Question: Please answer Question 1 Roberts thinks that his financial requirements to fund his foreign purchases will be approximately $250,000. He wants to maximize his profit

Please answer Question 1

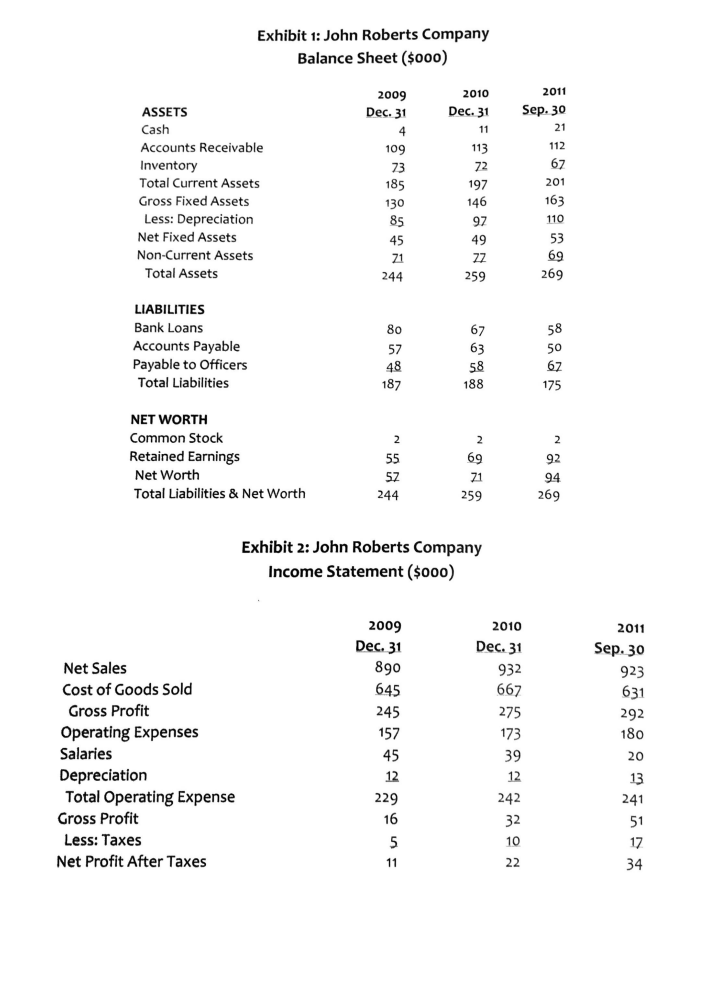

Roberts thinks that his financial requirements to fund his foreign purchases will be approximately $250,000. He wants to maximize his profit margins without taking too much risk. Some of the facts he had been able to uncover included some interesting information. For example, Roberts learned from Lopez that the Mexican banks through which his sight draft letters of credit could be drawn using El Paso Bank were offering more favorable rates than the borrowing rates at El Paso Bank. The discount rate in Mexico on acceptances of up to 180 days, together with El Paso Bank's acceptance commission on 180 day drafts, would also be less than the borrowing rate at El Paso Bank. With the changes required by Lopez, Mr. Roberts was on the horns of a dilemma. How is he going to get the bank to fund his foreign purchases, which will probably total \$250,000? Roberts' loan officer, Frank Jones, suggested several options to Roberts, while carefully noting that any financing would be subject to the bank loan committee approval. Therefore, he could give no assurances on the ability to provide financing. The three options suggested were a commercial loan, letter of credit (L/C), or a banker's acceptance (B/A). Mr. Roberts has done business with Lopez for almost 10 years, but he is very concerned about sending his money into Mexico before he has sold the goods. He also posed an interesting question to his GENERAL INFORMATION loan officer, "Should I do business in dollars or pesos because I am not sure what the exchange rates will do to hurt my profit?" in El Paso, Texas, selling furniture and accessories manufactured by Lopez Products Statement (Exhibit 2) are attached. in Mexico. The operation has been relatively simple in past years, with the company receiving the goods on consignment and paying Lopez Products upon the receipt of the sales proceeds. In this capacity, the company sold its goods in the Texas and QUESTIONS Oklahoma markets. Lopez Products (hereafter referred to as "Lopez") advised Mr. 1. Discuss the operation of a letter of credit to cover the obligations to Lopez by Roberts that beginning in 2010, he would receive an additional 10\%, but would be Roberts. required to pay for the goods upon delivery. 2. Discuss the ways a banker's acceptance might be used to cover the obligations Roberts has very limited knowledge of operating in a foreign country such as to Lopez by Roberts. Mexico. Up to this point, Lopez delivered all of Robert's merchandise to him in the 3. Should the El Paso Bank evaluate the request for a letter of credit or banker's U. S. on consignment with no consequences. Under the new arrangement, Roberts acceptance from a credit evaluation approach much like a loan request? Why or would have financial risk regardless of what approach he chose. why not? 4. Would a direct conventional loan be a better way to accomplish Robert's purpos- FINANCIAL CONSIDERATIONS es as opposed to a letter of credit or banker's acceptance? Roberts' commissions were 10% as a manufacturer's representative, which 5. Discuss the risks and benefits of doing business in dollars. were adequate to cover expenses and allow for a nominal profit. In the past, Roberts only incurred rent and selling expenses, which required minimum funding. Rob- 6. Discuss the risks and benefits of doing business in pesos. erts' banking relationship had been with the El Paso Bank since his company's estab- 7. Discuss the risk versus the reward of the new arrangement between Roberts lishment in 1998. He had a $25,000 line of credit secured by marketable securities and Lopez. with the bank, which Roberts used to fund his rent and expenses until he received his commissions. He kept all of his depository accounts at the El Paso Bank. Exhibit 1: John Roberts Company Balance Sheet (\$000) Exhibit 2: John Roberts Company Income Statement ($000) Roberts thinks that his financial requirements to fund his foreign purchases will be approximately $250,000. He wants to maximize his profit margins without taking too much risk. Some of the facts he had been able to uncover included some interesting information. For example, Roberts learned from Lopez that the Mexican banks through which his sight draft letters of credit could be drawn using El Paso Bank were offering more favorable rates than the borrowing rates at El Paso Bank. The discount rate in Mexico on acceptances of up to 180 days, together with El Paso Bank's acceptance commission on 180 day drafts, would also be less than the borrowing rate at El Paso Bank. With the changes required by Lopez, Mr. Roberts was on the horns of a dilemma. How is he going to get the bank to fund his foreign purchases, which will probably total \$250,000? Roberts' loan officer, Frank Jones, suggested several options to Roberts, while carefully noting that any financing would be subject to the bank loan committee approval. Therefore, he could give no assurances on the ability to provide financing. The three options suggested were a commercial loan, letter of credit (L/C), or a banker's acceptance (B/A). Mr. Roberts has done business with Lopez for almost 10 years, but he is very concerned about sending his money into Mexico before he has sold the goods. He also posed an interesting question to his GENERAL INFORMATION loan officer, "Should I do business in dollars or pesos because I am not sure what the exchange rates will do to hurt my profit?" in El Paso, Texas, selling furniture and accessories manufactured by Lopez Products Statement (Exhibit 2) are attached. in Mexico. The operation has been relatively simple in past years, with the company receiving the goods on consignment and paying Lopez Products upon the receipt of the sales proceeds. In this capacity, the company sold its goods in the Texas and QUESTIONS Oklahoma markets. Lopez Products (hereafter referred to as "Lopez") advised Mr. 1. Discuss the operation of a letter of credit to cover the obligations to Lopez by Roberts that beginning in 2010, he would receive an additional 10\%, but would be Roberts. required to pay for the goods upon delivery. 2. Discuss the ways a banker's acceptance might be used to cover the obligations Roberts has very limited knowledge of operating in a foreign country such as to Lopez by Roberts. Mexico. Up to this point, Lopez delivered all of Robert's merchandise to him in the 3. Should the El Paso Bank evaluate the request for a letter of credit or banker's U. S. on consignment with no consequences. Under the new arrangement, Roberts acceptance from a credit evaluation approach much like a loan request? Why or would have financial risk regardless of what approach he chose. why not? 4. Would a direct conventional loan be a better way to accomplish Robert's purpos- FINANCIAL CONSIDERATIONS es as opposed to a letter of credit or banker's acceptance? Roberts' commissions were 10% as a manufacturer's representative, which 5. Discuss the risks and benefits of doing business in dollars. were adequate to cover expenses and allow for a nominal profit. In the past, Roberts only incurred rent and selling expenses, which required minimum funding. Rob- 6. Discuss the risks and benefits of doing business in pesos. erts' banking relationship had been with the El Paso Bank since his company's estab- 7. Discuss the risk versus the reward of the new arrangement between Roberts lishment in 1998. He had a $25,000 line of credit secured by marketable securities and Lopez. with the bank, which Roberts used to fund his rent and expenses until he received his commissions. He kept all of his depository accounts at the El Paso Bank. Exhibit 1: John Roberts Company Balance Sheet (\$000) Exhibit 2: John Roberts Company Income Statement ($000)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts