Question: please answer pronlems 1a 1b & 2! 1. Gamble, Inc. is considering a very risky new three-year expansion project that requires an initial fixed asset

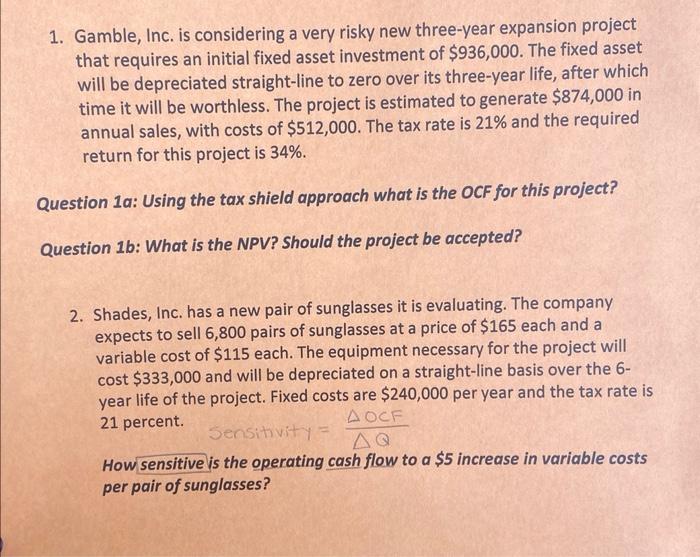

1. Gamble, Inc. is considering a very risky new three-year expansion project that requires an initial fixed asset investment of $936,000. The fixed asset will be depreciated straight-line to zero over its three-year life, after which time it will be worthless. The project is estimated to generate $874,000 in annual sales, with costs of $512,000. The tax rate is 21% and the required return for this project is 34%. Question 1a: Using the tax shield approach what is the OCF for this project? Question 1b: What is the NPV? Should the project be accepted? 2. Shades, Inc. has a new pair of sunglasses it is evaluating. The company expects to sell 6,800 pairs of sunglasses at a price of $165 each and a variable cost of $115 each. The equipment necessary for the project will cost $333,000 and will be depreciated on a straight-line basis over the 6 year life of the project. Fixed costs are $240,000 per year and the tax rate is 21 percent. How sensitive is the operating cash flow to a$5 increase in variable costs per pair of sunglasses

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts