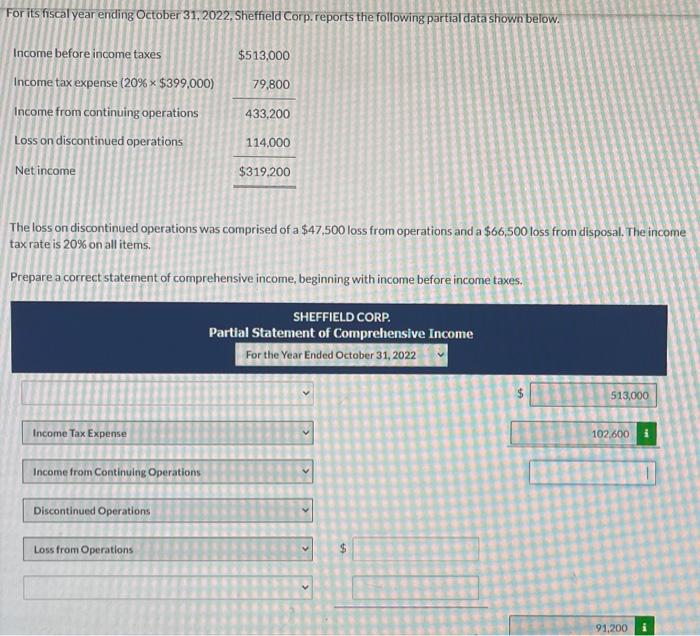

Question: Please answer problem #6 ALL SECTIONS NOT ANSWERED, SHOWING ALL WORK ACCORDINGLY. Thank you! For its fiscal year ending October 31, 2022, Sheffield Corp.reports the

For its fiscal year ending October 31, 2022, Sheffield Corp.reports the following partial data shown below. $513,000 79,800 Income before income taxes Income tax expense (20% $399,000) Income from continuing operations Loss on discontinued operations 433,200 114.000 Net income $319,200 The loss on discontinued operations was comprised of a $47,500 loss from operations and a $66,500 loss from disposal. The income tax rate is 20% on all items. Prepare a correct statement of comprehensive income, beginning with income before income taxes. SHEFFIELD CORP Partial Statement of Comprehensive Income For the Year Ended October 31, 2022 513,000 Income Tax Expense 102 600 Income from Continuing Operations Discontinued Operations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts