Question: please answer problem B. thank you!! Amortize Premium by Interest Method Shunda Corporation wholesales parts to appliance manufacturers. On January 1, Shunda issued $22,000,000 of

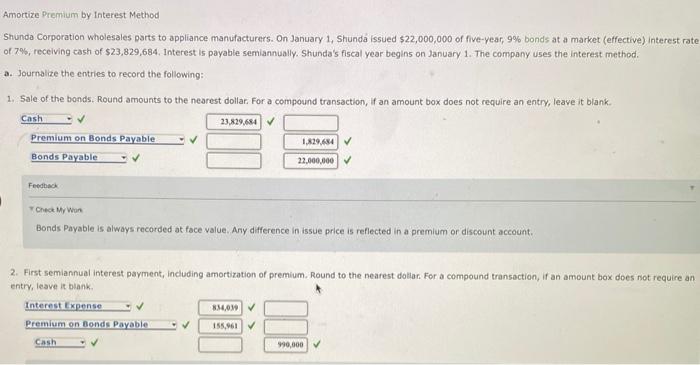

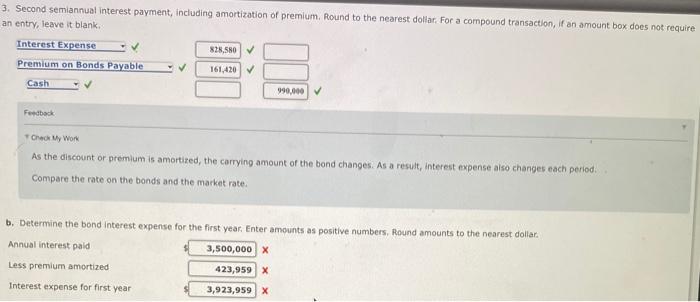

Amortize Premium by Interest Method Shunda Corporation wholesales parts to appliance manufacturers. On January 1, Shunda issued $22,000,000 of five-year, 9% bonds at a market (effective) Interest rate of 7%, receiving cash of $23,829,684. Interest is payable semiannually. Shunda's fiscal year begins on January 1. The company uses the interest method. a. Journalize the entries to record the following: 1. Sale of the bonds. Round amounts to the nearest dollarFor a compound transaction, If an amount box does not require an entry, leave it blank Cash 23.829,684 Premium on Bonds Payable 1.829.684 Bonds Payable 22,000,000 Feedback Check My Won Bonds Payable is always recorded at face value. Any difference in issue price is reflected in a premium or discount account 2. First semiannual interest payment, including amortization of premium. Round to the nearest dollar. For a compound transaction, if an amount box does not require an entry, leave it blank Interest Expense 80,00 Premium on Bonds Payable 155,961 Cash 990,000 3. Second semiannual Interest payment, including amortization of premium. Round to the nearest dollar. For a compound transaction, if an amount box does not require an entry, leave it blank. Interest Expense 828,580 Premium on Bonds Payable 161,420 Cash 990,000 Feedback Check My Wor As the discount or premium is amortized, the carrying amount of the bond changes. As a result, interest expense also changes each period Compare the rate on the bonds and the market rate. b. Determine the bond interest expense for the first year. Enter amounts as positive numbers, Round amounts to the nearest dollar. Annual interest paid 3,500,000 X Less premium amortized Interest expense for first year 423,959 X 3,923,959 x

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts