Question: please answer question 10. i need to know 1245 recapture In 2017, Olive's Optometry, a sole proprietorship, purchased a piece of business-use property (Equipment A)

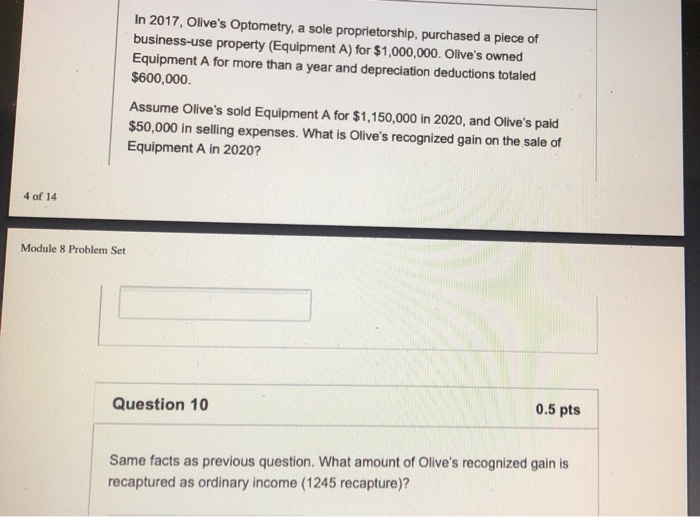

In 2017, Olive's Optometry, a sole proprietorship, purchased a piece of business-use property (Equipment A) for $1,000,000. Olive's owned Equipment A for more than a year and depreciation deductions totaled $600,000 Assume Olive's sold Equipment A for $1,150,000 in 2020, and Olive's paid $50,000 in selling expenses. What is Olive's recognized gain on the sale of Equipment A in 2020? 4 of 14 Module 8 Problem Set Question 10 0.5 pts Same facts as previous question. What amount of Olive's recognized gain is recaptured as ordinary income (1245 recapture)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts