Question: please answer Q6 based on the questions 1to 5 that i calculated. please explain the answer with examples. 6. Considering all of your work in

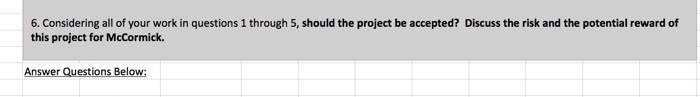

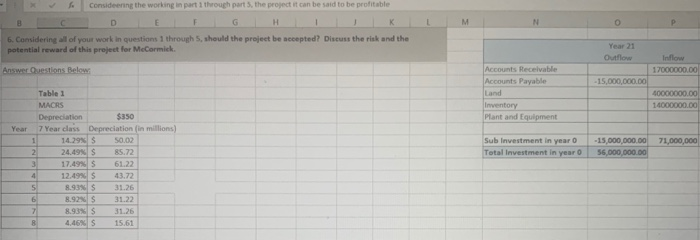

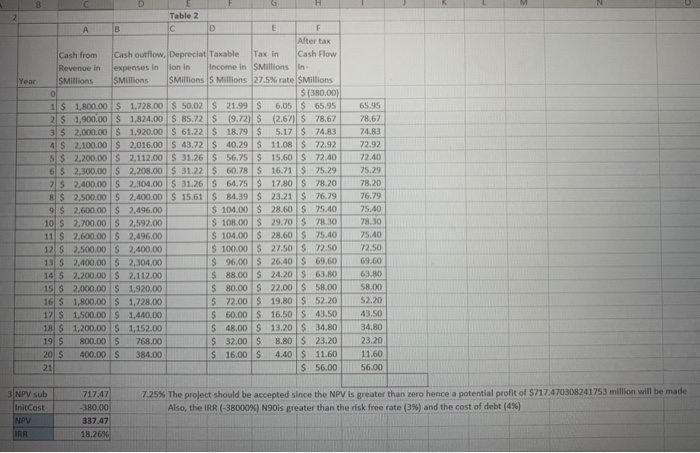

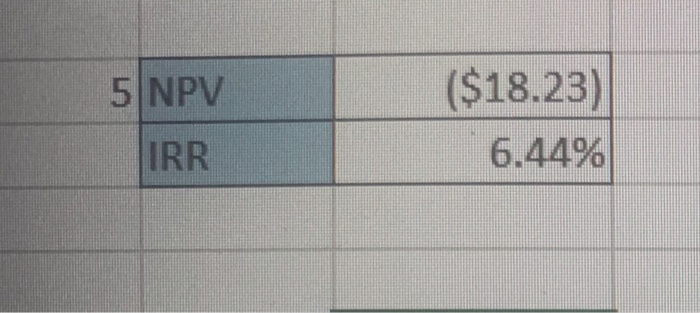

6. Considering all of your work in questions 1 through 5, should the project be accepted? Discuss the risk and the potential reward of this project for McCormick. Answer Questions Below: Considering the working in part through parts, the project it can be said to be profitable - - M B G H 1 K 6. Considering all of your work in questions through 5, should the project be accepted? Discuss the risk and the potential reward of this project for MeCormick Year 21 Outflow Inflow 17000000.00 Answer Ouestions Below Accounts Receivable Accounts Payable -15,000,000.00 Iland 40000000.00 14000000.00 Inventory Plant and Equipment 71,000,000 Sub Investment in year o Total Investment in year o -15,000,000.00 56,000,000.00 Table 1 MACRS Depreciation $350 Year 7 Year class Depreciation (in millions) 14.29S 50.02 2 24.49 S 85.72 3 17.49% 61.22 4 12.49S 5 8.93% $ 31.26 6 8.92 31.22 7 8.93% $ 31.26 8 4.46S 15.61 2 8 D G H Table 2 A B D F After tax Cash from Cash outflow, Depreciat Taxable Tax in Cash Flow Revenue in expenses in lon in Income in Millions in Year SMillions SMillions SMillions S Millions 27.5% rate Millions 0 S (380.00) 1 $ 1,800.00 $ 1,728.00 $ 50.02 S 21.99 $ 6.05 S 65.95 2 $ 1,900.00 $ 1,824.00 S 85.72 S 19.72) S (2.67 $ 78.67 3 $ 2,000.00 $ 1,920.00 S 61.22 S 18.79 $ 5.17 $ 74.83 4 $ 2,100.00 $2,016,00 S 43.72 S 40.29 $ 11.08 $72.92 S$ 2,200.00 $ 2,112.00 $ 31.26S 56.75 $ 15.60 $ 72.40 6 $ 2,300.00 $ 2,208.00 $ 31.22 $ 60.78 $ 16.71 $ 75.29 7 $2,400.00 $ 2,304.00 S 31.26 S 64.75 $17.80 S 78.20 8 $ 2,500.00 $ 2,400.00 $ 15.61 S 84.39 $ 23.21 $ 76.79 9 $2,600.00 $ 2.496.00 $ 104.00 $ 28.60 $ 75.40 10 $ 2,700.00 $ 2,592.00 $ 108.00 $ 29.70 S 78.30 11 S 2,600.00 $ 2,496.00 $ 104.00 $28.60 $ 75.40 12 $ 2,500.00 $ 2,400.00 $ 100.00 $ 27.50 S 72.50 13 S 2.400.00 $ 2,304.00 $ 96.00 $26.40 $ 69.60 14 $ 2,200.00 $ 2,112.00 $ 88.00 S 24.20 S 63.80 15 $2,000.00 $ 1,920.00 $ 80.00 $ 22.00 S 58.00 16 $ 1,800.00 $1,728.00 $72.00 $ 19.80 $ 52.20 17 $ 1,500.00 $ 1,440.00 $ 60.00 $ 16.50 S 43.50 18 $ 1,200.00 $ 1,152.00 $ 48.00 S 13.20 $ 34.80 19 $ 800.00 $ 768.00 $ 32.00 $ 8.80 $ 23.20 20 S 400.00 $ 384.00 $ 16.00 $ 4.40 $ 11.60 21 $ 56,00 65.95 78.67 74.83 72.92 72.40 75.29 78.20 76.79 75.40 78.30 75.40 72.50 69.60 63.80 58.00 52.20 43.50 34.80 23.20 11.60 56.00 NPV sub InitCost NPV IRR 717.47 -380.00 337.47 18.26% 7.25% The project should be accepted since the NPV is greater than zero hence a potential profit of $717.470308241753 million will be made Also, the IRR (-38000%) N90is greater than the risk free rate (3%) and the cost of debt (4%) 4 Table 3 5 B IC D E F Year 5 7 3 10 2 3 14 Tax in SMillions 27.5% rate in years 1 After tax Cash from Cash outflow, Depreciat Taxable 2, 3 and Cash Flow Revenue in expenses in ion in Income in 50% there in SMillions $Millions $Millions $ Millions after $Millions 0 $ $0.00 $ $ $ $ (380.00) 1 $ 1,800.00 $ 1,762.56 $ 50.02 $ (12.57) $ (3.46) $ 40.90 2 $ 1,900.00 $ 1,860.48 $ 85.72 $ (46.20) $ (12.70) $ 52.22 3 $ 2,000.00 $ 1,958.40 $ 61.22 $ (19.62) $ (5.39) $ 46.99 4 $ 2,100.00 $ 2,056.32 $ 43.72 $ (0.04) $ (0.02) $ 43.70 5 $ 2,200.00 $ 2,154.24 $ 31.26 $ 14.50 $ 7.25 $ 38.51 6 $ 2,300.00 $ 2,252.16 $ 31.22 $ 16.62 $ 8.31 $ 39.53 7 $ 2,400.00 $ 2,350.08 $ 31.26 $ 18.67 $ 9.33 $ 40.59 8 $ 2,500.00 $ 2,448.00 $ 15.61 $ 36.39 $ 18.20 $ 33.81 9 $ 2,600.00 $ 2,545.92 $ $ 54.08 $ 27.04 $ 27.04 10 $ 2,700.00 $ 2,643.84 $ $ 56.16 $ 28.08 $ 28.08 11 $ 2,600.00 $ 2,545.92 $ $ 54.08 $ 27.04 $ 27. 12 $2,500.00 $ 2,448.00 $ $ 52.00 S 26.00 $ 26.00 13 $ 2,400.00 $ 2,350.08 $ $ 49.92 $ 24.96 $ 24.96 14 $ 2,200.00 $ 2,154.24 $ $ 45.76 $ 22.88 $ 22.88 15 $ 2,000.00 $ 1,958.40 $ $ 41.60 $ 20.80 $ 20.80 16 $ 1,800.00 $ 1,762.56 $ $ 37.44 $ 18.72 $ 18.72 17 $ 1,500.00 $ 1,468.80 $ $ 31.20 $ 15.60 $ 15.60 18 $ 1,200.00 $ 1,175.04 $ $ 24.96 $ 12.48 $ 12.48 19 $ 800.00 $ 783.36 $ $ 16.64 $ 8.32$ 8.32 20 $ 400.00 $ 391.68 $ $ 8.32$ 4.16 $ 4.16 21 $ $ $ $ $ $ 56.00 15 16 7 18 19 0 1 3 14 15 16 17 18 19 5 NPV Instructions ($18.231 Cost of Capital Capital Budgeting 5 NPV ($18.23) 6.44% IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts