Question: Please answer question 1; A,B and C (WQ5) Question 1 (1 point) Traditionally your business has been selling sports memorabilia. You are considering a venture

Please answer question 1; A,B and C (WQ5)

Please answer question 1; A,B and C (WQ5)

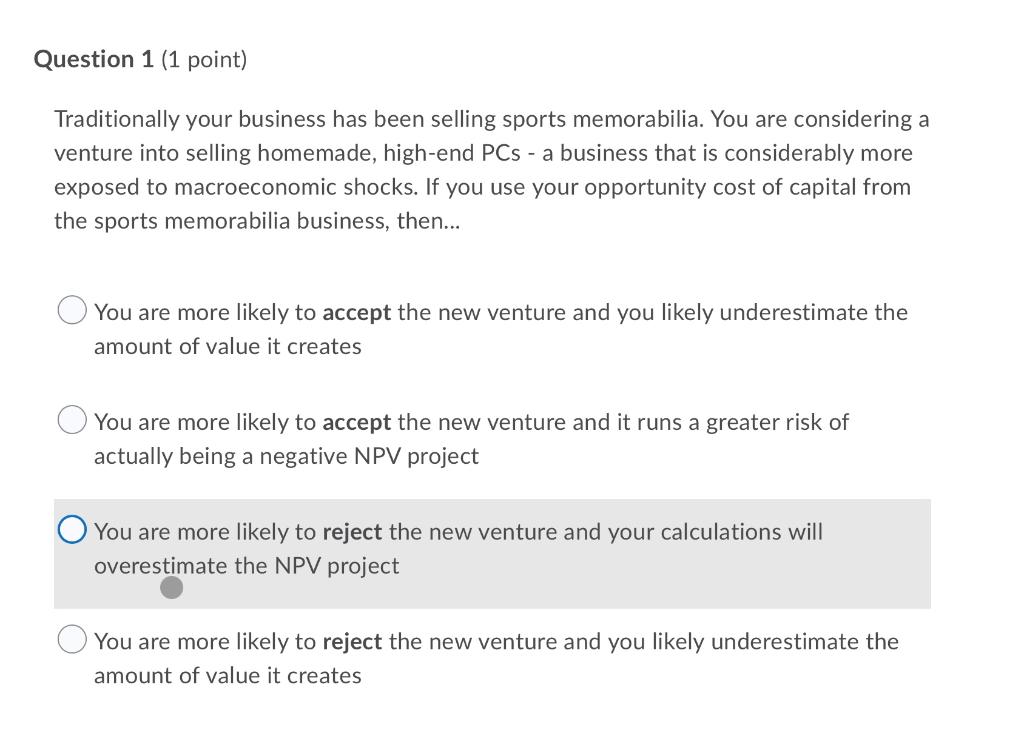

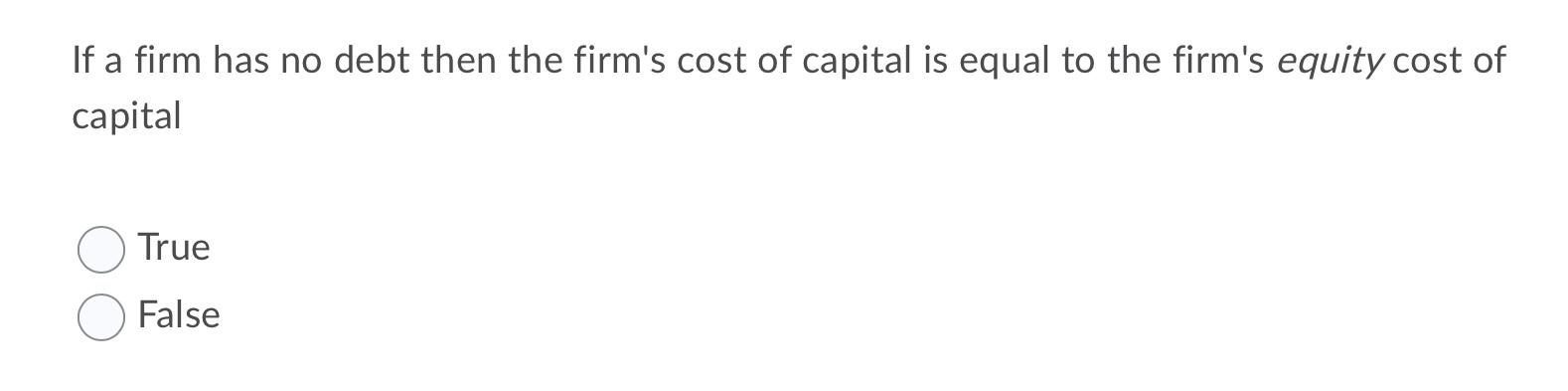

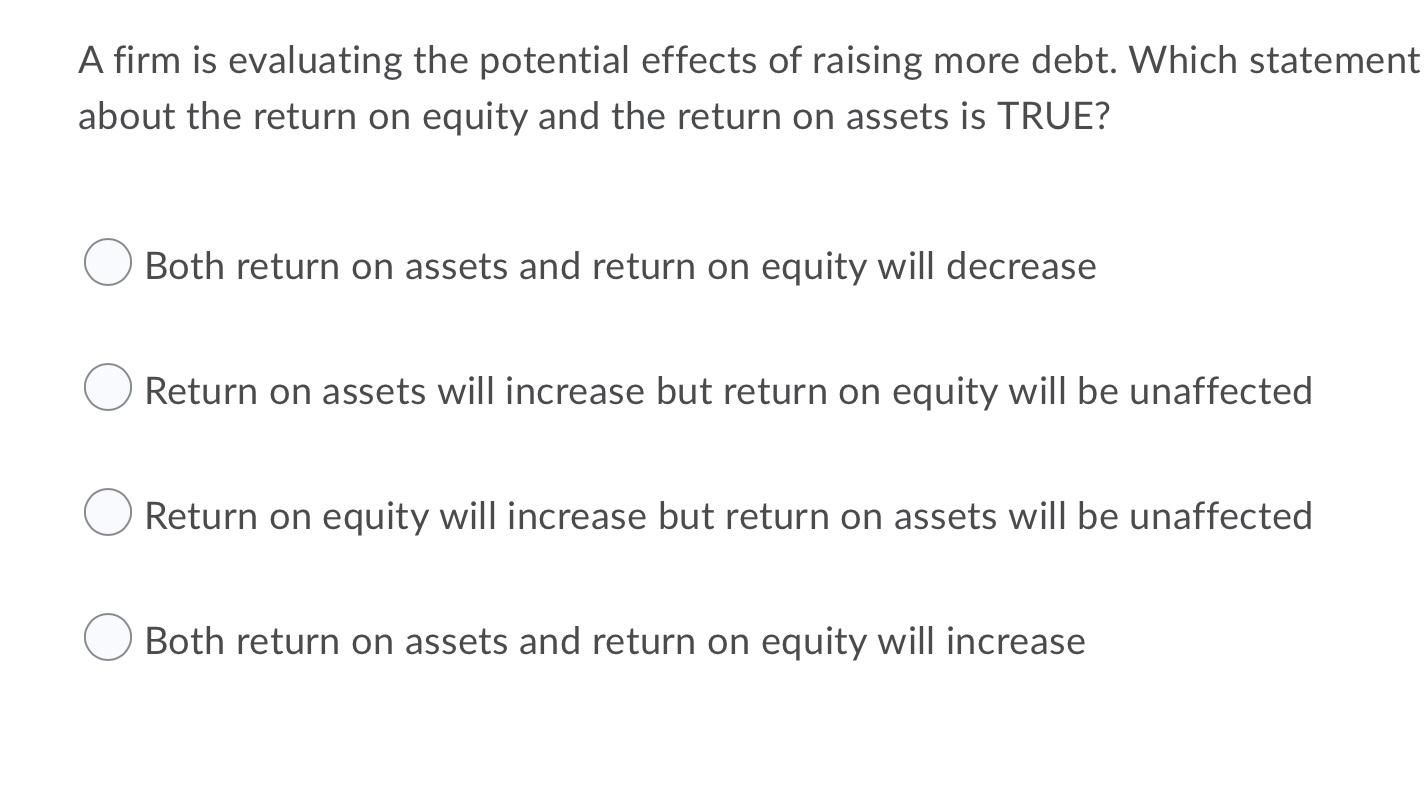

Question 1 (1 point) Traditionally your business has been selling sports memorabilia. You are considering a venture into selling homemade, high-end PCs - a business that is considerably more exposed to macroeconomic shocks. If you use your opportunity cost of capital from the sports memorabilia business, then.... You are more likely to accept the new venture and you likely underestimate the amount of value it creates You are more likely to accept the new venture and it runs a greater risk of actually being a negative NPV project You are more likely to reject the new venture and your calculations will overestimate the NPV project You are more likely to reject the new venture and you likely underestimate the amount of value it creates If a firm has no debt then the firm's cost of capital is equal to the firm's equity cost of capital True False A firm is evaluating the potential effects of raising more debt. Which statement about the return on equity and the return on assets is TRUE? Both return on assets and return on equity will decrease Return on assets will increase but return on equity will be unaffected Return on equity will increase but return on assets will be unaffected Both return on assets and return on equity will increase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts