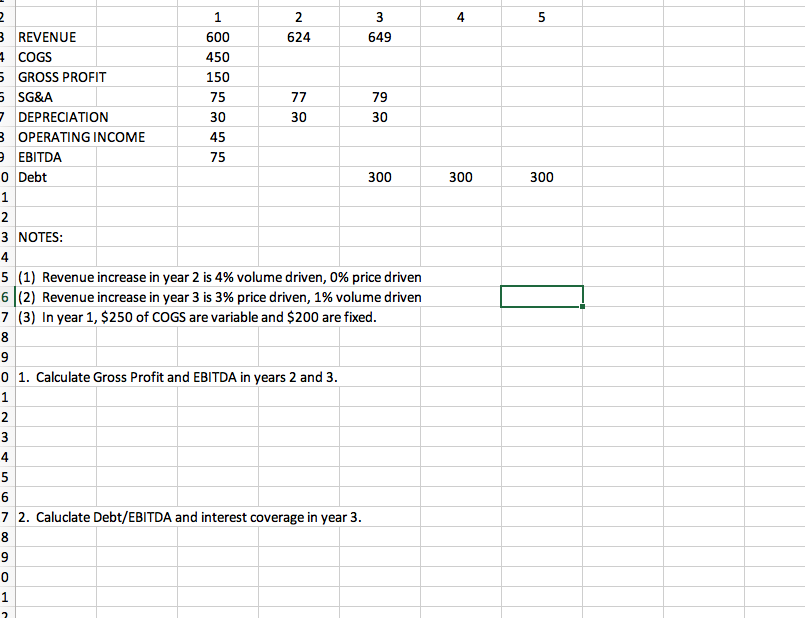

Question: Please answer Question 1 and 2 4 1 2 3 600 3 REVENUE 624 649 4COGS 450 5 GROSS PROFIT 5 SG&A DEPRECIATION 3OPERATING INCOME

Please answer Question 1 and 2

4 1 2 3 600 3 REVENUE 624 649 4COGS 450 5 GROSS PROFIT 5 SG&A DEPRECIATION 3OPERATING INCOME 150 77 75 79 30 30 30 45 9EBITDA 75 0 Debt 300 300 300 1 2 3 NOTES 4 5 (1) Revenue increase in year 2 is 4% volume driven, 0% price driven 6 (2) Revenue increase in year 3 is 3% price driven, 1% volume driven 7 (3) In year 1, $250 of COGS are variable and $200 are fixed. 8 9 0 1. Calculate Gross Profit and EBITDA in years 2 and 3 1 2 4 5 6 7 2. Caluclate Debt/EBITDA and interest coverage in year 3 8 0 4 1 2 3 600 3 REVENUE 624 649 4COGS 450 5 GROSS PROFIT 5 SG&A DEPRECIATION 3OPERATING INCOME 150 77 75 79 30 30 30 45 9EBITDA 75 0 Debt 300 300 300 1 2 3 NOTES 4 5 (1) Revenue increase in year 2 is 4% volume driven, 0% price driven 6 (2) Revenue increase in year 3 is 3% price driven, 1% volume driven 7 (3) In year 1, $250 of COGS are variable and $200 are fixed. 8 9 0 1. Calculate Gross Profit and EBITDA in years 2 and 3 1 2 4 5 6 7 2. Caluclate Debt/EBITDA and interest coverage in year 3 8 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts