Question: please answer question 1 -22 and please explain how you got the anawer, it'll help me understand the material. thank you JOB ORDER COSTING PROBLEM

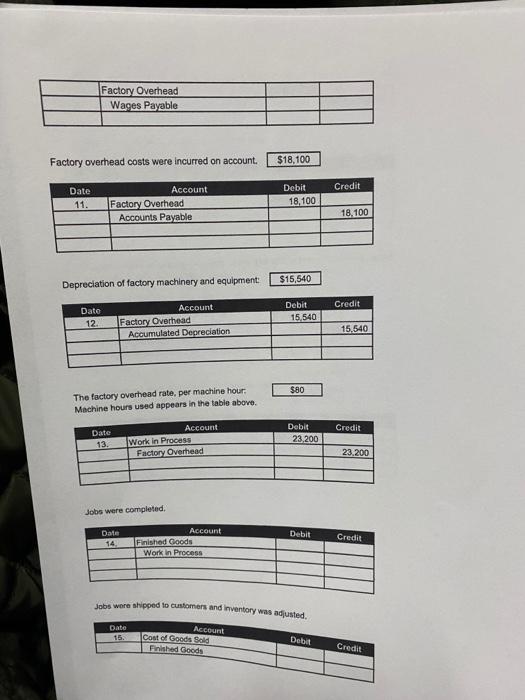

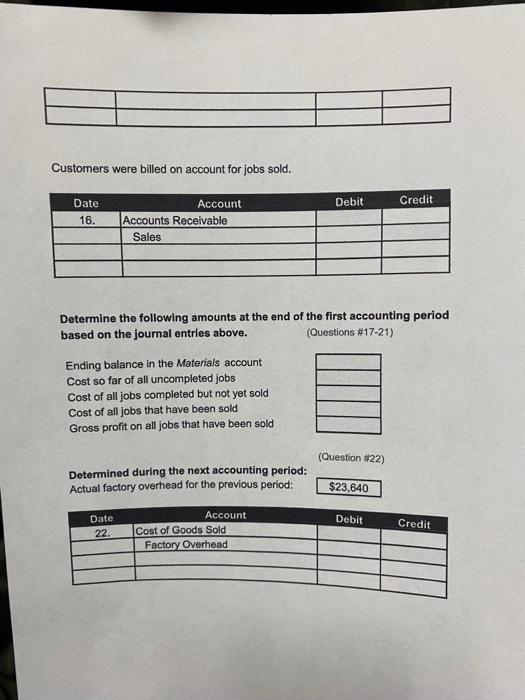

JOB ORDER COSTING PROBLEM Jonick Industries, Inc. uses a job order costing system in manufacturing custom products. The following table summarizes data related to production in June, the first month of operations. Determine the cost to date of each of the seven jobs below. (only If sold) (Questions #1-7) Factory Machine Sales Job Cost Job Materials Labor Hours Completed Price to Date Job 201 3440 12,300 20 yes 29,480 1. Job 202 15,200 9,400 30 yos 45.900 2. Job 203 14,730 17,510 30 yes 3. Job 204 12,600 4.250 80 4. Job 205 13,870 4,710 35 yes 5. Job 206 6,720 13,740 45 8. Job 207 14,710 9,540 50 yes 48,030 7. For general factory use 16,950 17,360 The factory overhead rate per machine hour appears in cell Complete the following transactions for Jonick Industries by entering the amounts. The transactions relate to one another. (Questions #8-16) Materials were purchased on account. $142,420 Credit Date 8. Account Materials Accounts Payable Debit 142,420 142,420 Materials were requisitioned (based on the information in the table above.) Date 9 Credit Account Work in Process Factory Overhead Materials Debit 152,720 34 310 Factory labor was used based on the information in the table above.) Account Debit Date 10 Work in Process Credit Factory Overhead Wages Payable Factory overhead costs were incurred on account. $18,100 Credit Date 11. Account Factory Overhead Accounts Payable Debit 18,100 18.100 $15,540 Depreciation of factory machinery and equipment: Credit Date Debit 15,540 12 Account Factory Overhead Accumulated Depreciation 15,540 $80 The factory overhead rate, per machine hour. Machine hours used appears in the table above Credit Date 13 Account Work in Process Factory Overhead Debit 23,200 23.200 Jobs were completed. Date 14 Debit Credit Account Finished Goods Work in Process Jobs were shipped to customers and Inventory was adjusted Account Cost of Goods Sold Finished Goods Date 15. Debit Credit Customers were billed on account for jobs sold. Debit Credit Date 16. Account Accounts Receivable Sales Determine the following amounts at the end of the first accounting period based on the journal entries above. (Questions #17-21) Ending balance in the Materials account Cost so far of all uncompleted jobs Cost of all jobs completed but not yet sold Cost of all jobs that have been sold Gross profit on all jobs that have been sold (Question #22) Determined during the next accounting period: Actual factory overhead for the previous period: $23,640 Debit Date 22. Credit Account Cost of Goods Sold Factory Overhead

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts