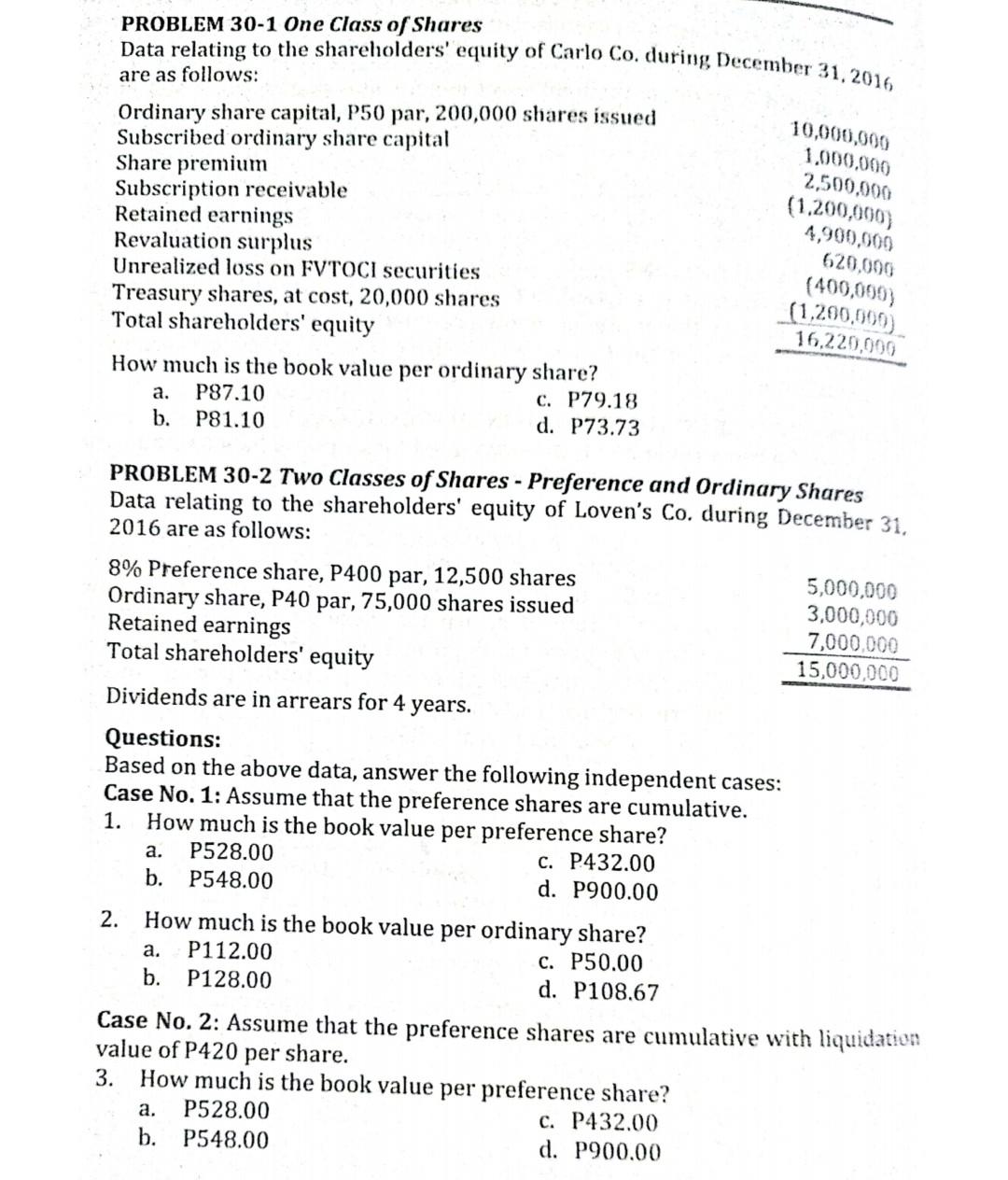

PROBLEM 30-1 One Class of Shares Data relating to the shareholders' equity of Carlo Co. during December 31, 2016 are as follows: Ordinary share capital, P50 par, 200,000 shares issued Subscribed ordinary share capital Share premium Subscription receivable Retained earnings Revaluation surplus Unrealized loss on FVTOCI securities Treasury shares, at cost, 20,000 shares Total shareholders' equity How much is the book value per ordinary share? P87.10 C. P79.18 b. P81.10 d. P73.73 10,000,000 1,000,000 2,500,000 (1,200,000) 4,900,000 620,000 (400,000) (1,200,000) 16,220,000 a. PROBLEM 30-2 Two Classes of Shares - Preference and Ordinary Shares Data relating to the shareholders' equity of Loven's Co. during December 31, 2016 are as follows: 8% Preference share, P400 par, 12,500 shares 5,000,000 Ordinary share, P40 par, 75,000 shares issued 3,000,000 Retained earnings 7,000,000 Total shareholders' equity 15,000,000 Dividends are in arrears for 4 years. Questions: Based on the above data, answer the following independent cases: Case No. 1: Assume that the preference shares are cumulative. 1. How much is the book value per preference share? a. P528.00 C. P432.00 b. P548.00 d. P900.00 2. How much is the book value per ordinary share? a. P112.00 C. P50.00 b. P128.00 d. P108.67 Case No. 2: Assume that the preference shares are cumulative with liquidation value of P420 per share. 3. How much is the book value per preference share? P528.00 c. P432.00 b. P548.00 d. P900.00 a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts