Question: please answer problems 1-5 1. Avon's Foreign-Source Income. Avon is a U.S.based direct seller of a wide array of products. Avon markets leading beauty, fashion,

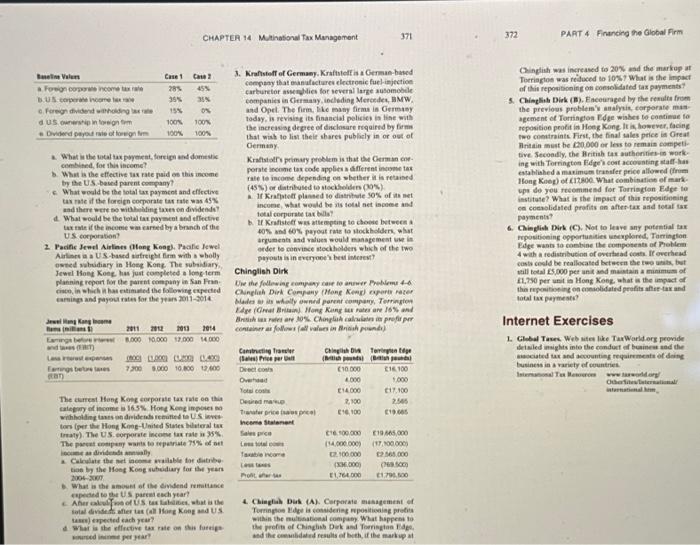

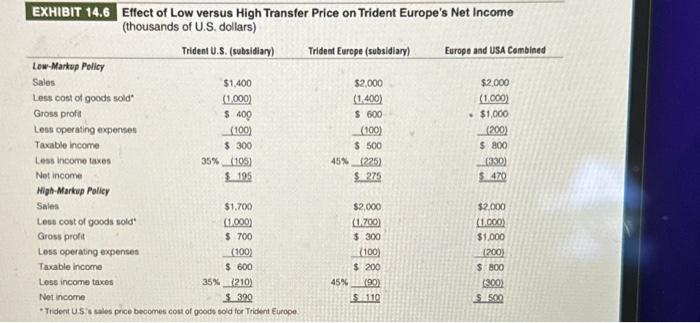

1. Avon's Foreign-Source Income. Avon is a U.S.based direct seller of a wide array of products. Avon markets leading beauty, fashion, and home products in more than 100 countries. As part of the training in its corporate treasury offices, it has its interns build a spreadsheet analysis of the following hypothetical subsidiary earnings/distribution analysis. Use the analysis presented in Exhibit 14.6 for your basic structure. 3. Krafisteff of Germany, Kraftsteff is a Cernan-bated cempany that enanufacturev electronic fuel-iajectice carteuretor assecties for several lare ausomoble companies in Ciermasy, inclsding Meresdea, BMW, and Opel. The ferm, the rasny firme in Cermosy todsy, is reviaist its financiat pelicies is lise with be increasise depee of disclosare reqairnd by firm that wish to list their shares publicly in or oet of Oermany. 2. What in the utal tax poyerent, foreipi and domesic cembined, for this inceme? b. What th the effective tra pate paid es this increme by the US. bout parent coespany? c. What would be the lotal tax payment and cficctive tar rate if the forsitn corporate tat tate was 45Y 4. What coald the the tetal fax poyment and affective tax rale if the income war carted by a branch of the US eocraration? 2 Padife Jewel Airlines Otene Keapl. Factie Jewel Airlines a a US based sirfreiple firm with o =bolly ovted whidiary in Hoee Kone. The wabsiary. Jewel llost Koes, has juit conpleted a lose term plansing roport for the farret exmpany in San Fran. The clarrest Hang Kose eurparnte tax rate oe thit categary of income 3163%. Hohe Kene impeaci in traty). The US. eorperate incolu tax rate in 35%. tan by the Ifoes Koog nuteidiary for the yean 20053000. b. What is the anowes of the eivilend remaltasice feproch to ge US parent ead year? takes) expected each year? d. What is the eflectove tas rate on thin fureige hisured ininnet per pear? Cinglish was increased to 20% and the markup at 5. Cainelinh Dirk (8). Finceuraged by the remita frum the previous problem' analysis, earporate mas. seement of Torrington Fdge winket to continae to teposition peofit in Hoeg Kone It is hosever, tacing two coestraints. First, the final sales pelice is Great Aritain mest be Ca000 or less to remais eompeti. tive Stecoally, the Britiab tas authenties-io work. Mong Kites) of Cazeoe. What combinatios of mark. upr de you recemmend for Torriagian Filfe to institate? What is the impact of this roposifioeing ce coenolidnted profits an aftestax asd tetal tax payments? 6. CMinglish birk (C). Not to leave any potential tre 4 wath a redistribution of esitatad conth. If overhead costo cosld be reallocated bet eesn be two unis, bet At,2s0 per unt ia Hong Kong, what is the uspoct of tatal cax permeste? Internet Exercises 1. Glebal Tases. Web ates like TaxWorld ors provide tusiness in o variety ef countries. intanstienal hem, 4. Chinglah Dik (A). Corporate masugement of Terringos Hole is cosaideries repositivaine probis and ihe cenaibdatid results of beth, if ibe markp at EXHIBIT 14.6 Effect of Low versus High Transfer Price on Trident Europe's Net Income (thousands of U.S. dollars) 1. Avon's Foreign-Source Income. Avon is a U.S.based direct seller of a wide array of products. Avon markets leading beauty, fashion, and home products in more than 100 countries. As part of the training in its corporate treasury offices, it has its interns build a spreadsheet analysis of the following hypothetical subsidiary earnings/distribution analysis. Use the analysis presented in Exhibit 14.6 for your basic structure. 3. Krafisteff of Germany, Kraftsteff is a Cernan-bated cempany that enanufacturev electronic fuel-iajectice carteuretor assecties for several lare ausomoble companies in Ciermasy, inclsding Meresdea, BMW, and Opel. The ferm, the rasny firme in Cermosy todsy, is reviaist its financiat pelicies is lise with be increasise depee of disclosare reqairnd by firm that wish to list their shares publicly in or oet of Oermany. 2. What in the utal tax poyerent, foreipi and domesic cembined, for this inceme? b. What th the effective tra pate paid es this increme by the US. bout parent coespany? c. What would be the lotal tax payment and cficctive tar rate if the forsitn corporate tat tate was 45Y 4. What coald the the tetal fax poyment and affective tax rale if the income war carted by a branch of the US eocraration? 2 Padife Jewel Airlines Otene Keapl. Factie Jewel Airlines a a US based sirfreiple firm with o =bolly ovted whidiary in Hoee Kone. The wabsiary. Jewel llost Koes, has juit conpleted a lose term plansing roport for the farret exmpany in San Fran. The clarrest Hang Kose eurparnte tax rate oe thit categary of income 3163%. Hohe Kene impeaci in traty). The US. eorperate incolu tax rate in 35%. tan by the Ifoes Koog nuteidiary for the yean 20053000. b. What is the anowes of the eivilend remaltasice feproch to ge US parent ead year? takes) expected each year? d. What is the eflectove tas rate on thin fureige hisured ininnet per pear? Cinglish was increased to 20% and the markup at 5. Cainelinh Dirk (8). Finceuraged by the remita frum the previous problem' analysis, earporate mas. seement of Torrington Fdge winket to continae to teposition peofit in Hoeg Kone It is hosever, tacing two coestraints. First, the final sales pelice is Great Aritain mest be Ca000 or less to remais eompeti. tive Stecoally, the Britiab tas authenties-io work. Mong Kites) of Cazeoe. What combinatios of mark. upr de you recemmend for Torriagian Filfe to institate? What is the impact of this roposifioeing ce coenolidnted profits an aftestax asd tetal tax payments? 6. CMinglish birk (C). Not to leave any potential tre 4 wath a redistribution of esitatad conth. If overhead costo cosld be reallocated bet eesn be two unis, bet At,2s0 per unt ia Hong Kong, what is the uspoct of tatal cax permeste? Internet Exercises 1. Glebal Tases. Web ates like TaxWorld ors provide tusiness in o variety ef countries. intanstienal hem, 4. Chinglah Dik (A). Corporate masugement of Terringos Hole is cosaideries repositivaine probis and ihe cenaibdatid results of beth, if ibe markp at EXHIBIT 14.6 Effect of Low versus High Transfer Price on Trident Europe's Net Income (thousands of U.S. dollars)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts