Question: Please answer Question 1 (max loan, max down payment/ equity and Total offering price using) using information in parts 1-7(first image) as well as the

Please answer Question 1 (max loan, max down payment/ equity and Total offering price using) using information in parts 1-7(first image) as well as the diagram I have attached (second image). Then use that information to answer question 2

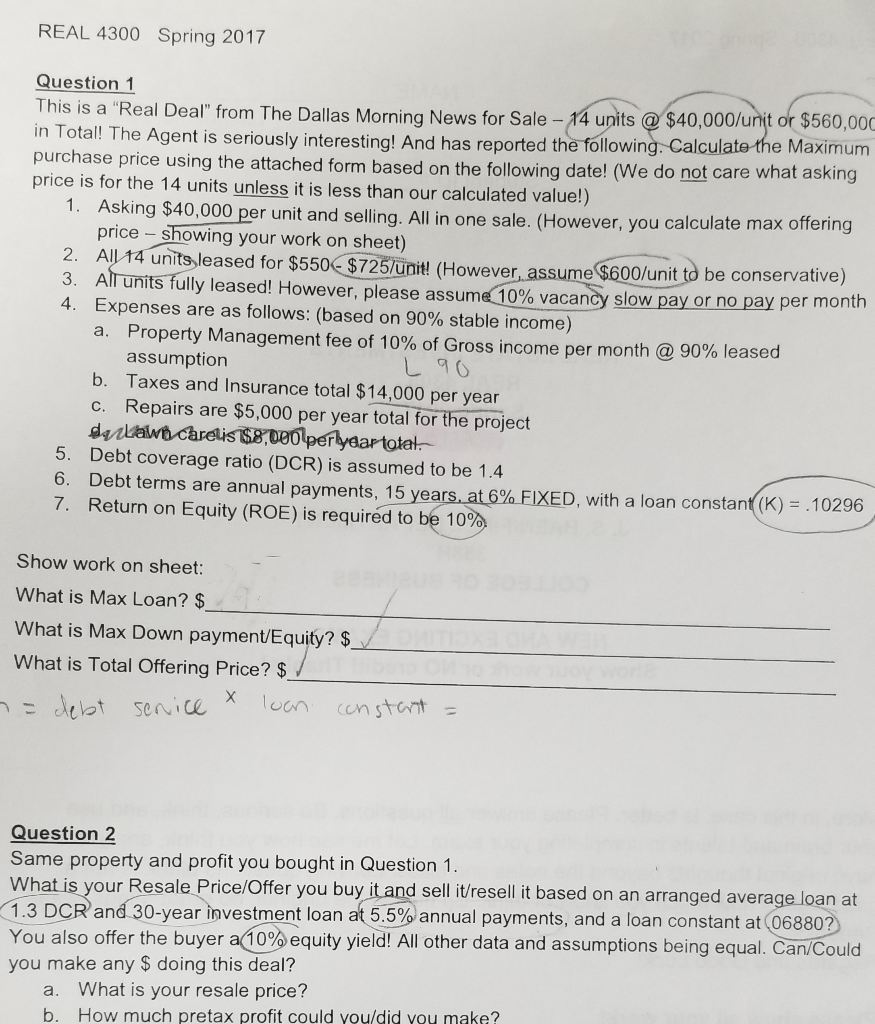

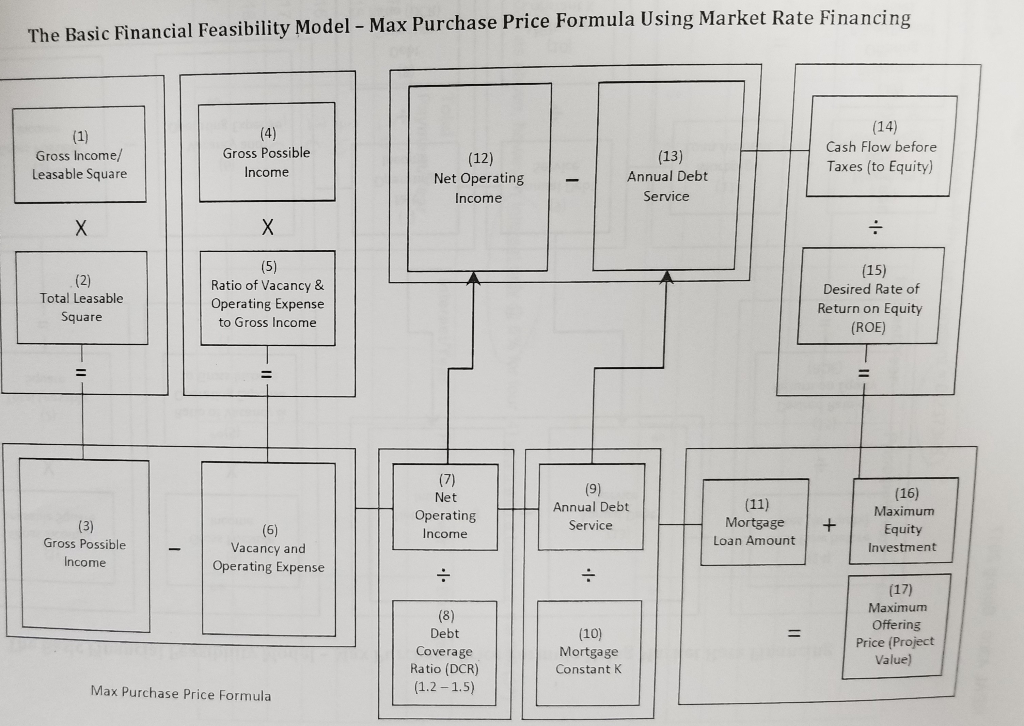

REAL 4300 Spring 2017 Question 1 This is a "Real Deal" from The Dallas Morning News for Sale - 14 units @ $40,000/unit or $560,000 in Total! The Agent is seriously interesting! And has reported the following. Calculate the Maximum purchase price using the attached form based on the following date! (We do not care what asking price is for the 14 units unless it is less than our calculated value!) 1. Asking $40,000 per unit and selling. All in one sale. (However, you calculate max offering price - showing your work on sheet) 2. All 14 units leased for $550 $725/unit! (However, assume $600/unit to be conservative) 3. All units fully leased! However, please assume 10% vacancy slow pay or no pay per month 4. Expenses are as follows: (based on 90% stable income) a. Property Management fee of 10% of Gross income per month @ 90% leased assumption L 90 b. Taxes and Insurance total $14,000 per year c. Repairs are $5,000 per year total for the project darLawn Carelis $8,000 per year total. 5. Debt coverage ratio (DCR) is assumed to be 1.4 6. Debt terms are annual payments, 15 years, at 6% FIXED, with a loan constant (K) = .10296 7. Return on Equity (ROE) is required to be 10% Show work on sheet: What is Max Loan? $_ What is Max Down payment/Equity? $__ What is Total Offering Price? $ / na debt service x loan constant = Question 2 Same property and profit you bought in Question 1. What is your Resale Price/Offer you buy it and sell it/resell it based on an arranged average loan at 1.3 DCR and 30-year investment loan at 5.5% annual payments, and a loan constant at 06880? You also offer the buyer a 10% equity yield! All other data and assumptions being equal. Can/Could you make any $ doing this deal? a. What is your resale price? h ou much netay nrofit could you did you make? The Basic Financial Feasibility Model - Max Purchase Price Formula Using Market Rate Financing (1) Gross Income/ Leasable Square Gross Possible Income (14) Cash Flow before Taxes (to Equity) (12) Net Operating Income (13) Annual Debt Service (2) Total Leasable Square Ratio of Vacancy & Operating Expense to Gross Income (15) Desired Rate of Return on Equity (ROE) II- Net Operating Income Annual Debt Service (11) Mortgage Loan Amount (3) Gross Possible Income (16) Maximum Equity Investment (6) Vacancy and Operating Expense (8) Debt Coverage Ratio (DCR) (1.2-1.5) (17) Maximum Offering Price (Project Value) (10) Mortgage Constant K Max Purchase Price Formula REAL 4300 Spring 2017 Question 1 This is a "Real Deal" from The Dallas Morning News for Sale - 14 units @ $40,000/unit or $560,000 in Total! The Agent is seriously interesting! And has reported the following. Calculate the Maximum purchase price using the attached form based on the following date! (We do not care what asking price is for the 14 units unless it is less than our calculated value!) 1. Asking $40,000 per unit and selling. All in one sale. (However, you calculate max offering price - showing your work on sheet) 2. All 14 units leased for $550 $725/unit! (However, assume $600/unit to be conservative) 3. All units fully leased! However, please assume 10% vacancy slow pay or no pay per month 4. Expenses are as follows: (based on 90% stable income) a. Property Management fee of 10% of Gross income per month @ 90% leased assumption L 90 b. Taxes and Insurance total $14,000 per year c. Repairs are $5,000 per year total for the project darLawn Carelis $8,000 per year total. 5. Debt coverage ratio (DCR) is assumed to be 1.4 6. Debt terms are annual payments, 15 years, at 6% FIXED, with a loan constant (K) = .10296 7. Return on Equity (ROE) is required to be 10% Show work on sheet: What is Max Loan? $_ What is Max Down payment/Equity? $__ What is Total Offering Price? $ / na debt service x loan constant = Question 2 Same property and profit you bought in Question 1. What is your Resale Price/Offer you buy it and sell it/resell it based on an arranged average loan at 1.3 DCR and 30-year investment loan at 5.5% annual payments, and a loan constant at 06880? You also offer the buyer a 10% equity yield! All other data and assumptions being equal. Can/Could you make any $ doing this deal? a. What is your resale price? h ou much netay nrofit could you did you make? The Basic Financial Feasibility Model - Max Purchase Price Formula Using Market Rate Financing (1) Gross Income/ Leasable Square Gross Possible Income (14) Cash Flow before Taxes (to Equity) (12) Net Operating Income (13) Annual Debt Service (2) Total Leasable Square Ratio of Vacancy & Operating Expense to Gross Income (15) Desired Rate of Return on Equity (ROE) II- Net Operating Income Annual Debt Service (11) Mortgage Loan Amount (3) Gross Possible Income (16) Maximum Equity Investment (6) Vacancy and Operating Expense (8) Debt Coverage Ratio (DCR) (1.2-1.5) (17) Maximum Offering Price (Project Value) (10) Mortgage Constant K Max Purchase Price Formula

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts