Question: Please answer question 1 & 2 with clear layout so that i can understand the steps. Question 1 (25 points): A project needs an initial

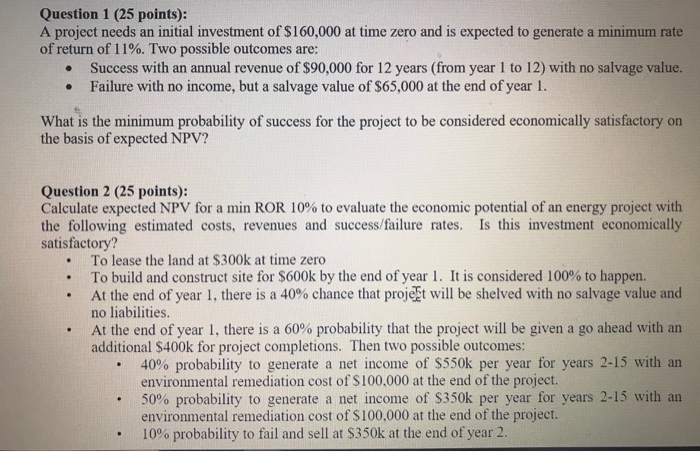

Question 1 (25 points): A project needs an initial investment of $160,000 at time zero and is expected to generate a minimum rate of return of 11%. Two possible outcomes are: . Success with an annual revenue of $90,000 for 12 years (from year 1 to 12) with no salvage value. Failure with no income, but a salvage value of $65,000 at the end of year 1. What is the minimum probability of success for the project to be considered economically satisfactory on the basis of expected NPV? Question 2 (25 points): Calculate expected NPV for a min ROR 10% to evaluate the economic potential of an energy project with the following estimated costs, revenues and success/failure rates. Is this investment economically satisfactory? To lease the land at $300k at time zero To build and construct site for $600k by the end of year 1. It is considered 100% to happen. At the end of year 1, there is a 40% chance that projekt will be shelved with no salvage value and no liabilities. At the end of year 1, there is a 60% probability that the project will be given a go ahead with an additional $400k for project completions. Then two possible outcomes: 40% probability to generate a net income of $550k per year for years 2-15 with an environmental remediation cost of $100.000 at the end of the project. 50% probability to generate a net income of $350k per year for years 2-15 with an environmental remediation cost of $100.000 at the end of the project. 10% probability to fail and sell at S350k at the end of year 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts