Question: Please answer properly. Thanks On May 1, 2017, Whispering Ltd. issued a series of bonds in order to raise money for some upcoming projects. The

Please answer properly. Thanks

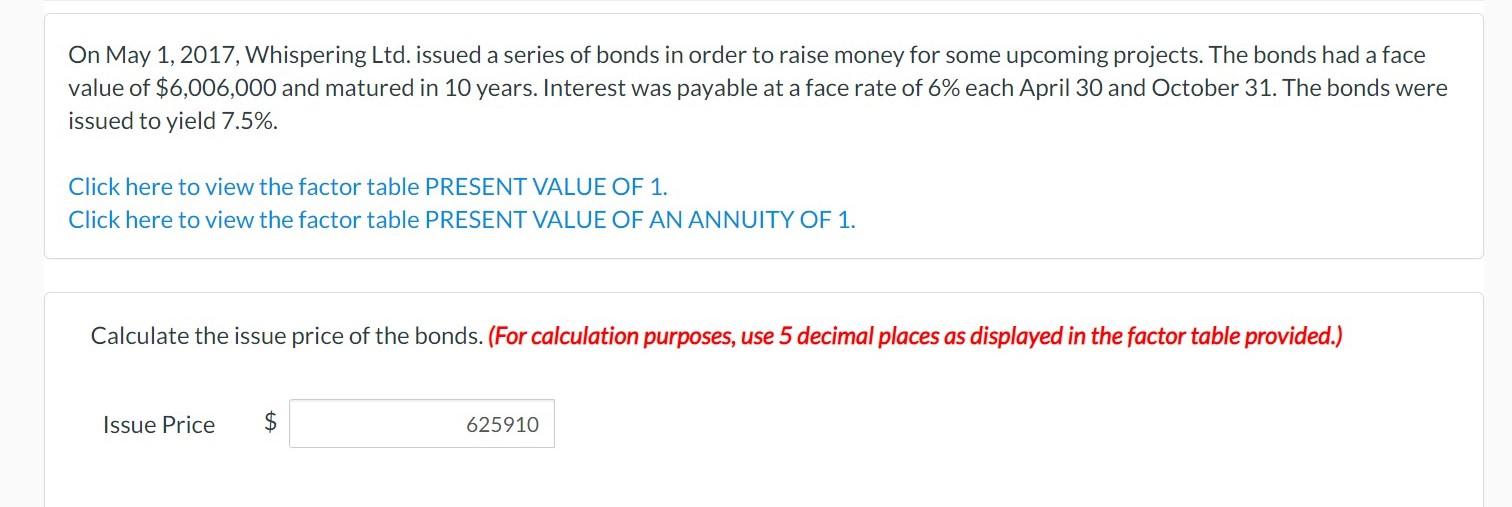

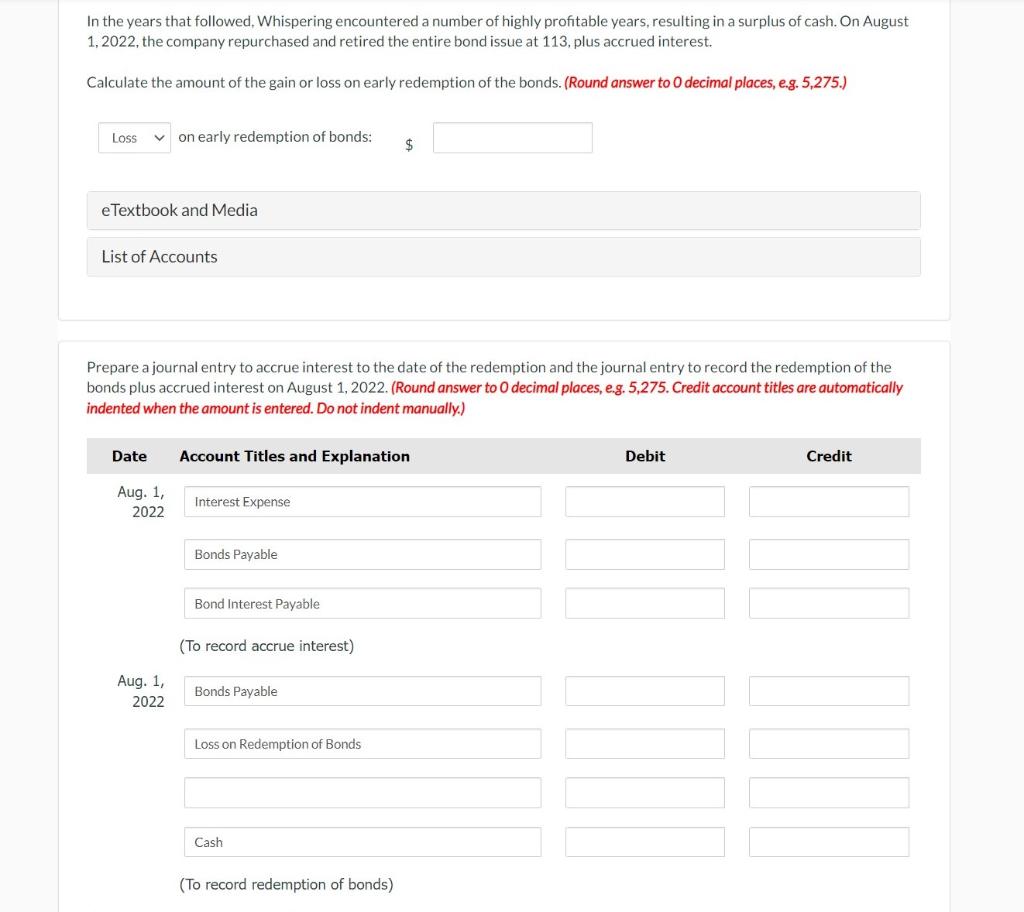

On May 1, 2017, Whispering Ltd. issued a series of bonds in order to raise money for some upcoming projects. The bonds had a face value of $6,006,000 and matured in 10 years. Interest was payable at a face rate of 6% each April 30 and October 31. The bonds were issued to yield 7.5%. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. Calculate the issue price of the bonds. (For calculation purposes, use 5 decimal places as displayed in the factor table provided.) Issue Price $ 625910 In the years that followed, Whispering encountered a number of highly profitable years, resulting in a surplus of cash. On August 1,2022, the company repurchased and retired the entire bond issue at 113, plus accrued interest. Calculate the amount of the gain or loss on early redemption of the bonds. (Round answer to O decimal places, e.g. 5,275.) Loss on early redemption of bonds: $ e Textbook and Media List of Accounts Prepare a journal entry to accrue interest to the date of the redemption and the journal entry to record the redemption of the bonds plus accrued interest on August 1, 2022. (Round answer to O decimal places, e.g. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Aug. 1, 2022 Interest Expense Bonds Payable Bond Interest Payable (To record accrue interest) Aug. 1, 2022 Bonds Payable Loss on Redemption of Bonds Cash (To record redemption of bonds)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts