Question: Please answer question 1; Parts A,B, and C Question 1 (1 point) You want to buy a bond that has a coupon rate of 0.04

Please answer question 1; Parts A,B, and C

Please answer question 1; Parts A,B, and C

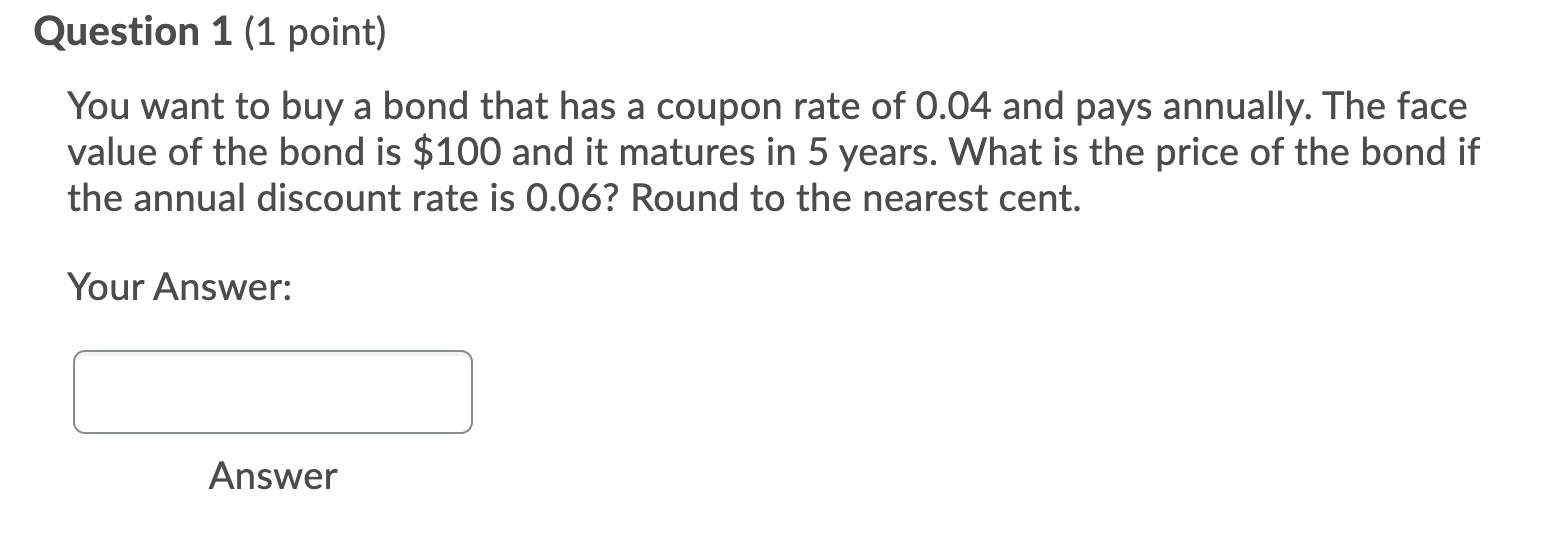

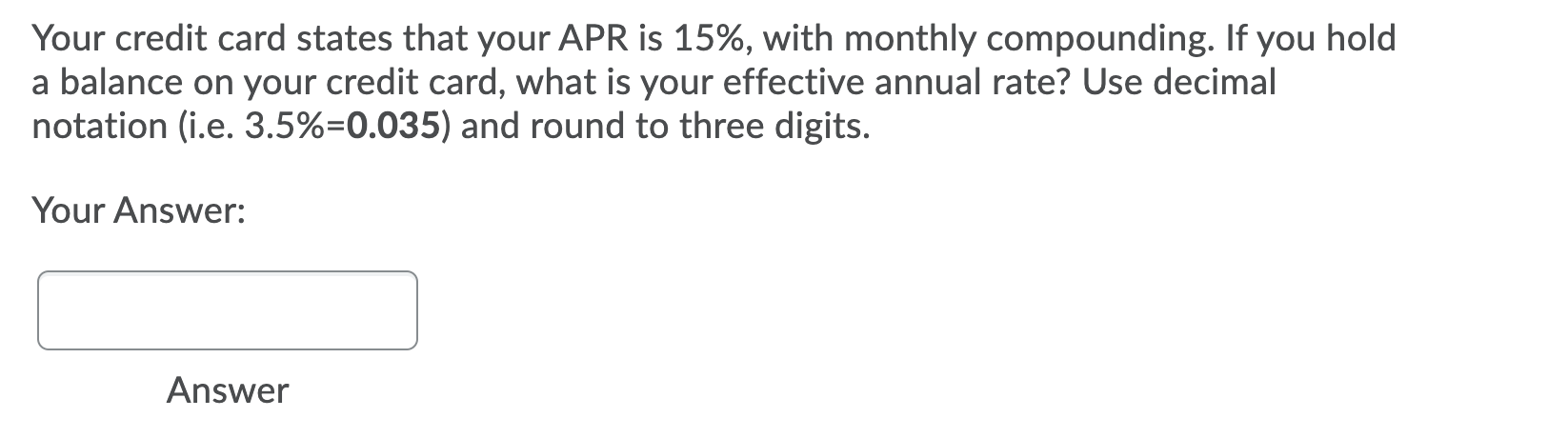

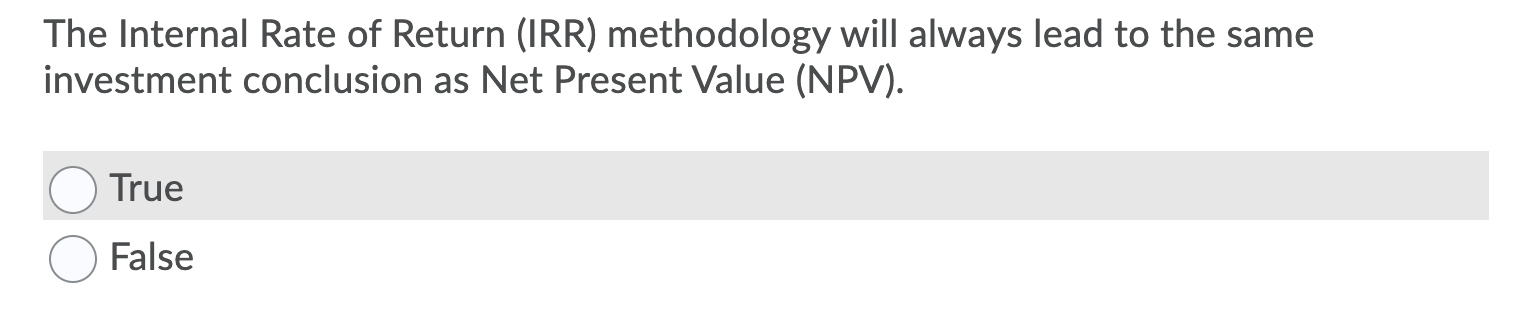

Question 1 (1 point) You want to buy a bond that has a coupon rate of 0.04 and pays annually. The face value of the bond is $100 and it matures in 5 years. What is the price of the bond if the annual discount rate is 0.06? Round to the nearest cent. Your Answer: Answer Your credit card states that your APR is 15%, with monthly compounding. If you hold a balance on your credit card, what is your effective annual rate? Use decimal notation (i.e. 3.5%=0.035) and round to three digits. Your Answer: Answer The Internal Rate of Return (IRR) methodology will always lead to the same investment conclusion as Net Present Value (NPV). True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts